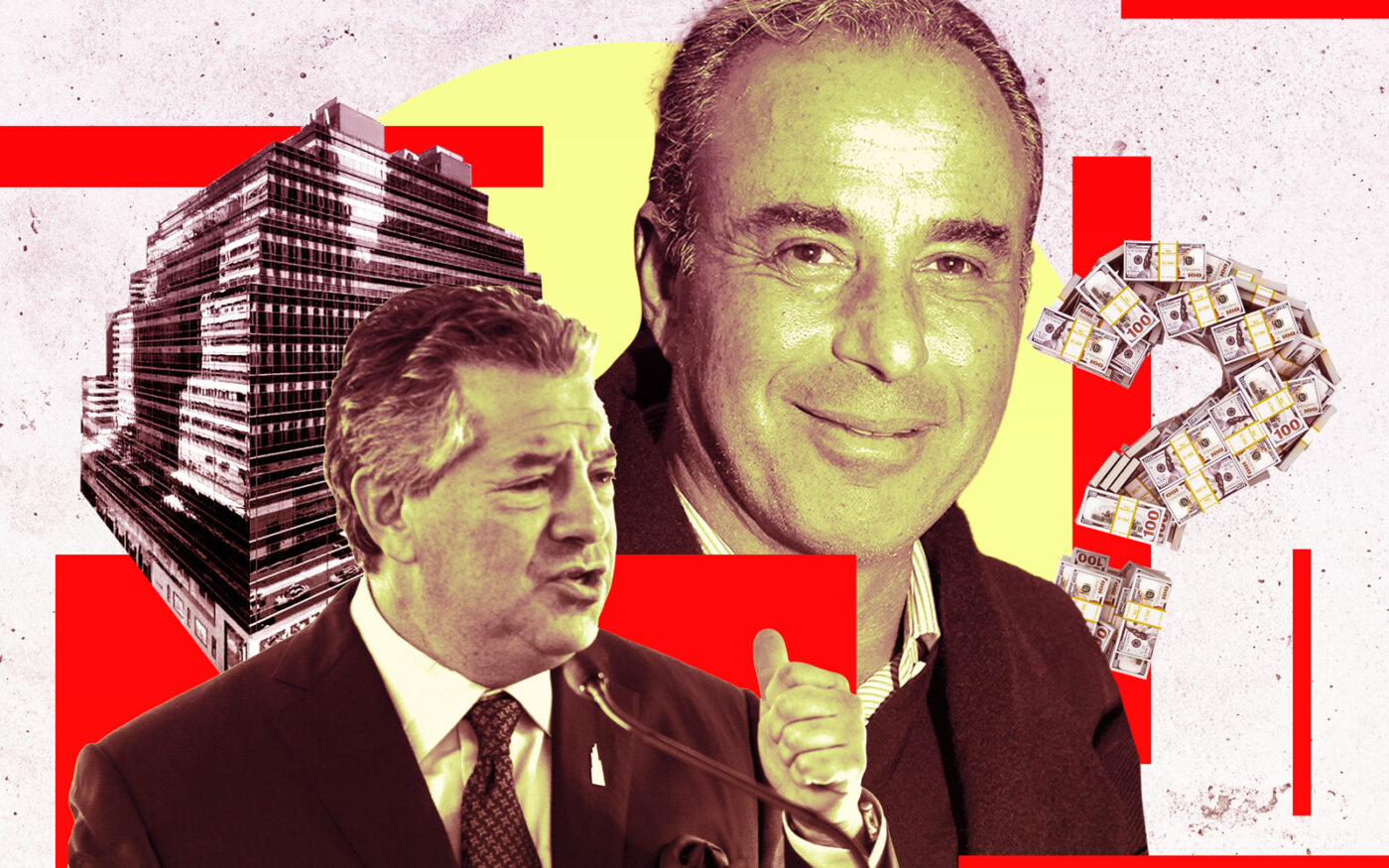

A new twist in the epic battle between SL Green and Ben Ashkenazy over a Midtown office building hinges on one question: How much is Ashkenazy worth?

The decade-long dispute is now centered around Ashkenazy’s alleged default on a $195 million loan tied to the land beneath 625 Madison Avenue. A complaint filed last week demands that Ashkenazy hand over missing records regarding his net worth and liquid assets, documents required to remain in good standing with his lender.

The clash of real estate titans began in 2013, when Ashkenazy nabbed the ground beneath SL Green’s office building for $400 million — a price that implied plans for a hefty rent hike.

SL Green then found a way to gain leverage over Ashkenazy in 2019 when it bought a stake in the mezzanine loan he’d used to finance his purchase of the land. The loan’s originator, the U.K.-based Children’s Investment Fund, sued Ashkenazy the following year for defaulting on the debt in a filing that listed SL Green’s special-servicing arm as a plaintiff.

The lawsuit alleged Ashkenazy had breached a personal guarantee by failing to pay down $40 million in debt by November 2018. Ashkenazy had paid just $30 million, the suit claimed, resulting in a default that left him liable for the $10 million balance and an additional $10 million in penalties. A state Supreme Court judge ruled in the lender’s favor, ordering Ashkenazy to fork over $20 million plus interest.

But Ashkenazy appealed and the Appellate Division sided with him in May 2022, ruling that the terms of the loan were “ambiguous” as to whether Ashkenazy was on the hook for the $20 million at the time of default or when the loan came due.

That ruling kicked the case back to a trial court to decide.

Ashkenazy’s loan comes due on June 6, and the approaching deadline presents yet another obstacle for his lenders.

If the trial court judge rules that Ashkenazy doesn’t have to pay until the loan comes due and he can knock out the balance at maturity, “then there is no claim against Mr. Ashkenazy,” his attorney Robert Smith told the court last year.

“I am not disagreeing with that,” Judge Andrew Borrok responded. “If the lender is paid in full including any statutory interest that is due, that is true.”

Children’s Investment Fund is pushing for a judgment before that June 6 maturity date.

With that case pending, Children’s Fund, through its SL Green-affiliated special servicer, has filed a separate suit against Ashkenazy demanding he cough up four years’ worth of missing financial statements.

The complaint calls on Ashkenazy to furnish records showing that he’s maintained a net worth of $195 million and liquid assets of $5 million, as required by the loan agreement.

If a borrower breaks such a covenant, as the suit alleges Ashkenazy did, it can be considered a technical default, allowing the lender to accelerate repayment of the loan. Still, the loan’s approaching maturity would offer little room to squeeze Ashkenazy.

Attorneys for Ashkenazy and Children’s Investment Fund did not respond to requests for comment.

625 Madison Avenue isn’t Ashkenazy’s only pain point in Midtown. He’s facing a foreclosure attempt across the street at 635 Madison Avenue, where he owns another ground lease, after defaulting on a $90 million loan in 2020. And he’s facing foreclosure at 2067 Broadway after he and his partners, the Gindi family, defaulted on an $11.6 million loan last year.

Read more