In the string of landlord-tenant lawsuits sparked by Housing Rights Initiative investigations, 421a overcharge cases have been a constant.

Since its formation six years ago, the watchdog group has encouraged dozens of tenants to sue the owners of buildings that scored lucrative the property tax break, claiming their landlords registered outsized rents with the state housing authority to secure larger annual increases than should be allowed.

In the past year, landlords have scored victories in three of those suits, and landlord attorneys believe those rulings will be upheld on appeal.

Why, then, has HRI kept encouraging tenants to file complaints alleging the same type of fraud?

As landlords celebrated an Appellate Division win last December, tenants also pocketed a favorable decision, one which HRI claims could set a precedent for 421a overcharge lawsuits to come.

First, some context: Before 421a expired in June, the program extended a 35-year tax break to developers who set aside a percentage of their buildings’ units as affordable, meaning rent increases on those units are subject to limits set forth each year by the city’s Rent Guidelines Board.

The HRI-inspired suits contend that landlords, looking to inflate those annual bumps, will offer tenants a lower rent, typically through one free month. But when the owners register the rents with the state, the suits allege, they do not prorate concessions across the life of the lease, but instead register the higher monthly amount paid by the tenant.

Landlords have argued that this is a common practice. Tenant advocates say it amounts to illegal rent inflation.

Read more

In one case, John Catsimatidis’ Red Apple Group allegedly offered a “one-time construction concession rider” to a tenant on a 13-month, $3,350-per-month lease.

If Red Apple averaged out that free month over the lease term, the tenant would have paid a net-effective rent of $3,092 a month. But Red Apple registered the higher figure with the state, “manipulating the way it assessed a unit’s rent,” according to the tenant’s complaint.

The courts sided with Red Apple, and the decision was upheld on appeal last December, with the Appellate Division ruling that “a one-time rent concession that applies to a specific month … does not affect the legal regulated rent.” In other words, landlords don’t need to factor a discount into monthly rent paid — or tell the state about it.

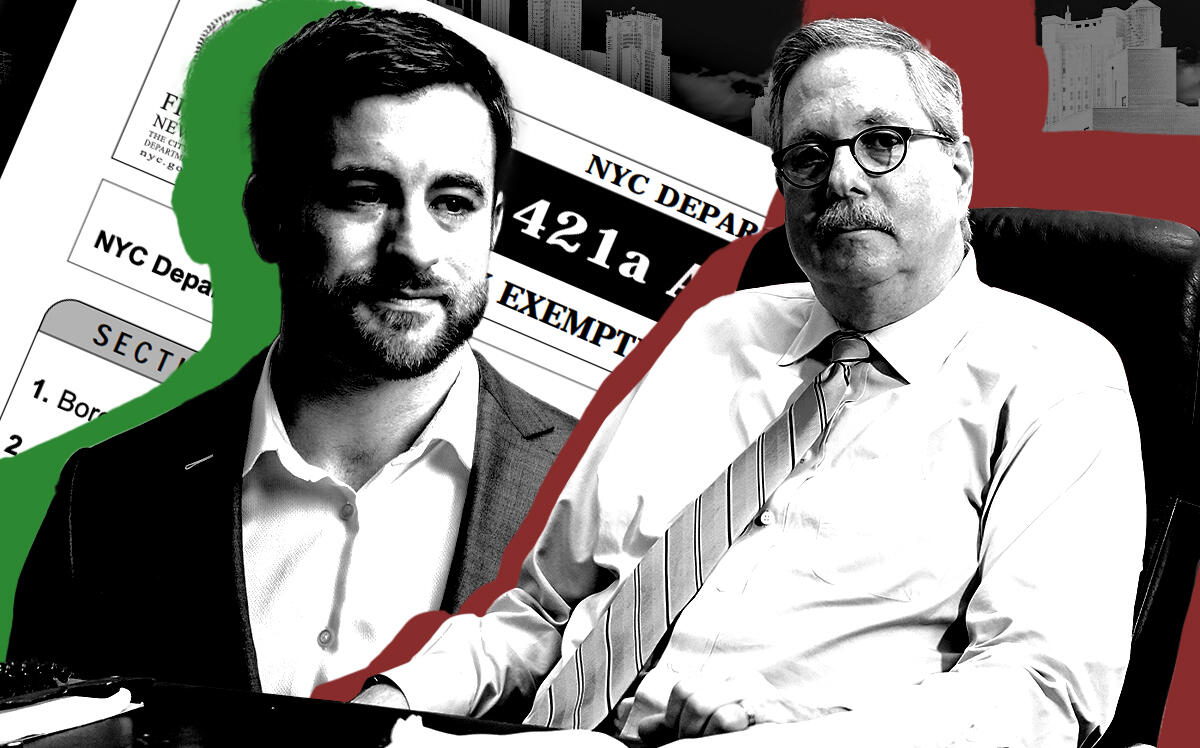

“The court is saying there is no concept of net-effective rent under rent stabilization,” said Sherwin Belkin, of Belkin Burden Goldman, who has represented Red Apple and many other landlords in overcharge suits, adding that his team couldn’t find a single statute in New York where the phrase was used.

It was the third such win for landlords last year. Two months earlier, a lower court sided with Muss Development and Heatherwood Luxury Rentals, ruling that one-time concessions did not need to be reported in a legal regulated rent.

But the Red Apple case included another crucial detail: When the tenant received the free month’s rent by way of a construction rider, the building was under a temporary certificate of occupancy — something afforded to new buildings that are safe to occupy but may need some finishing touches. They may be missing amenities or have minor ongoing construction.

“It is not unusual in the sense that that first tenant might be given some concession because they are moving into what is not a finished product,” Belkin said.

The same day the Red Apple decision came down, the Appellate Division released a separate ruling in an overcharge case brought against Spruce Capital Partners that said landlords offering construction riders after work had been completed would need to include that concession when reporting rents to the state.

In a press release, HRI touted the decision as a victory in its “crusade against 421-a fraud,” as every case the group has helped to generate or could generate falls under the rubric of its Spruce Capital Partners suit.

“The decision .. ensures the floodgates of 421-a litigation have been opened,” HRI executive director Aaron Carr said in a statement at the time.

In the year since, lawsuits spawned by HRI regarding alleged overcharges by Chetrit Group and Tishman Speyer have nabbed class-action status; others have prevailed against landlords’ motions to dismiss.

In August, for example, the Supreme Court denied Essex Capital Partners’ attempt to toss an overcharge suit, noting the Red Apple decision was irrelevant as the building in question had wrapped construction when concessions were offered.

“There is an issue as to whether there actually was construction ongoing that could justify a concession or, as [the tenants] argue, the concession was just a ruse to allow it to register a higher rent,” court filings read.

Belkin doesn’t view those developments as an indicator that tenant advocates have gained ground.

While the Red Apple decision tossed tenants’ claim that any concession should be factored into the legal rent, Belkin said of the Spruce Capital decision, “All they won is that the case wasn’t dismissed outright.”

“Their basic position has been dismissed so they are trying to alter their position.” he added, noting that the class-action status achieved by tenants in two cases “has nothing to do with the merits.”

Despite those doubts, tenants helped along by HRI have appealed real estate’s wins in the Muss Development and Heatherwood Luxury Rentals, and in continuing to file suits this year, appear confident that their reworked argument could influence future decisions.

Newman Ferrara, which represents the tenants in the pending suits, was unavailable to comment. HRI’s Carr declined to comment.