New York City’s industrial real estate market remains healthy, but its pandemic boom appears to be coming to a close.

Only 730,000 square feet of industrial space was leased in the first quarter, according to a quarterly data from CBRE reported by the Commercial Observer.

The total is less than half of the 1.5 million square feet leased in the fourth quarter and down 25.6 percent from the three-year quarterly average.

Construction on industrial space is also slowing. There were 12 properties in the midst of construction during the first quarter, spanning 5.8 million square feet. The square footage volume being constructed declined 19.9 percent year-over-year.

The period marked a landing from the sector’s unprecedented boom at the onset of the pandemic. Tenants and developers who responded to the rise of e-commerce in response to pandemic lockdown orders have since been bogged down by rising interest rates.

The market may be cooling, but it carried strong demand last quarter. The availability rate declined to 6.5 percent from the previous quarter, while asking rents rose 2.1 percent to $25.59 per square foot.

Read more

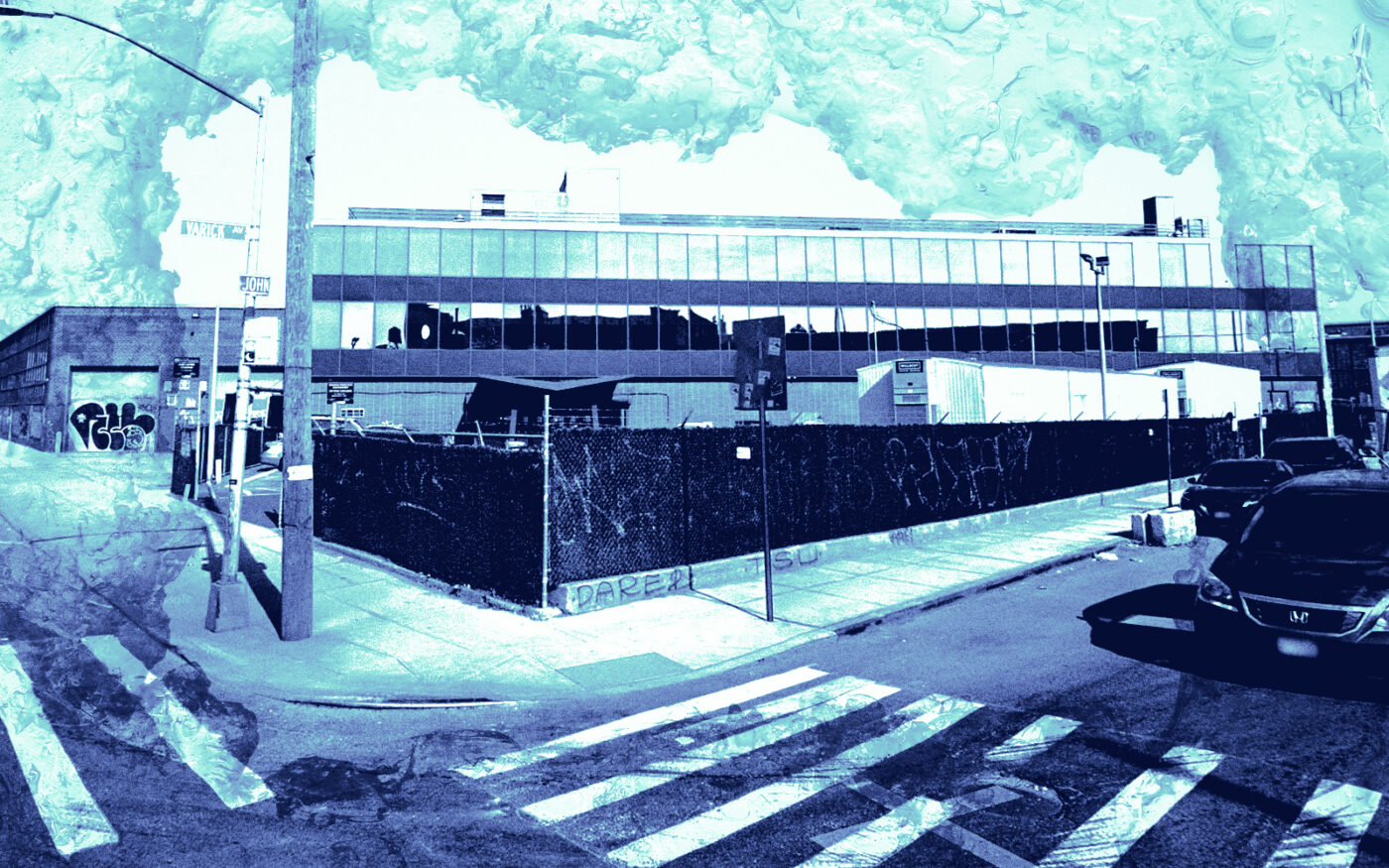

Brooklyn had a banner month, boasting more than half of the industrial space leased in the city during the first quarter. The 400,000 square feet taken marked a 24.5 percent increase year-over-year. The borough also had the quarter’s largest individual lease, a 156,000-square-foot deal by the New York City Department of Transportation at 101 Varick Avenue in East Williamsburg.

On the other end of the spectrum, Staten Island saw a lowly one lease close in the quarter for 2,000 square feet, the worst performance among the four outer boroughs; Manhattan isn’t included in the report due to its dearth of industrial space.

— Holden Walter-Warner