At the last minute, the state legislature revived a property tax break for landlords who renovate their apartment buildings, but provisions will narrow its use to mostly affordable properties.

Lawmakers over the weekend passed the “Affordable Housing Rehabilitation Program,” which replaces the lapsed J-51 tax break. The measure awaits the governor’s signature, which is expected.

As with its predecessor, the program must be authorized by the City Council; the state bill merely gives the city the ability to implement the program. If approved, it would apply to renovation work completed after June 29, 2022 — when the previous version expired — and before June 30, 2026.

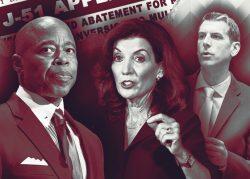

The tax break closely follows a proposal included in Gov. Kathy Hochul’s executive budget. Like the governor’s bill, the new program features a few key changes from the tax break that lapsed.

It is now an abatement-only program that lasts for up to 20 years. For rentals, buildings must be at least 50 percent affordable, part of the state’s Mitchell-Lama program, or receive “substantial government assistance.” The Department of Housing Preservation and Development would determine the income levels for the affordable units.

The J-51 replacement was one of the few housing-related bills approved this session in Albany. The leaders of the Senate and Assembly majorities said they could not reach a broader agreement on issues including the tax break for new housing development, 421a, and a version of good cause eviction that mirrored California’s rent control law.

The Senate managed to pass a few more measures, including a pair of bills aimed at helping tenants prove fraud in rent overcharge cases and increase access to rent histories. It also approved a bill that would expand the city housing agency’s loan authority. The Assembly is reportedly expected to return in a few weeks and may pick up these issues.

Approval from both houses is necessary for a bill to become law.

The new J-51 program applies to condos and co-ops with an assessed valuation of less than $45,000 per unit, which is a slight increase from the old J-51, but still severely limits eligibility.

The abatement is also limited to 70 percent of the reasonable cost of renovation work — the “reasonable” cost of specific types of work is determined by HPD — over the life of the break, and capped at 8.3 percent each year.

Landlords must certify that they have not harassed tenants in the past five years to qualify. They also must not keep affordable units off the market “for a period that is longer than reasonably necessary,” and must keep units rent-stabilized for at least 15 years, even if the abatement term is shorter.

The units also cannot simultaneously qualify for rent increases through the major capital improvements program. Those increases were severely limited by the 2019 rent stabilization reform.

Over the years, the number of properties applying J-51 waned, with landlords citing outdated cost limitations set by HPD and the mounting litigation surrounding the program. Landlord groups and attorneys were similarly unimpressed by the governor’s proposal.

Jay Martin, executive director of the Community Housing Improvement Program, said the new tax break only helps a “narrow universe” of landlords, due to the affordability restrictions. He said the two measures approved by the Senate that deal with rent histories and fraud liability would likely scare owners away from the new J-51 if they were to become law.

“They just don’t understand that a property owner can’t run a business like this,” he said. “We don’t view it as a victory at all.”

The tax break was a priority for Mayor Eric Adams, who also pushed for 421a and changes to state law to allow for more commercial-to-residential conversions. Without these latter measures, the mayor’s goal to build 500,000 homes in the next decade is likely out of reach.

His housing agency’s touting of the new J-51 stands in stark contrast to the lack of enthusiasm from Martin’s group.

“J51 — a critical law to preserve low-cost homes & good conditions — just passed both houses of the NYS Legislature! The fight for tenants & our work to solve the housing crisis is far from over, but this is an important step forward for all New Yorkers, both renters & owners,” HPD tweeted.

The city’s Rent Guidelines Board is preparing to vote on allowable rent increases on stabilized apartments. Landlords and tenants are likely to use the lack of state action on housing production and tenant protections to respectively bolster their cases for higher and lower increases, respectively.

Read more