After a crackling March, the city’s new development market slowed to catch its breath again in April. Sales volume and median prices both declined, while the luxury segment logged its worst month since the start of the year.

Buyers signed contracts for 282 new development condos in April, down 19 percent compared to March, according to a Marketproof report. The slowdown was not enough to undo a relatively hot February and March: On a year-to-date basis, contracts are still up 8 percent compared to the pre-pandemic average.

Sales volume fell 21 percent to $600 million, compared to $763 million in March, while the median price for new condos slipped 7 percent to $1,581 per square foot.

“After a very active March, demand contracted in April,” Marketproof CEO Kael Goodman wrote in the report, “but that’s to be expected.” March is typically a peak month in the spring selling season, Goodman noted.

But even when accounting for the seasonal slowdown, brokers at the highest end of the market seemed to have a difficult time finding buyers last month. Signed contracts for luxury apartments priced at $4 million and above, which are heavily concentrated in Manhattan, tumbled 38 percent compared to March. The $4 million and up segment logged its slowest month since December, with 23 percent fewer deals than in a typical April.

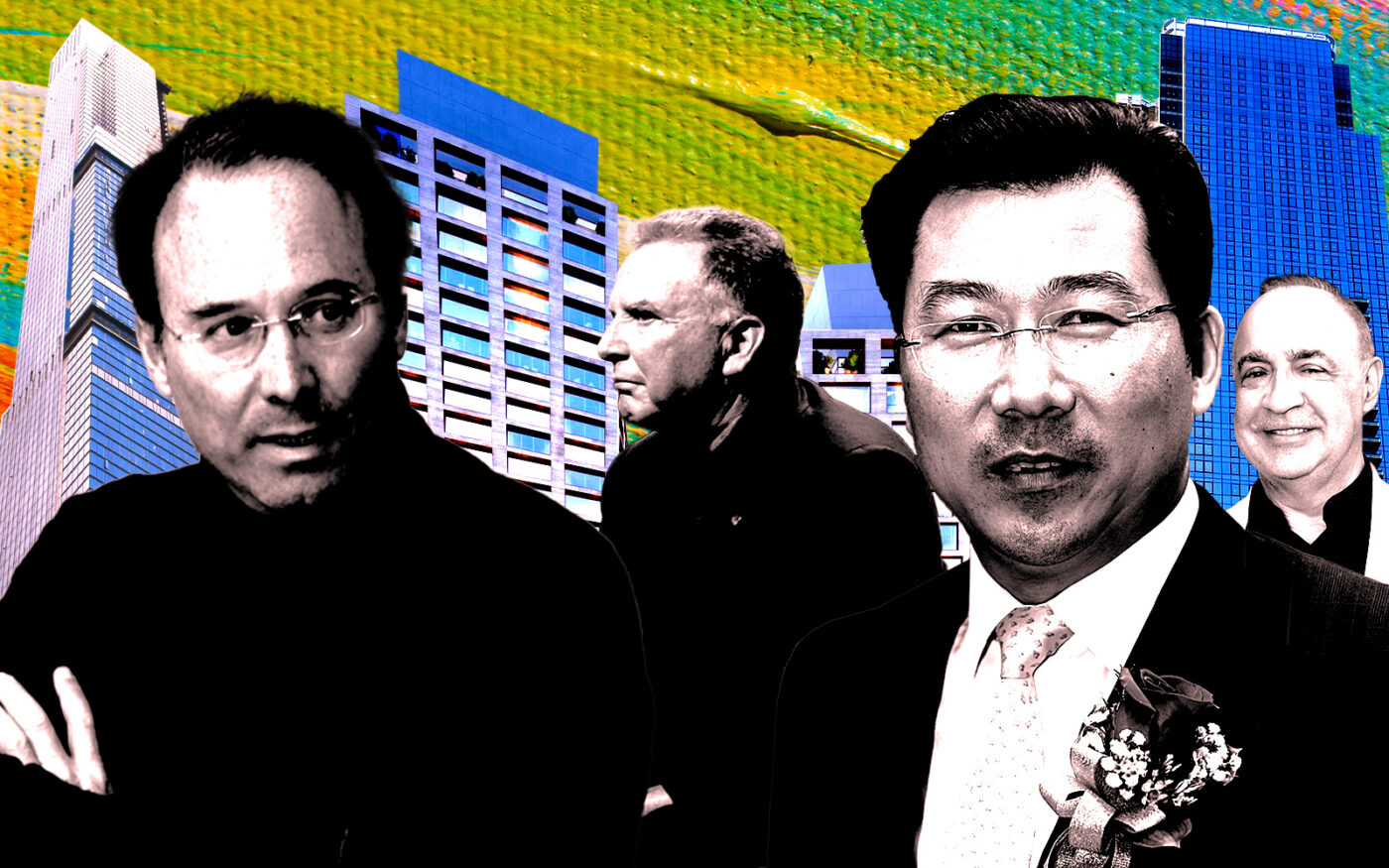

Three luxury pads at Extell’s Central Park Tower, which recently took on a $500 million inventory loan, went into contract with a combined asking price of $38 million, and one closed for $5,300 per square foot. The Witkoff Group and Len Blavatnik’s One High Line — formerly HFZ Capital Group’s the XI — found buyers for two units in Chelsea asking a combined $35 million, including a penthouse that asked $4,900 per square foot.

Manhattan’s 118 new signed contracts last month were down 18 percent from April’s pre-pandemic average and 34 percent from March. At 300 West 30th Street in Chelsea, the 69-unit project by Queens-based Hiwin Group USA saw 16 units go into contract, and Extell’s One Manhattan Square, in Two Bridges, sold six units.

In Brooklyn, new contract signings fell by a third compared to March. But April’s 96 deals were still 20 percent more than an average April from 2015 to 2019. Extell’s Brooklyn Point in Downtown Brooklyn sold six apartments and CIM Group and LIVWRK’s 111 Montgomery Street in Crown Heights had five units go into contract.

Read more

The priciest unit to go into contract was a penthouse at Tishman Speyer’s 11 Hoyt Street in Downtown Brooklyn asking $6.1 million. It was the only unit in the borough that sold for north of $4 million.

In Queens, Chris Xu’s Skyline Tower notched four new contracts after investor Risland took on a $60 million inventory loan, and ZD Jasper’s 130-unit offering recorded 49 contracts for the month, most of which actually sold in prior months but were not reported.