Even if New York City’s decline in office values sink to a worst-case situation, the possible shortfall in tax revenue due to may not be as large as previously feared.

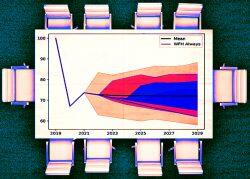

The city would face a revenue shortfall of $323 million in fiscal year 2025 (which starts on July 1, 2024) if the value of office properties declines 40 percent from 2023 to 2029, according to a projection by New York City Comptroller Brad Lander reported by Bloomberg.

By the time fiscal year 2027 rolls around, that shortfall would be projected to jump to $1.1 billion. That figure represents only 3 percent of the city’s property tax levy and 1.4 percent of its tax revenues.

The city’s tax coffers may be in slightly worse condition than suggested by the comptroller’s report, which took its cues from researchers at New York University and Columbia University. The institutions recently revised a study regarding the values of office properties to put the number at 44 percent by 2029.

Considering the percentage was revised upwards by 16 percentage points from a year ago, possible office valuations appear to still be a moving target.

“We now estimate a more persistent work-from-home regime, which has more of an impairment of office values even in the long run,” said NYU associate professor Arpit Gupta, one of the study’s authors, in an email.

Read more

Real estate taxes are the most significant provider of city tax revenue, accounting for 30 percent of the amount. Of that 30 percent, roughly 20 percent is derived from office properties, which accounts for approximately 10 percent of the city’s overall revenue.

The city levies property taxes on offices based on the net operating income from the prior year.

— Holden Walter-Warner