RFR Holding is on the hunt with for refinancing with three months until maturity at the Seagram Building.

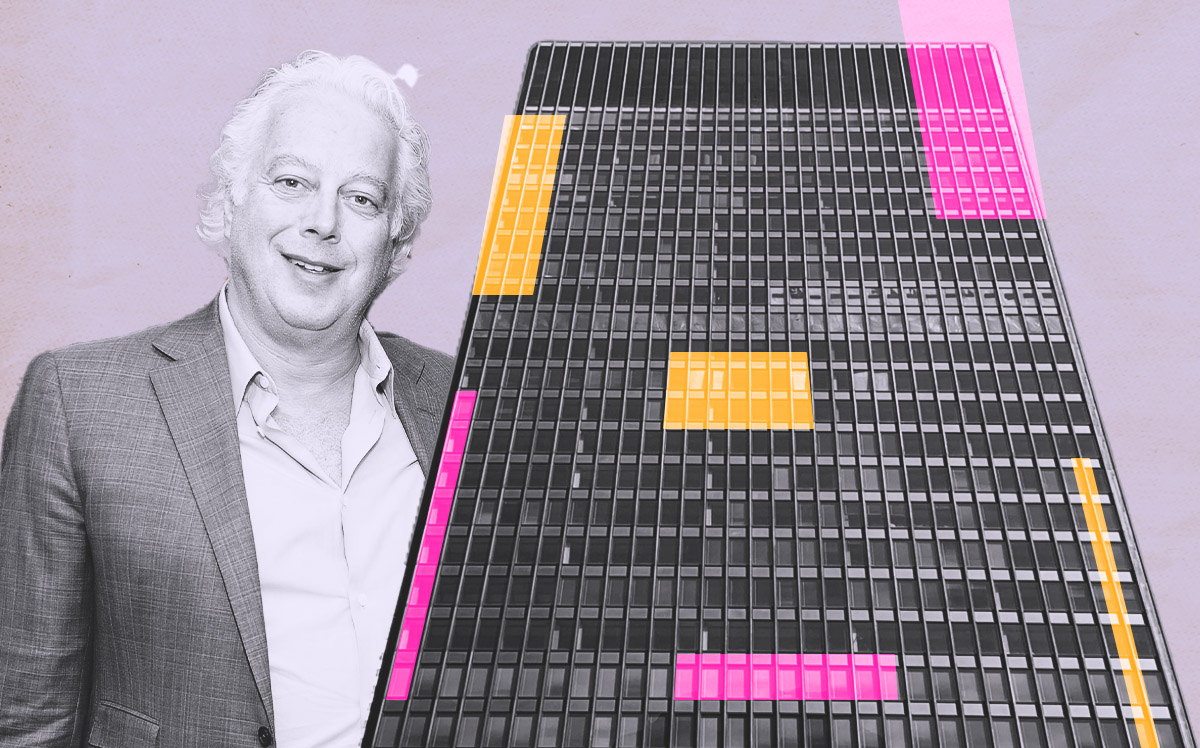

Aby Rosen and Michael Fuchs’ firm hired Eastdil Secured to secure a loan to retire the outstanding debt on the 38-story office property at 375 Park Avenue, the Commercial Observer reported.

The $1 billion financing package RFR secured a decade ago is scheduled to mature in May, according to Commercial Mortgage Alert. The package comprises $783 million in senior CMBS debt from Citigroup and Deutsche Bank and $217 million of mezzanine loans. None of the outstanding debt has been paid; RFR has discussed extending the loan.

An additional $100 million of preferred equity in the deal — provided by MSD Partners — is also maturing alongside the larger package. If it’s not paid off, MSD can purchase the preferred equity at par and exercise mezzanine rights.

In total, RFR needs a $1.1 billion capital stack. The firm did not return the Observer’s request for comment.

RFR recently conducted a $25 million renovation of the 860,000-square-foot tower, adding a 35,000-square-foot amenity space to replace a parking garage.

Private equity firm Blue Owl Capital recently signed a lease for 138,000 square feet, increasing the volume of leasing at the building last year to at least 375,000 square feet. Still, RFR is smarting from the departure of Wells Fargo a couple of years ago; the bank shifted to Hudson Yards.

Commercial mortgage maturities are cascading across the New York City office market, facing a one-two punch between rising interest rates and waning interest in full-time in-person office work. More than $16 billion in loans secured by commercial properties are scheduled to mature this year, according to Trepp.

The $783 million CMBS debt is one of the most significant loans set to mature this year. The property is approximately 96 percent leased.

Read more

— Holden Walter-Warner