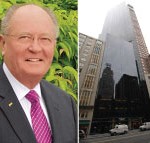

Owners of the Metropolitan Tower in the Plaza District have stopped making payments on their mortgage in what is likely the largest case of distress in the city’s premiere office district since the Financial Crisis.

L&L Holding and its partner are in default on the $92.5 million loan backing the office portion of the 68-story, mixed-use tower at 142 West 57th Street, sources told The Real Deal.

The lender, Aareal Capital Corporation, is looking to sell the non-performing loan. A new buyer could renegotiate the debt or try to take control of the property through foreclosure.

Representatives for L&L and Aareal Capital declined to comment.

The loan offering is sure to be watched closely as a barometer for New York’s office market and the distress many are expecting with debt maturing, lending tight and interest rates having risen. A Newmark team led by Adam Spies and Dustin Stolly is marketing the note for sale.

Rob Lapidus and David Levinson’s L&L bought the 18-story office portion of the glass-and-steel tower with BlackRock in 2006 for an undisclosed sum. The building, developed in 1987 by Harry Macklowe, has residential condominium units above.

L&L and BlackRock in 2016 sold the majority of the equity in the office portion to the Mitsubishi Corporation through a fund administered by GreenOak Real Estate, which merged with Bentall Kennedy in 2019.

BlackRock exited the property and L&L retained a 1.14 percent stake. It was at that time that the new owners took on a $100 million loan from Aareal. Aareal refinanced the debt in 2021 with a $92.5 million loan — the one now in default.

Read more

The three-year loan is interest-only with a rate of 300 basis points above LIBOR, according to marketing materials from Newmark. That interest rate jumps by 300 points once the loan is deemed to be in default.

It’s not immediately clear what led the owners to stop paying, but rising interest rates and the shift to hybrid work have put stress on office owners.

The increasingly troubled WeWork is a tenant in the building.