Owners should think twice before welcoming Chick Fil-A to their roosts, one investor previously warned The Real Deal, as the busy chicken chain makes for a surefire moneymaker — but not an easy neighbor.

Some properties might be plagued by the dilemma laid out by real estate personality Strip Mall Guy, but one of New York’s largest retail landlords is betting that going all-in on Chick Fil-A is going to land them on the upside.

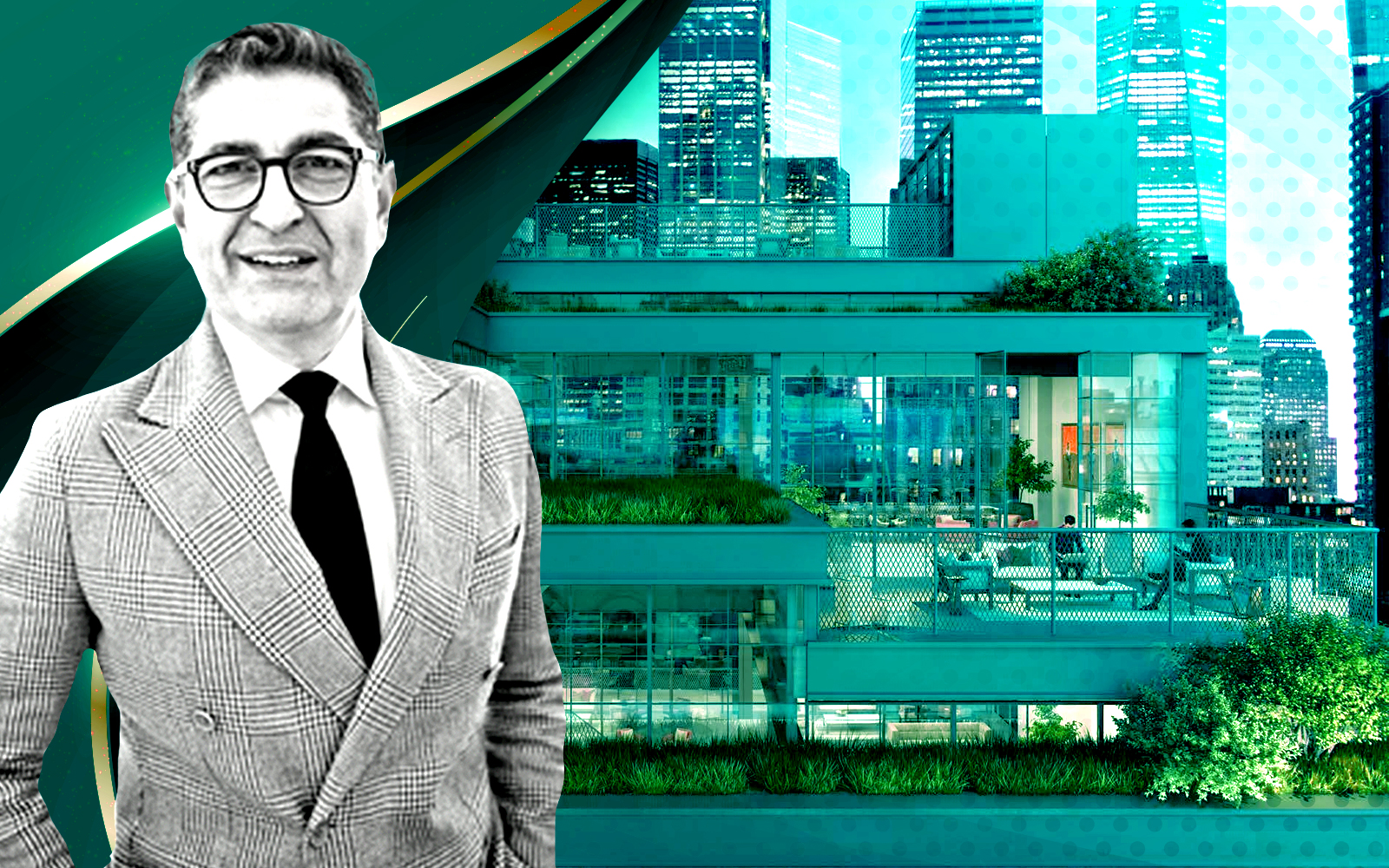

Crown Acquisitions, the commercial real estate company run by the Chera family, listed its 5-story, 8,625 square foot property at 144 Fulton Street for a whopping $44 million. The firm is looking for a sizable gain from the $25 million it acquired the property for in 2015.

The owners leased the entire property to Chick-fil-A in 2018, making it the largest of the over 2,600 locations nationwide. The lease lasts until January 2038, which the property owners have advertised as a key selling point.

The restaurant has seating on three levels for 140 guests, a semi-private group meeting and dining space on the third floor and an open-air rooftop terrace with views of One World Trade Center. The restaurant also offers mobile and in-store ordering.

The property, which also boasts the only Chick-fil-A below 22nd Street, sits next door to the Fulton Center transit hub.

Avison Young, which listed the property on behalf of the family firm, and the seller declined requests for comment.

The Chera’s Crown Acquisitions have over 40 other properties in their portfolio, according to the firm’s website, including buildings elsewhere on Fulton Street: 490 Fulton and 522 Fulton.

Read more

The retail giant joined commercial owners’ woes across the city and country when its joint venture with Vornado and other investors defaulted on a $450 million non-recourse loan at 697-703 Fifth Avenue. The property, with a loan that matured in December, is part of a portfolio owned by the real estate investment trust that lost more than $1.5 billion since its peak.

Other Chera-owned properties include a retail condominium at 170 Broadway in Lower Manhattan and the Olympic Tower office building at 641 Fifth Avenue in Midtown, for which it landed a $1 billion refinancing in 2017.

The 170 Broadway unit was the subject of a Covid-related rent dispute in 2020. Retail tenant Gap stopped paying rent, causing Crown to fall behind on its mortgage. A court battle ensued, with the trial judge and appeals court both finding Gap was responsible for paying the rent, despite the pandemic.

CMBS documents show Crown corrected the default in late 2021.

Rich Bockmann contributed reporting.

This article has been updated with information about 170 Broadway.