In Gramercy, a deal for development rights has turned into a development wrong.

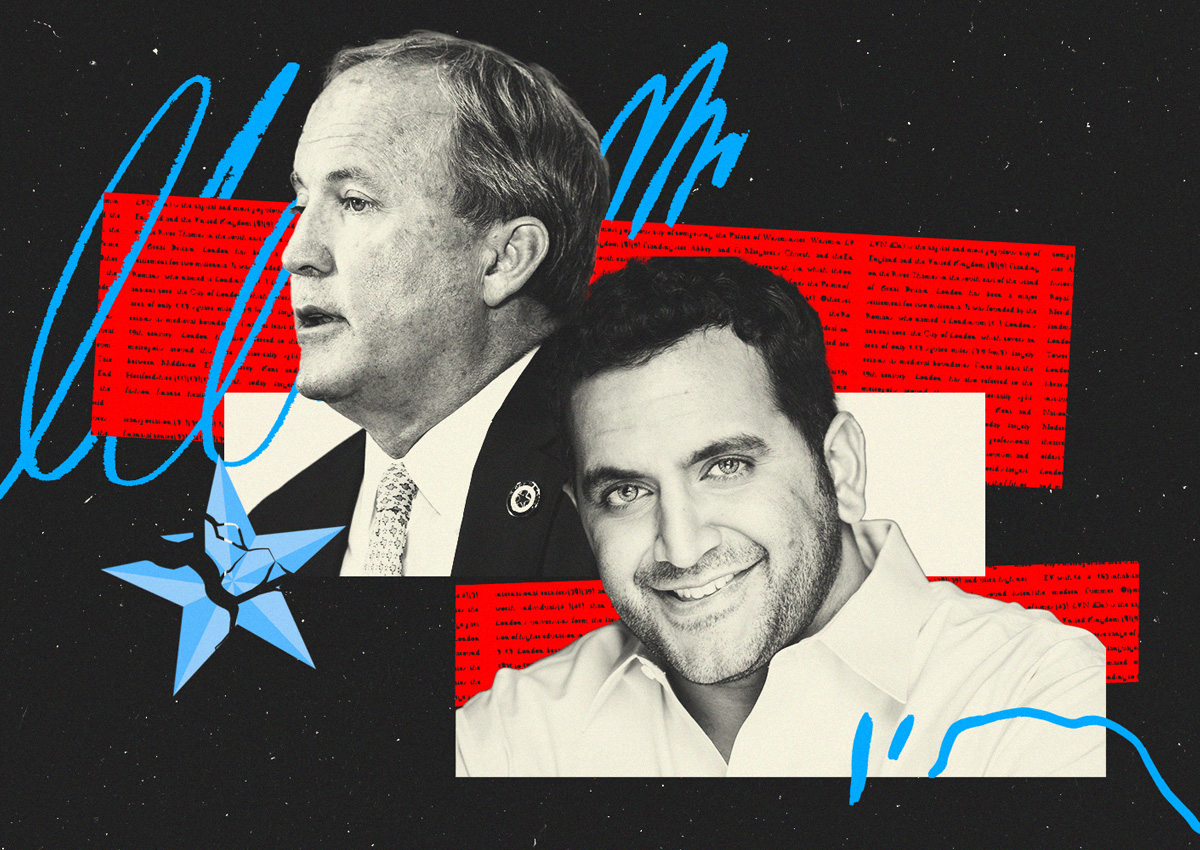

A sale agreement for air rights between a co-op fronting Gramercy Park and Victor Sigoura’s Legion Investment Group has been voided by a Manhattan court, handing the developer a defeat for a proposed condo project along Third Avenue.

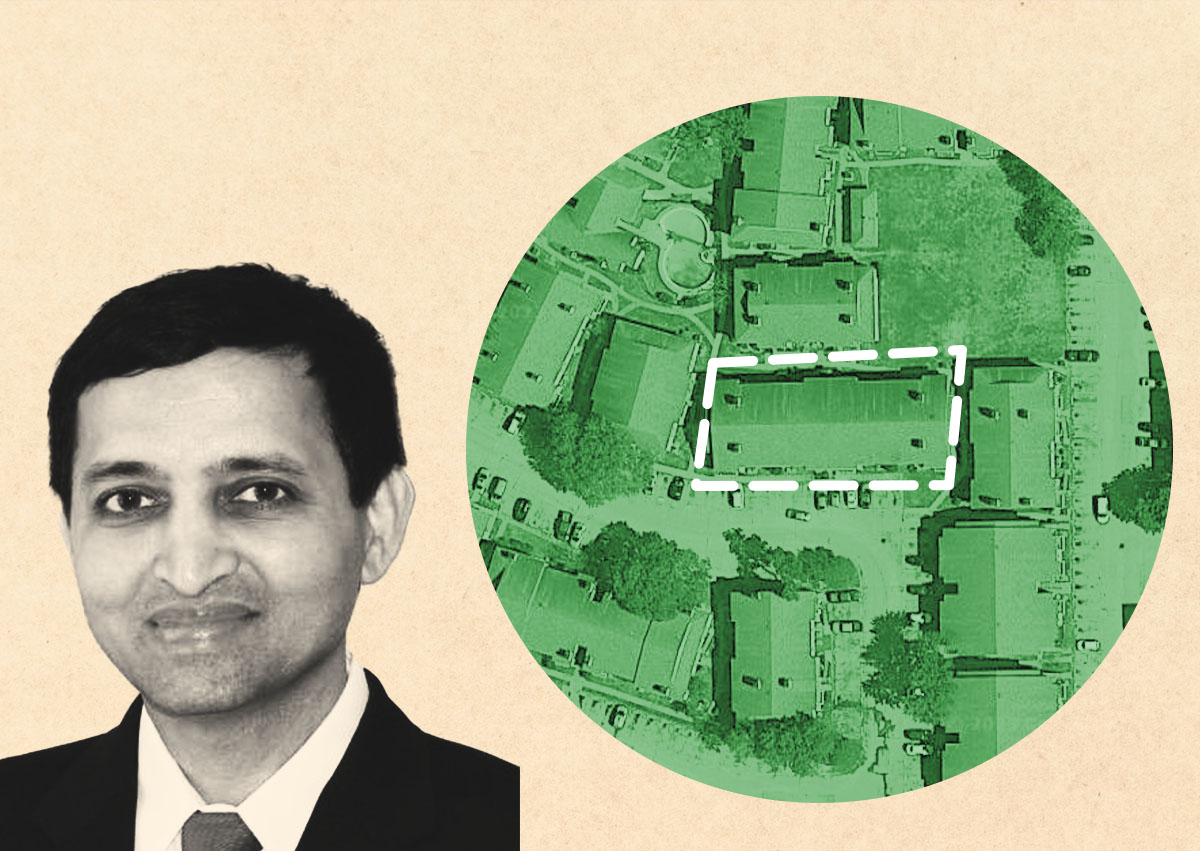

Legion wishes to build a 20-story condo at 252 – 258 Third Avenue that included designs for a cantilever to hang over a portion of the Gramercy co-op, at 38 Gramercy Park North.

Cantilevering the condo above the co-op would allow Legion to use a Gramercy Park address, according to court records, possibly opening the private Gramercy Park to Legion condo residents.

However, the court rebuked the co-op board over its campaign to “coerce” residents into selling the building’s air rights. The board presented the sale as a done deal to shareholders, the court found, and it planned to “pressure” residents to sell the entire building to Legion as a “unique” and “time-sensitive” opportunity.

The court also found that the board failed to properly value the air rights.

“The board members should be ashamed and should resign,” said attorney David Slarskey, who represented shareholder and real estate professional Joseph Cogan in opposition to the deal. An attorney for the co-op board declined to comment on the ruling.

Cogan works as an asset manager for ParkIt, a New York City-based parking lot owner, and has previously worked in real estate investment and finance, according to his LinkedIn page.

“If there is a deal to be done, Legion is going to have to pay a premium to shareholders,” Slarskey added. He accused the developer of trying to buy the building “on the cheap.”

Legion did not return a request for comment.

The court ruled the board failed its fiduciary duty to the co-op by not assessing the value of the building’s air rights in the context of Legion’s proposed development, and by not valuing the transfer of the Gramercy Park address. Additionally, the court found that a plan to pay co-op shareholders from the sale did not properly assess the value of their apartments.

Cogan had accused board members of wanting to cash out of their apartments while sticking other residents with units that would become shaded by the proposed cantilever.

A majority of shareholders can still vote to sell the building, although the court’s ruling noted a consistent unwillingness among many shareholders to sell in the past. “Hence, the multistep approach to coerce a sale,” the court ruled.

In November, Colliers was retained to sell 38 Gramercy at a price of $50 million, but Cogan’s attorney said the death of the air rights sale did not bode well for future deals at the property.

“As long as this board continues to listen to those who got them into this embarrassment, things will get worse for them,” he cautioned.

Read more