The Federal Reserve’s inflation battle is threatening to send office values plummeting as borrowing becomes more difficult for building owners.

The owners of aging office towers are facing the most dire value destruction, brokers and lenders told the Wall Street Journal. Some buildings in New York and Chicago have fallen by a quarter and previously low-level defaults are rising.

Offices have struggled with lower demand and growing vacancies since the onset of the pandemic. In the third quarter, office leasing in major cities was down 40 percent from pre-pandemic levels, according to JLL.

The office market was carrying too much office space and too little demand before the pandemic, but the imbalance was obscured by low interest rates that increased apparent building values even as rents declined. Investors also favored offices to securities and Treasury bonds, which were providing comparatively low yields.

But it has evened out as the Fed boosts interest rates to clamp down on inflation. Capitalization rates, which measure annual profits for a building divided by its value, and Treasury yields are becoming even in some cases, such as that of 1330 Sixth Avenue.

Read more

In 2015, Blackstone bought a 50 percent stake that valued the building at $507 million. The capitalization rate was 4 percent at the time of the deal, while yield for a 10-year Treasury bond was 2 percent. The latter has since risen to 4 percent, as of Friday.

“Why buy a building at 4% if you can buy a Treasury at 4%?” Northwind Group’s Ran Eliasaf told the Journal.

The answer: You don’t. Blackstone and RXR agreed to sell the office property in July to Empire Capital Holdings for $325 million, roughly 35 percent below the 2015 deal value.

Rising interest rates are cooling office transactions. There are usually plenty of trophy office listings come fall, but the market has been eerily quiet this autumn as rising interest rates and an economic slowdown are roiling the investment sales market.

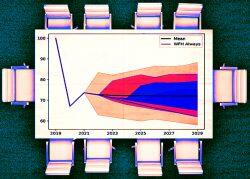

A recent analysis by NYU’s Arpit Gupta and Columbia University’s Vrinda Mittal and Stijn Van Nieuwerburgh estimated that by 2029, New York City’s office stock will fall 28 percent in value, roughly $49 billion, as remote work continues to take hold.

— Holden Walter-Warner