Naftali Group’s nascent lending platform is stepping in to help finance a condo project in Greenwich Village as banks continue to retreat from commercial real estate loans.

With the first deal of its second investment fund, Naftali Credit Partners said it provided a $22 million mezzanine note to a joint venture between Argo Real Estate and B Safal for an 11-story, 28-unit condo building with retail space at 64 University Place.

Naftali Credit Partners, the lending arm of luxury condo developer Naftali Group, is part of an $86 million capital stack with Deutsche Bank, which provided the senior loan. The Commercial Observer first reported the deal.

The building’s structure has been completed, and work on the facade and windows is underway. Construction is expected to be wrapped up in about a year, and all but a few of the units have been sold, the lender said.

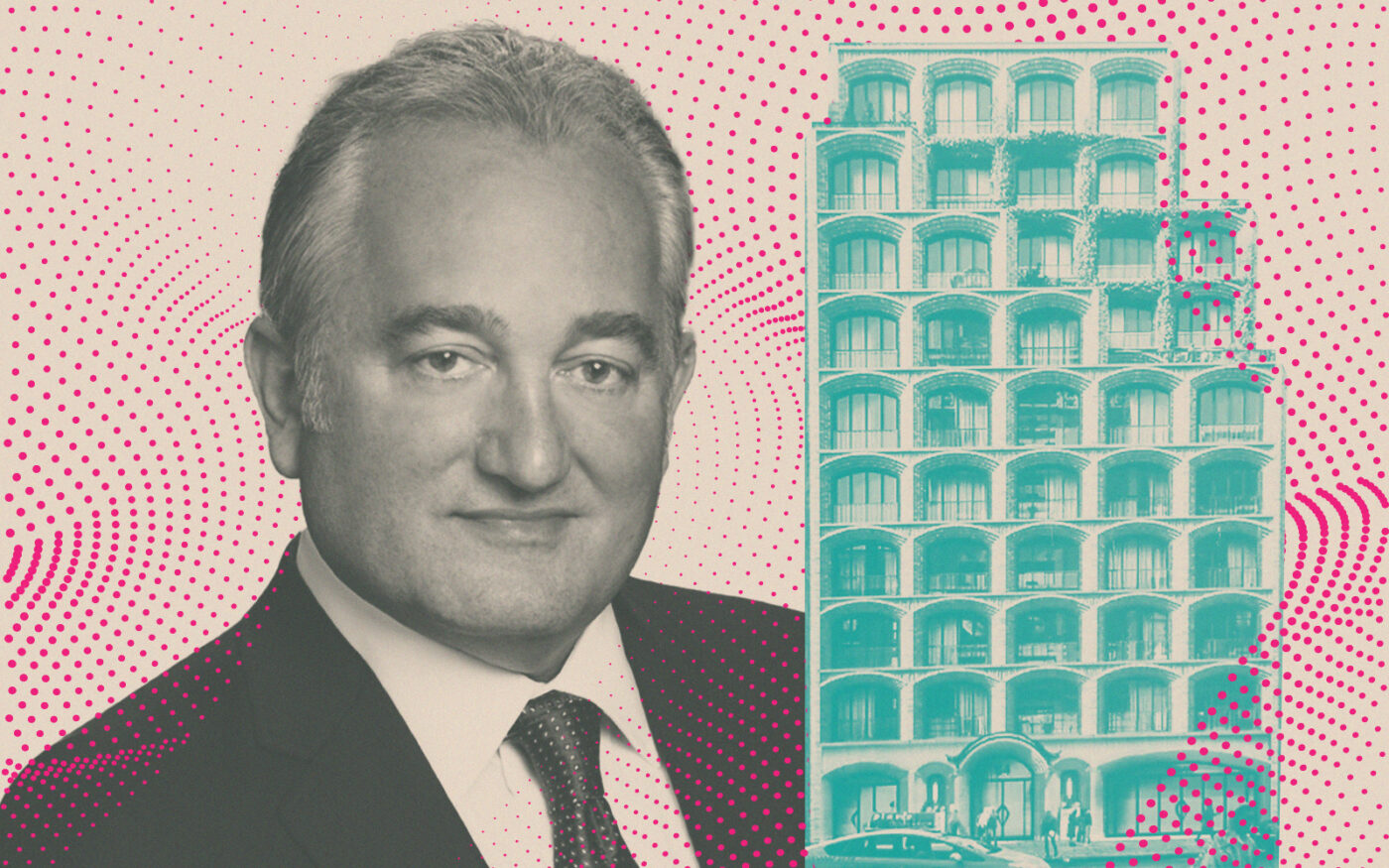

“We’re not finding distress to bet against our borrower,” said Glenn Grimaldi, CEO of Naftali Credit Partners. “The borrower is a good builder, has an extremely successful project up to this point, and needed to recapitalize the debt.”

“The market is illiquid for this kind of product, construction and condo inventory, and that played into our expertise,” he added.

Naftali Credit Partners is trying to fill the void left by traditional banks who have been pulling back on commercial real estate lending amid a sagging office sector and rapidly rising interest rates. It began raising equity for its second fund in March, and the Greenwich Village project is the first of what Grimaldi says will be more deals to come in the following months.

The fund will target anything and everything when it comes to the types of projects, but its “DNA” will be in multifamily, including ground-up construction, condos and rentals, he said. Mezzanine loans will be the primary type of debt, but the company is capable of originating whole loans and senior loans too.

Naftali Credit Partners’s first fund, which it launched in 2019, provided financing to 145 Central Park North and 28 Delancey Street, both luxury condo buildings.

“There’s been a unique and growing shift towards the private sector to provide debt to good borrowers, and that’s where we want to play,” Grimaldi said. “Our aim is to be one of the best alternative private capital sources for commercial real estate.”