The construction pipeline is getting narrower.

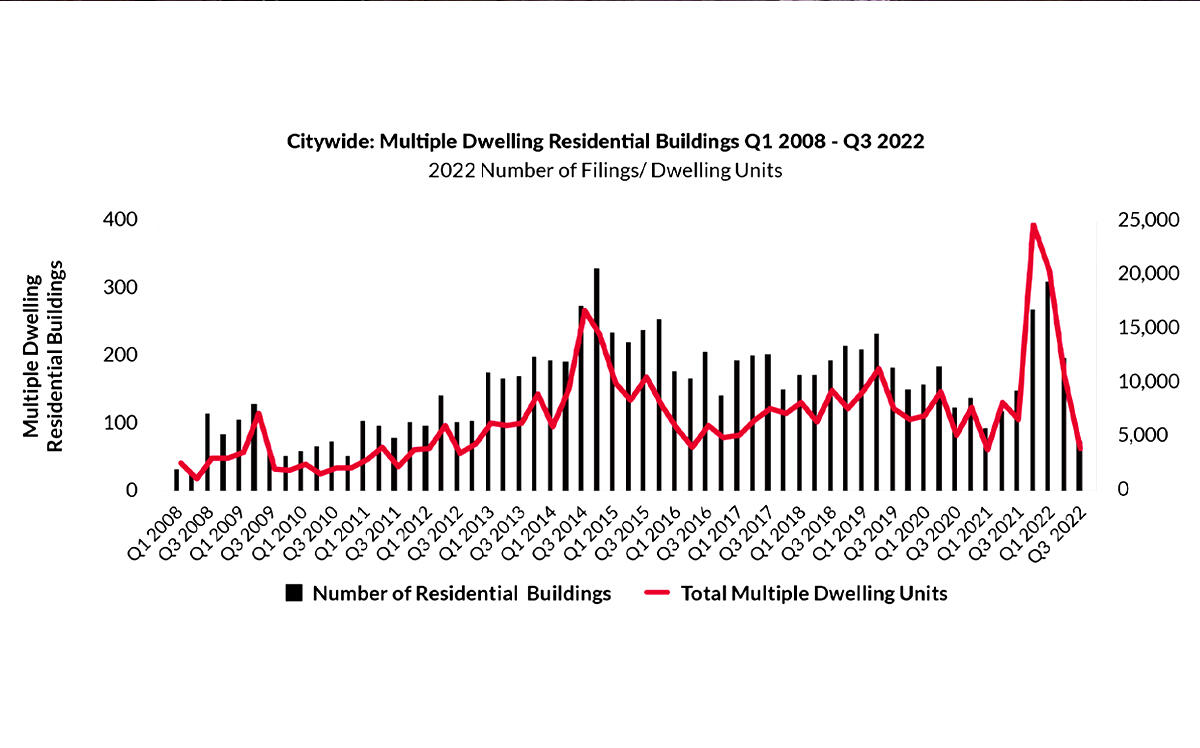

There were 351 new building filings in New York City in the third quarter, down 17 percent from the second quarter and 28 percent year-over-year, according to a report from the Real Estate Board of New York.

The drop is in part because the 421a property tax break for multifamily development in the city expired June 15, which triggered a rush of filings. The 689 in the first quarter were the most in a quarter since 2014, which, not coincidentally, was just before the previous version of 421a expired.

A drought followed the 2014 surge, and now history is repeating itself. Developers have all but stopped trying to put together investors to pursue rental projects that cannot get the 35-year property tax break. Condo projects were largely excluded from the most recent iteration of 421a.

Rising interest rates have also contributed to the decline, as financing projects of all kinds became more challenging for developers.

But the impact of 421a’s expiration is clear when comparing the slowdown in filings for rental projects to the overall drop in new-building filings. The quarter-over-quarter falloff in rental filings was 62 percent, nearly four times the quarterly decline overall. Only 78 rental projects were filed in the quarter, half as many as in the same period last year.

Those 78 projects are proposed to have 3,346 units, down 46 percent year-over-year and the smallest quarterly number in a decade — since the slump that followed the 2008 financial crisis.

Rental projects in much of the city became dependent on 421a over several decades. Progressives let the tax break lapse, believing it forgave too much property tax for too little affordability. Some predict it will be several years before it is replaced, although an abatement still exists for co-ops and condos.

Read more

Experts have estimated the city needs to build approximately 560,000 units by 2030 to catch up with demand for housing in the city.

The spikes in 2014 and 2022 coincide with expirations of 421a (REBNY)

“We face a severe housing shortage that is only getting worse and hopefully these sobering findings will encourage stakeholders to advance policies that facilitate more of the development and construction activity that our city needs,” REBNY’s Zachary Steinberg said in a statement.

More than a third of the quarter’s proposed multifamily units were in Brooklyn, while the Bronx and Queens both grabbed larger shares than in the second quarter.

Multifamily construction was quiet in Manhattan and Staten Island, though, which combined for only 10 multifamily developments. However, Boston Properties’ 982,000-square-foot project at 343 Madison Avenue in Manhattan was the largest filing of the quarter.

Third-quarter filings accounted for 6.4 million square feet, a drop of 57 percent from the previous quarter and 20 percent year-over-year.