Home foreclosure stories, like eviction stories, trigger two very different reactions.

One is sympathy for the homeowner, who is enduring a traumatic, life-changing event that could have been avoided. Inevitably some observers call the lenders cruel, the courts uncaring and the politicians corrupt.

The other reaction is from those who consider foreclosures essential for a functioning housing market (foreclosure makes mortgages possible) and focus on the homeowner’s role. They look for evidence that the borrower made irresponsible decisions and should deal with the consequences.

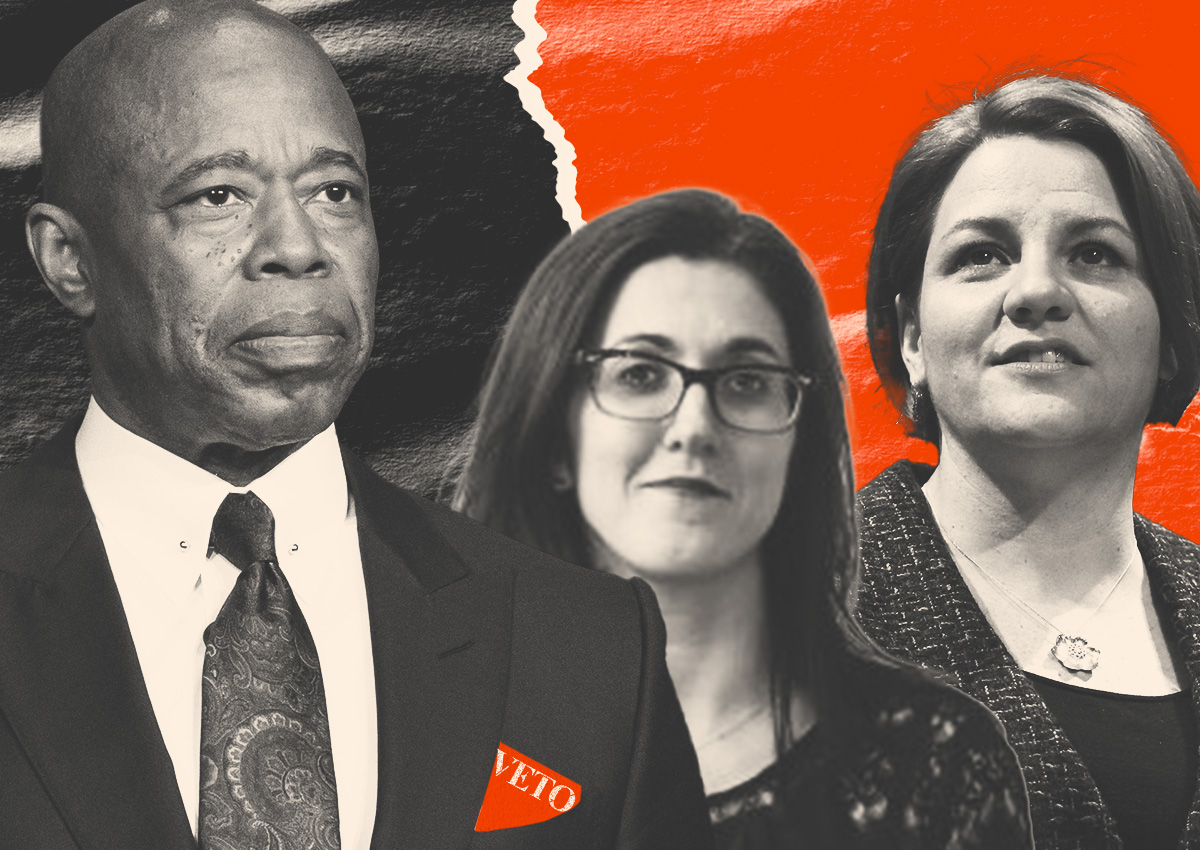

Which brings us to a Gothamist story Wednesday about New York’s courts pushing foreclosure cases along without assessing — as state law requires — whether the homeowner can afford a lawyer or should be given free representation.

It’s obviously important for the court system which declined Gothamist’s request for comment to follow the law. Advocacy groups and a Brooklyn homeowner have sued to ensure that it does, the article reported.

But readers were more interested in why the homeowner, Carl Fanfair, stands to lose the Bedford-Stuyvesant brownstone he bought in 1999 for $200,000.

Gothamist reported that Fanfair, 47, fell more than $80,000 behind on his mortgage after losing his appliance-repair job in the pandemic and taking time to care for his wife and her elderly mother.

Fanfair, a Yoruba priest, told Gothamist the court referee at his settlement conference never considered his need for a lawyer, and his lender, Reliance First Capital, sent no information about a loan modification.

“There’s no personal type of interaction,” he told the reporter. “You’re just a number.”

Real estate “speculators” hound him daily, knowing he’s in foreclosure — a fate that disproportionately affects Black and Latino homeowners, as do fraud and deed theft schemes, Gothamist noted.

All of the above is true, but some in the article’s comment section quickly set about discrediting the portrayal of Fanfair as a victim. How, they wondered, could he possibly be in trouble on a house worth six times more than he paid for it 24 years ago?

“The idea of having unpayable debt that is well under the equity value of the property just doesn’t make sense,” noted one commenter, rational_brooklyn.

Another commenter, Emjayay, posted that Fanfair could easily get a home equity loan to cover the $80,000 arrears, a few more years of payments and a lawyer’s fees, too.

“Unless they already pulled out all the value of the property and have nothing left,” the commenter added. “Maybe there’s more to that story.”

There was indeed more. And it didn’t take long for other readers to unearth it.

“What isn’t mentioned is that since 1999, there have been six different mortgages taken out on the property,” OriginalSobchack responded. “The last mortgage in 2019 was to the tune of $502k.”

In that light, the commenter didn’t see Fanfair as an unsophisticated, undeserving pawn being run over by a brutal home-finance system.

“I can buy the notion that someone might not have enough income to pay for an attorney and may need assistance,” OriginalSobchack wrote. “What I don’t buy is this idea that foreclosure is just so complicated and complex and these folks are just out of their depths. Not [so] out of their depths to be able to take out mortgage after mortgage and apparently understand how that is done, but when the bill comes, throw up your hands and say, Oh, I don’t understand!”

The sleuthing continued. Readers discovered that Fanfair’s three-story row house rented out a unit last year for nearly $2,500 a month, which would cover about 80 percent of the mortgage payments.

Another reader posted a flier showing Fanfair advertising his services as a life coach and motivational speaker. One noted that Fanfair was just 23 when he bought the house, a sign that he’s a savvy consumer, not a clueless peon.

Of course, neither Fanfair nor the lawsuit claim otherwise, although some readers felt the article did. The case is ostensibly about the courts not considering whether people in foreclosure need a lawyer, as the law demands.

Finding the perfect homeowner plaintiff to make a case in the media can be a challenge. This lawsuit might well succeed in the courts of New York. But in the court of public opinion, it’s off to a rough start.

Read more