It’s out of the frying pan and into bankruptcy court for a West Chelsea office development.

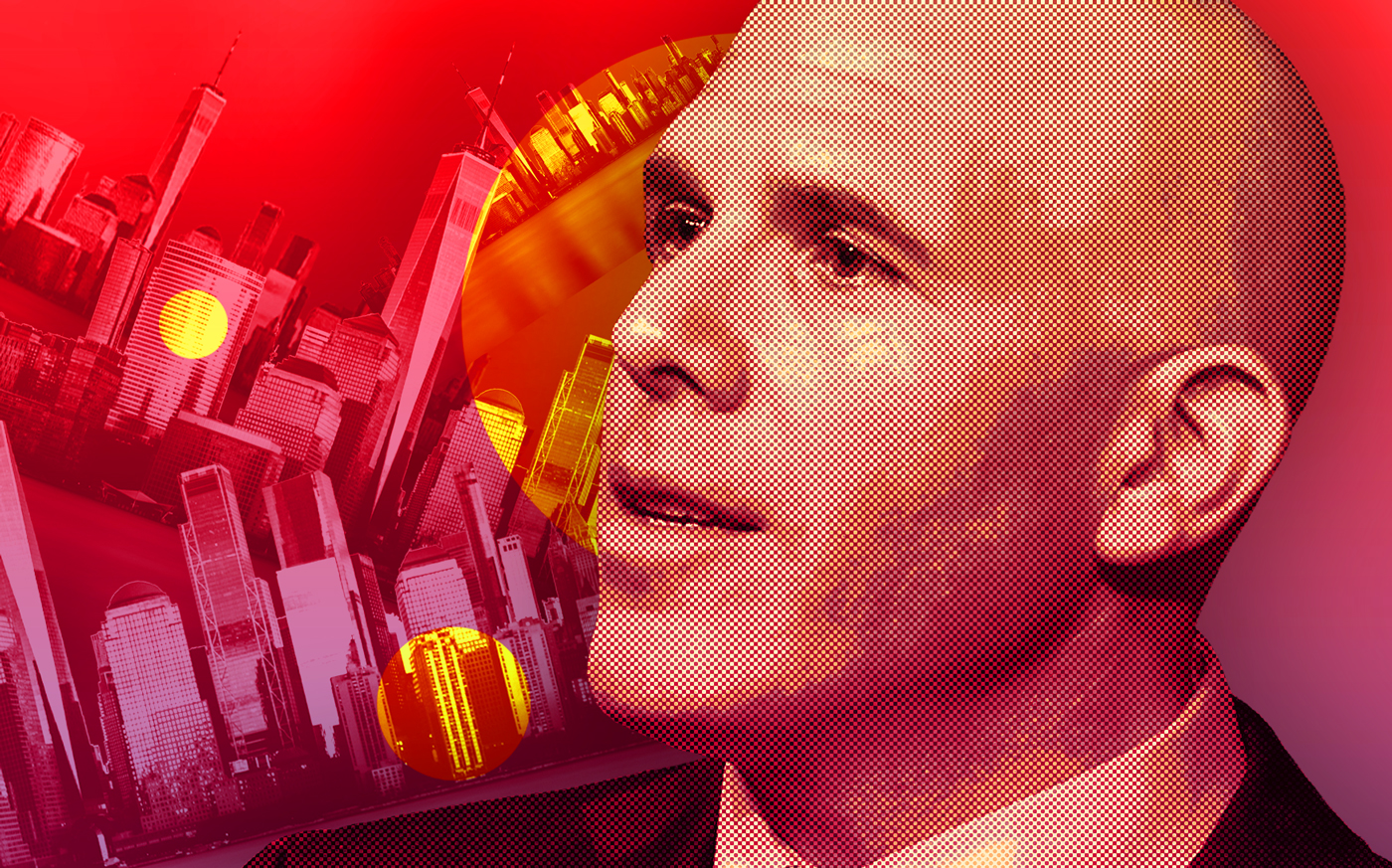

Erno Bodek, the owner of 541 West 21st Street since the early 1980s, has put his conversion project there into bankruptcy to halt foreclosure proceedings initiated by mezzanine lender SME Capital.

Bodek told a bankruptcy court Tuesday that he isn’t to blame for cost overruns at the project.

Instead he pointed the finger at Cecora Investment Advisors, which he hired “because I had no experience in redeveloping commercial property in Manhattan,” Bodek said in court filings.

Cecora was brought in to advise on converting the 65,000-square-foot warehouse into a “first-class modern office building,” according to Bodek. The owner says he needs another $500,000 and three to six months to get a temporary certificate of occupancy, and that with stable tenancy, the building would be worth $80 million.

“Although the office building sector has been weakened as a result of the Covid-19 pandemic and remote working,” Bodek told the court, “there is still significant demand for newly constructed class A office space, especially near The High Line.”

Senior lender G4 Capital and mezzanine lender SME Capital Ventures have together lent almost $62 million to the project, and negotiations were underway to salvage it, Bodek claimed, until SME “made it clear it intends to take over” and cut Bodek out.

Bodek told the court that other lenders have lined up to finish construction, make tenant improvements and pay leasing commissions to stabilize the building. Cecora (which also goes by CIA Group), G4 and SME did not immediately return requests for comment.

Although newer office buildings such as Bodek’s may command higher rents than older ones, tenancy is down across the board in New York City. Office leasing plunged more than 30 percent in the fourth quarter from the same period a year ago.

Read more

Recent examples of the distressed office market include co-working firm Bond Collective being locked out of its offices for allegedly failing to pay $2.8 million in rent at 115 East 23rd Street, Related walking away from a Long Island City office campus, and RXR deciding to give two buildings back to the bank.

Vacancy improved marginally at Manhattan offices last quarter to just below 17 percent, and asking rents rose slightly to $75.41 per square foot.