When a borrower hands the keys to a property over to its lender, it’s supposed to be a friendly gesture — a clean break that allows the parties to move on from a troubled loan but preserve their relationship.

That’s not how one deed-in-lieu is playing out.

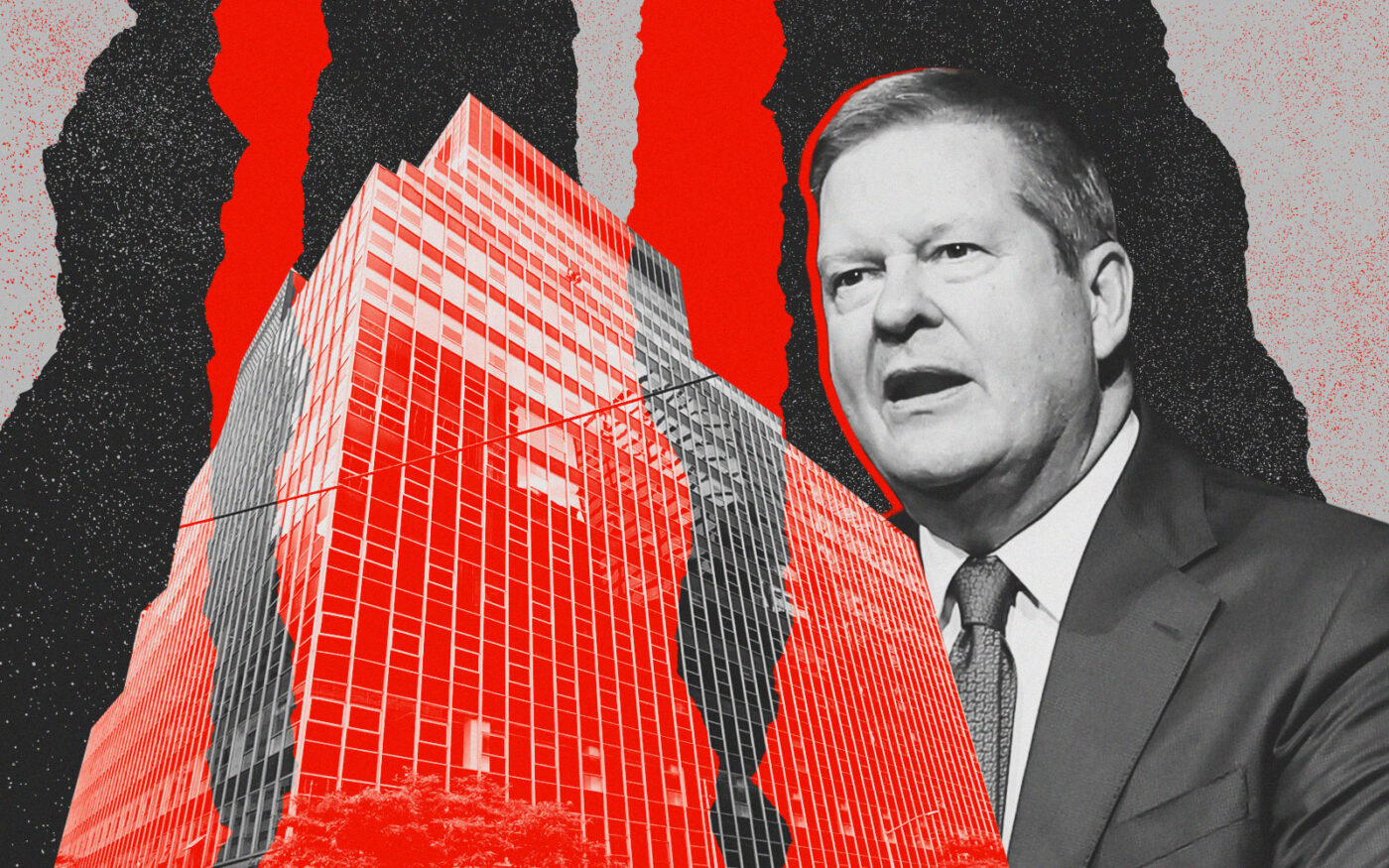

Jacob Chetrit claims that when he walked away from the 21-story office building at 850 Third Avenue earlier this year, he handed $10.5 million over to his lender, Scott Kapnick’s HPS Investment Partners, to cover transfer taxes owed to the city and state.

But HPS only paid the city $8.7 million, Chetrit alleges in a lawsuit, pocketing the difference and exposing his company to a tax liability and penalties.

Chetrit said that when he handed over the property, he signed a deed showing the balance on the loans to be $320 million. But HPS created a separate deed, Chetrit claims, showing the balance to be only $266 million.

“HPS then filed the fraudulent ACRIS forms with New York City in which it misrepresented the terms of the transaction in order to reduce the amount of the applicable transfer taxes and exit fee,” attorneys for Chetrit wrote in a complaint filed Tuesday in Manhattan Supreme Court.

The reduced loan amount allowed HPS to charge Chetrit more for other expenses like an exit fee and interest costs, according to the lawsuit. Chetrit is asking the court to hold HPS responsible for paying the tax shortfall to the city and state finance authorities, and is suing for more than $10 million in punitive damages.

A spokesperson for HPS said the company paid all the applicable taxes, and that it plans to defend itself against what it called meritless claims.

“HPS and Chetrit reached a settlement in transitioning the property to HPS where HPS agreed to waive significant penalties, default interest and other payments from the Chetrits in exchange for a lump sum payment and a release of claims,” the spokesperson wrote in an email.

Chetrit’s Chetrit Organization bought the 617,000-square-foot Midtown East office building in 2019 for $422 million from China’s HNA Group, which at the time was selling off properties as it struggled under a heavy debt burden.

By the time Chetrit closed, the property’s largest tenant, Discovery Inc., had decided to relocate, and occupancy dropped from 91 percent to 57 percent. Chetrit financed the building in 2021 with a $220 million mortgage and a $100 million mezzanine loan from HPS.

But he fell behind on a $177 million CMBS loan tied to the property, and in 2021 faced a UCC foreclosure brought by a junior mezzanine lender.

Read more