After taking control of a coveted West Side portfolio amassed by real estate investor Robert Gans, Gary Barnett wasted little time stripping off its most infamous property.

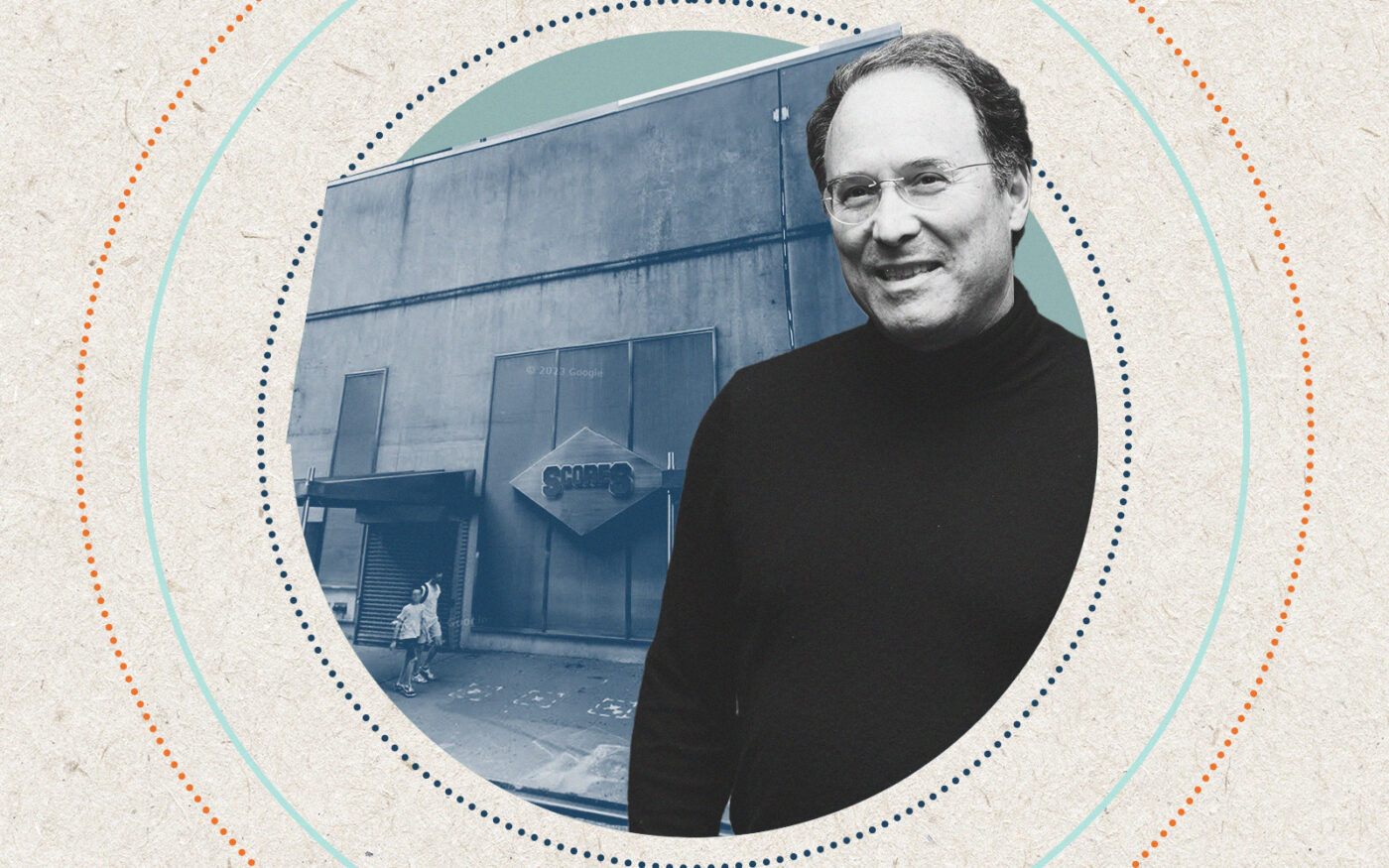

Barnett’s Extell Development sold a three-story commercial building at 533 West 27th Street and 534 West 28th Street — best known as the home of the Chelsea strip club Scores — to Hamptons developer Silvera Properties for $24.5 million, property records filed Tuesday show.

David Silvera told The Real Deal that he has no immediate plans for the property, but that it has a promising future as a residential development site. Silvera can double the size of the existing building to 60,000 square feet as of right.

The developer plans to buy additional air rights that will bring the total square footage to more than 77,000 square feet and a total price of roughly $35 million, according to Cushman & Wakefield broker Bryan Hurley, who brokered the sale with his colleague Michael Gembecki.

Along with its East Side location, Scores had a veneer of celebrity clientele through the early aughts, but gained notoriety for its mafia ties, financial crimes and a ring of strippers who drugged and robbed male patrons, inspiring the 2019 film “Hustlers.”

The building was an unusual acquisition for Extell, one of the city’s most ambitious developers, which took control of the property earlier this year after Eli Tabak’s Bluestone Group foreclosed on debt tied to Gans’ portfolio.

The portfolio included the Scores building, a retail property in Soho and several industrial buildings in Queens, but the crown jewel was a Hell’s Kitchen assemblage with development potential on 11th Avenue between West 45th and West 46th streets.

The foreclosure sparked lawsuits, and Gans, who put the portfolio into bankruptcy last summer to thwart Extell and Bluestone’s takeover attempt, accused Barnett and Tabak of engaging in a “predatory scheme” to sell his property out from under him.

Gans had refinanced the portfolio with a $148 million loan in 2018, but his businesses suffered during the pandemic. Last year, Bluestone, which had loaned Gans $5 million as part of the refinancing, bought the senior debt that Gans owed but could no longer pay.

Gans’ lawsuit failed to keep the properties in his possession and Extell, having acquired the more lucrative Eleventh Avenue assemblage in a deal with Tabak, had less use for the nightclub. Now Silvera Properties will determine its fate.

Silvera manages a pair of rental properties in New York City, including 29 Leonard Street in Tribeca which it bought in 2018 for $24.5 million. But its primary business is in the Hamptons, where it has sold several homes for north of $10 million and is active in summer rentals.

Read more