Chris Peck has a “no asshole” policy when it comes to clients, which can be a challenge when your job is lining up financing for some of the biggest commercial real estate players in New York City.

So it says something that JLL’s Peck has worked for more than a decade with Domain Companies, a firm run by Matt Schwartz and Chris Papamichael that has become one of the city’s most prolific developers.

Just between May 2021 and June 2022, Domain submitted filings to build 1.3 million square feet — second only to the Chetrit Group — across four outer-borough, mixed-use developments, according to an analysis by The Real Deal of projects larger than 25,000 square feet.

“You don’t do $2 billion worth of development in New York without being tough as nails, but [Domain] is one of a handful that … can be tough as nails, can compete with New York real estate people but be a gentleman,” Peck said.

Domain’s planned mixed-use projects include 420 Carroll and Majestic in rezoned Gowanus, where the firm has roughly 600 residential units in the pipeline; the 499-unit, 484,000-square-foot Jasper at Hunter’s Point in Long Island City; and the two-tower, 544-unit Estela in Mott Haven.

All four projects are slated for completion over the next two years and are 421a-eligible. Domain secured construction financing for each development ahead of the tax abatement’s expiration last summer.

Domain’s story began in 2004 when Schwartz and Papamichael, a pair of Tulane University graduates, teamed up to start it. Schwartz was at Related Capital, where he was responsible for the acquisition and development of multifamily properties and affordable housing. Papamichael previously worked at W&M Properties, Crescent Heights and Aris Investment and Management, where he was responsible for all investment and development.

The company’s strategy has been focused on identifying neighborhoods in need of mixed-income housing and developing a community there, according to Schwartz. Among Domain’s initial projects was the 582-unit Spring Creek Gardens on an East New York site acquired from Related.

“Affordable and mixed-income housing was really a focus of ours,” the Brooklyn-born Schwartz said. “And over the years, we’ve expanded that view of affordability, of community development to a more holistic approach.”

To that end, Domain’s portfolio now consists of at least three-dozen mixed-use multifamily, hospitality, restaurant and coworking properties in New York City, New Orleans and Salt Lake City.

Schwartz and Papamichael returned to their Bayou roots after Hurricane Katrina left New Orleans in need of redevelopment, and Domain’s foray into Salt Lake City came after meeting with a local developer when traveling to the airport following a ski trip.

“[Domain] doesn’t feel constrained by project type,” L+M Development Partners’ David Dishy said. “They’ve done hotel stuff, they’ve done restaurant stuff, they have a whole coworking thing going on. … All these sorts of things create some synergy in their projects and they’ve done a really good job of it.”

“You want to run through a wall for people like that.”

Another integral component of Domain’s strategy is choosing the right project partners. Vorea Group, the development firm run by Papamichael’s cousin Peter Papamichael, is a co-minority sponsor on several Domain developments. At its 12-story Long Island City project, Domain is working with Ron Moelis’ L+M Development, another one of the city’s most active developers, and Jonathan Slager’s Bridge Investment Group.

Schwartz said it’s vital that long-term collaborators share Domain’s vision of sustainable, mixed-use development in burgeoning neighborhoods.

“Our partners really need to understand the local market well and the landscape, be able to identify the opportunity and have the vision for where that particular community and that site is going,” Schwartz said.

L+M Development and Domain long shared a mutual respect before the two companies teamed up with Vorea to acquire the Long Island City development site at 2-33 50th Avenue in 2021 for $88 million. Dishy, who runs L+M’s mixed-use development arm LMXD, called the Domain partnership a natural fit.

“We’re definitely on a similar page, which is what I’ll call sort of a civic mindedness about what we do,” Dishy said. “We’re building developers, so we’re making investments … but there’s sort of a disposition toward ‘this is good for the city, this is a specifically interesting, compelling project’ and kind of being honorable, non-jerky partners.”

Not screwing your partners might seem obvious, but it’s not uncommon for firms in a development to turn on each other.

Bridge Investment Group’s Rachel Diller, whose relationship with Schwartz goes back more than 20 years from their days as cubemates at Related Capital, cited Domain’s perseverance when describing how the firm was able to develop its 210-unit Eleven33 in Greenpoint in 2014. Diller, who was with Goldman Sachs’ Urban Investment Group at the time, was responsible for securing bond financing for the 270,000-square-foot project.

To negotiate the ground lease, Schwartz had to wear down the parcel owner, who showed no interest in doing a deal. Schwartz would go to the owner’s office in the basement of the building next door and linger as long as 12 hours for availability, Diller recalled.

“(Schwartz) would just wait until the guy shuffled by and finally was like, ‘What do you want?’” Diller said. “He’d walk by him like a hundred times and Matt would just have to sit there.”

The persistence eventually paid off, as he was able to close on the land. Diller called it a testament to his ability to build relationships.

“I really don’t believe that there’s anyone else who could’ve done this, but this is how New York real estate gets done,” Diller said. “There’s probably people who died trying to get this guy to do a deal for the 10 years before, and only Matt could.”

Peck, who began working with Domain in New Orleans when he was at HFF before the company merged with JLL, echoed Diller’s sentiment.

“Pardon my French, but they don’t [screw] around,” Peck said. “They bring everyone up to their level. The expectations they have of us are always greater than the expectations that we have for ourselves. It makes you want to run through a wall for people like that.”

However, it hasn’t been all smooth sailing for Domain. At its project at 1133 Manhattan Avenue in Greenpoint, the company sued a number of tenants in January, alleging they racked up $500,000 in arrears when the property was without gas and heat service for several months late last year.

Domain said the problem began in September, the delayed effect of botched plumbing by a subcontractor when the property was finished in 2014. The firm said that repairs totaled more than $1 million and that Domain provided tenants with space heaters, hot plates and catered dinners.

Service was restored in December and repairs were completed in January, when the firm reached an amicable resolution with its residents, according to a Domain spokesperson.

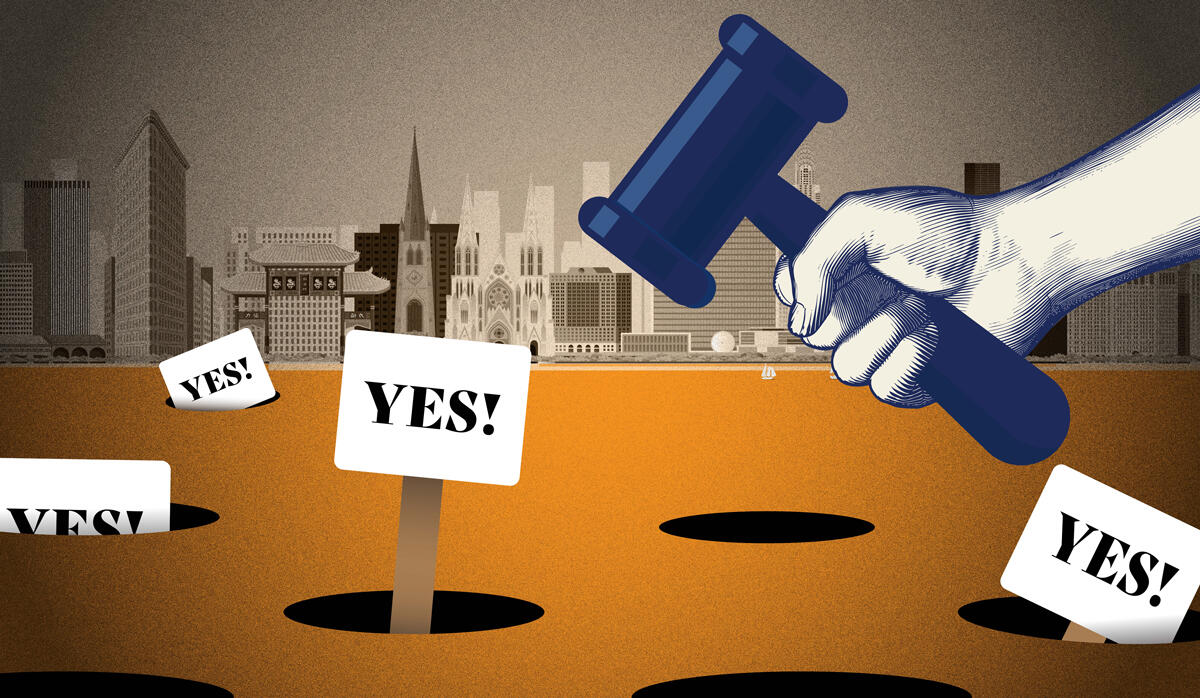

The big picture for Domain and other New York City developers is also a challenge, given high financing costs, stingy lenders, prickly politicians and the 421a tax break’s expiration and construction deadline. Schwartz said partnerships become more important when the industry is in flux.

“We’ve been through a variety of cycles and challenging environments. Relationships are everything in our business,” he said. “The key to navigating those challenges and the success we’ve had has always been choosing the right partners. Those relationships have not only helped us through tough times but have enabled us to capitalize on the opportunities that are inevitably created during times of disruption.”

One curiosity about Domain, which is based at 120 Broadway, is that it has not done a project in Manhattan. Schwartz said that the firm is open to developing in the central borough and that office-to-residential conversions is “a big opportunity that we’ll be looking at.” But in the meantime, Schwartz said Domain remains focused on areas where it has projects.

“We think that there is so much more potential in Gowanus, but also Mott Haven and others,” Schwartz said. “So we’re really looking for other opportunities there and to continue to build on those.”

Read more