A major real-estate-industry group says the federal government is setting a bad example, and hurting the overall office market, by allowing remote work and reducing its office footprint.

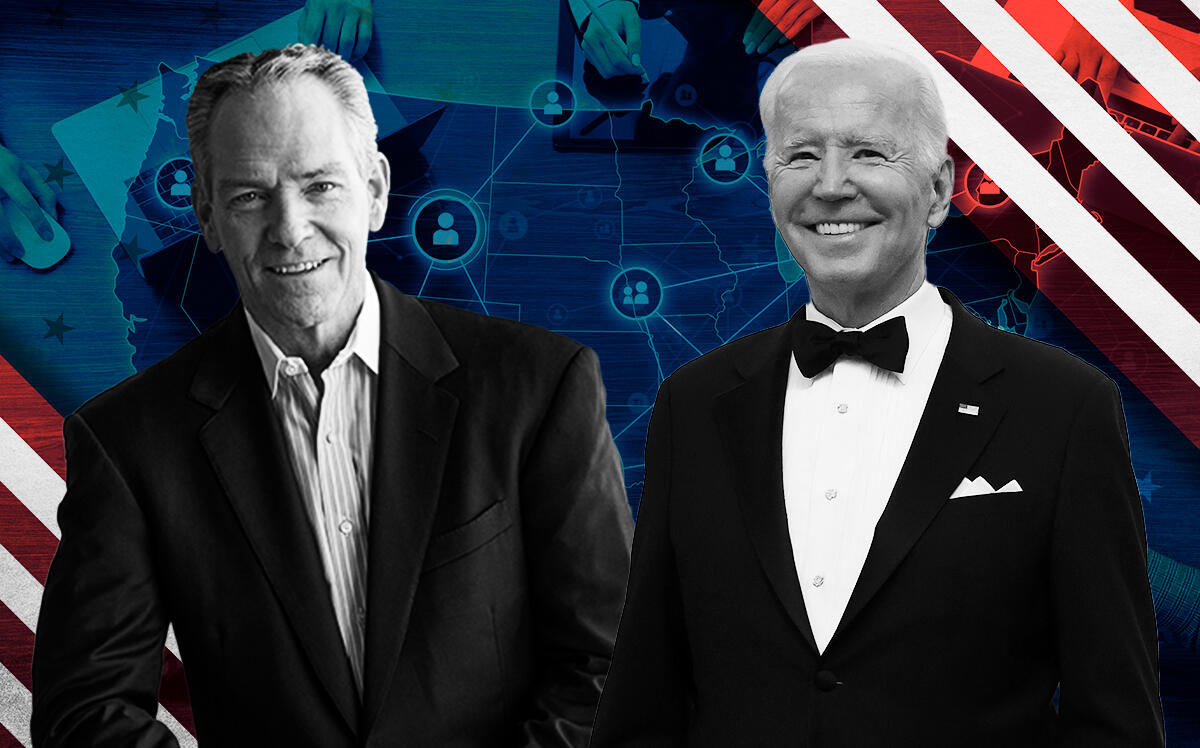

The Real Estate Roundtable — which is composed of ownership, development, lending and management firms along with trade associations — said in a letter that the Biden administration should make more efforts to lure federal workers back to their offices, CoStar reports.

“We are concerned that certain administration policy guidance is encouraging federal agencies to adopt permanent work-from-home policies for federal employees and thereby actually magnifying negative economic and social consequences for cities,” the letter signed by Real Estate Roundtable Chairman and Suffolk Construction CEO John Fish and Real Estate Roundtable President and CEO Jeffrey DeBoer, according to the outlet.

Citing Kastle Systems data, CoStar said office occupancy in 10 major U.S. cities is less than 50 percent of what it was before the pandemic struck in March 2020.

In addition, the group asked for legislation to make it easier to convert offices and other commercial properties into residential units.

Nationwide, the federal government owns 81 million square feet of office space and leases another 171.5 million square feet, the outlet said.

In a survey of 24 federal agencies, 16 planned over the next three years to cut the number of leases and 19 said they would scale back on square footage.

The group said the government’s reductions will result in the significant depreciation of building values.

Numerous private companies, adopting remote-work policies or looking to reduce costs, have reduced their office footprints nationwide. Meta, for example, said in October that it was spending $3 billion to consolidate office space.

In New York, JP Morgan has reduced its office footprint by 700,000 square feet since the beginning of the pandemic.

Over the summer, NFL Network, Yahoo and 20th Century Studios put about 120,000 square feet of office space back on the Silicon Beach market.

— Ted Glanzer