One developer is trying to soothe potential buyers’ concerns over borrowing costs with a perk at two of its New York City properties.

Extell Development is offering a “Rate Rewind” program at One Manhattan Square on the Lower East Side and Brooklyn Point in Downtown Brooklyn. Under the program, the sponsor buys down mortgage interest rates by 2 percent each year for the first three of the mortgage.

Broker Ryan Serhant, who is marketing Brooklyn Point, said the offer help “to bring serious buyers that were already in the market over the finish line.”

“As with any period of economic shift, the impact of rising interest rates can make it seem like there’s less of an opportunity to get great value in today’s market, which is simply not true,” Serhant said.

There’s plenty of room for buyers who want to snag the promotion. Marketproof data reported by Bloomberg show 57% of One Manhattan Square’s 814 units have sold, while 66% of Brooklyn Point’s 481 have sold.

The offer, which bases the mortgage on 75 percent of the purchase price to reduce monthly payments for a given period, is among the “sweeteners” built into marketing strategies of similarly large developments, Nestseekers chief economist Erin Sykes said.

“If it wasn’t profitable, they wouldn’t be taking losses,” Sykes said. “This is just to continue momentum and actually be more aggressive in a time where a lot of people are starting to be fearful. It’s a very bullish strategy.”

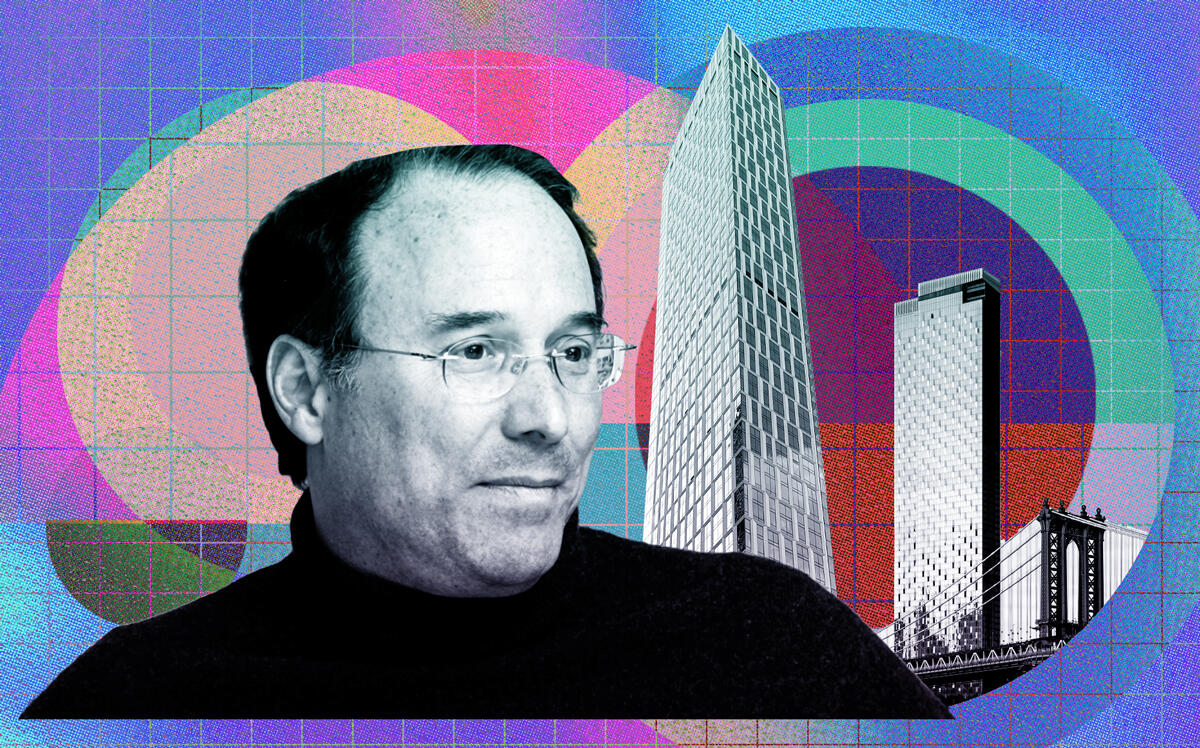

This isn’t the first incentive play by Gary Barnett’s firm, which is also behind iconic condo towers Central Park Tower and One57. To confront a slowdown in the condo market in 2018, Extell made a portfolio-wide offer to cover between three and five years of common charges for any apartment purchased by the end of the year. At the Lower East Side tower, it offered up to 10 years of free common charges before announcing a “rent-to-buy” program in 2019 to spur deals.

Barnett told Bloomberg the deal is moving buyers along, despite the market’s recent slowdown.

The developer’s latest offer comes as mortgage rates continue to climb. In October, the average 30-year fixed mortgage rate rose for the 10th straight week, surpassing 7 percent to reach a 21-year high.

Prospective homebuyers have responded by pulling back from the market. The Mortgage Bankers Association reported in late October that application activity dipped to its slowest pace since 1997.

New development sales in New York dropped to pre-pandemic levels in October, down 20 percent from September and 36 percent from October 2019. Ultra-luxury buyers are largely unmoved by higher borrowing costs, but rising mortgage rates stifled deals with entry-level and wealthy buyers.

Extell appears to be alone in targeting mortgage rates to lure buyers, but more developers will likely move to contend with the mortgage market’s unpredictable future. The Federal Reserve indicated earlier this month that smaller rate increases could be on the horizon as it continues to grapple with inflation, which is at a 40-year high.