Empire State Realty Trust had a strong third quarter of leasing despite uncertainty surrounding New York City’s office and retail markets and rising interest rates.

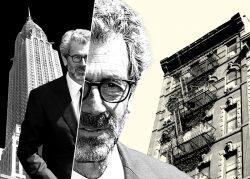

The REIT, led by Anthony Malkin, signed 34 leases covering 335,000 square feet in the quarter, bringing its 9.9-million-square-foot portfolio’s leasing rate up to 88.5 percent, it announced Thursday. Its commercial leasing rate was 87.8 percent in the previous quarter and 86.5 percent in the third quarter last year.

Among the office and retail landlord’s biggest leases in the period were a 79,000-square-foot renewal by Franklin Templeton at First Stamford Place in Connecticut, a 59,000-square-foot deal with Alfred Dunner at 1333 Broadway in Herald Square, and Universal Services of America relocating to 30,000 square feet at 501 Seventh Avenue in Midtown South.

Read more

ESRT is on pace to meet its 2022 occupancy goal of between 84 to 86 percent, but the firm said it’s focused on getting its third-quarter occupancy rate of 84.2 percent closer to its leasing rate. The REIT is “well positioned to move our occupancy up” and expects to achieve positive net absorption next year, according to executive vice president Tom Durels.

”We have a good pipeline of activity heading into the fourth quarter from a broad range of industry types,” Durels said on ESRT’s earning call on Thursday. “We benefit from a flight to quality, so I think we’ll outperform our competition. Where we sit today, I feel very good about our portfolio.”

ESRT also touted the state of its balance sheet, saying that the REIT “sees an opportunity ahead” with $1.2 billion in liquidity, no floating rate exposure and its $2.3 billion of debt not maturing until late 2024. This will allow the firm to continue strategically redeploying capital, according to CFO Christina Chiu.

“We are well positioned in a rising-rate environment,” Chiu said.

ESRT repurchased $20.1 million of common stock in the quarter, bringing the sum of its stock buybacks to $275 million since the initiative began in 2020. Despite the purchases, the stock price has fallen by 30 percent in the past year and by half over the past two.

The pandemic did no favors for the office-centric company, which saw its robust stream of tourism revenue from the observatory at its Empire State Building evaporate almost overnight.

The firm plans to take the $95 million from its sale of two Westchester County office properties and use it toward 1031 transactions. But it has no immediate plans to pick up offices. Chiu said ESRT is “focused on opportunities in the market that are the right deal and that make sense.”

CEO Anthony Malkin described the firm as “omnivorous opportunivores” when assessing potential acquisitions. The REIT’s office portfolio is 88.3 percent leased and 84 percent occupied.

“Office will be interesting to us when it reaches a point of attraction,” Malkin said. “We haven’t seen anything to date that reaches that point.”

Over the past year, ESRT has diversified its portfolio and ventured into the multifamily market as a hedge against an office market downturn. Malkin said the REIT is so far content with its multifamily play, citing the properties’ 98.4 percent occupancy.

“We thought they’ve done well,” Malkin said. “We’re ahead of where we thought we would be when we acquired and underwrote them.”