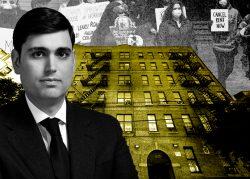

Loans for three buildings refinanced five years ago by well known multifamily landlord Isaac Kassirer were sold.

The three loans sold for $45.8 million, PincusCo reported. While the buyer could not be confirmed, Moshe Greenzweig’s Cedarbridge Management is the only owner registered at the address of the limited liability company behind the purchases.

The loans are secured by three properties in Harlem spanning 132 units: 350 Manhattan Avenue, 320 Manhattan Avenue and 312 West 114 Street. More than half of the original loan principal is tied up in 350 Manhattan Avenue, which is the largest of the three at 48,000 square feet. The building at 320 Manhattan Avenue has the most units, 59.

Kassier’s Emerald Equity Group purchased the three buildings from the Orbach Group for $61.5 million in 2017. The purchase price at the time came out to $473,000 per unit and $544 per square foot.

Read more

Kassirer refinanced the three buildings with Santander Bank in 2017. It’s not clear if Kassirer still has a stake in the properties. In 2019, Kassirer assigned his interests in Emerald Equity to Moshe Piller’s MP Management.

Kassirer became a well-known figure in the multifamily market in the mid 2010s, especially after buying the 47-building Dawnay Day portfolio in Harlem for $357.5 million and a 38-building Bronx portfolio for $140 million.

New York state devalued rent-stabilized buildings in 2019, however, and Kassirer ran into trouble. Emerald Equity defaulted on $203 million in loans from LoanCore for the Dawnay Day buildings in December 2020. Last year, his firm admitted to commingling security deposits at a handful of now-bankrupt buildings, which is prohibited by state law.

The company also attempted to pull a portfolio of South Bronx buildings from rent regulation, a bid that ultimately failed. Earlier this year, tenants at one of the buildings in question launched a rent strike. Kassirer disavowed any current connection to the Bronx properties.

— Holden Walter-Warner