It’s been a rough couple weeks for Zelig Weiss.

A federal bankruptcy judge dismissed the Brooklyn developer’s lawsuit against All Year Holdings, his partner in the William Vale hotel, claiming that a deal to sell the property was illegal. Meanwhile, a state court judge is requiring Weiss’ companies to comply with a subpoena from All Year or face a hefty fine.

The rulings should have all but closed the door on Weiss’ comeback attempt to buy the controlling stake in the posh and hotly contested Williamsburg property.

But last week, a new wrinkle emerged. All Year’s bondholders, apparently tired of all the litigation over the hotel, filed a petition to send All Year’s stake in the property into bankruptcy. A judge has yet to rule on the petition, and it’s unclear how it will impact the rest of the proceedings.

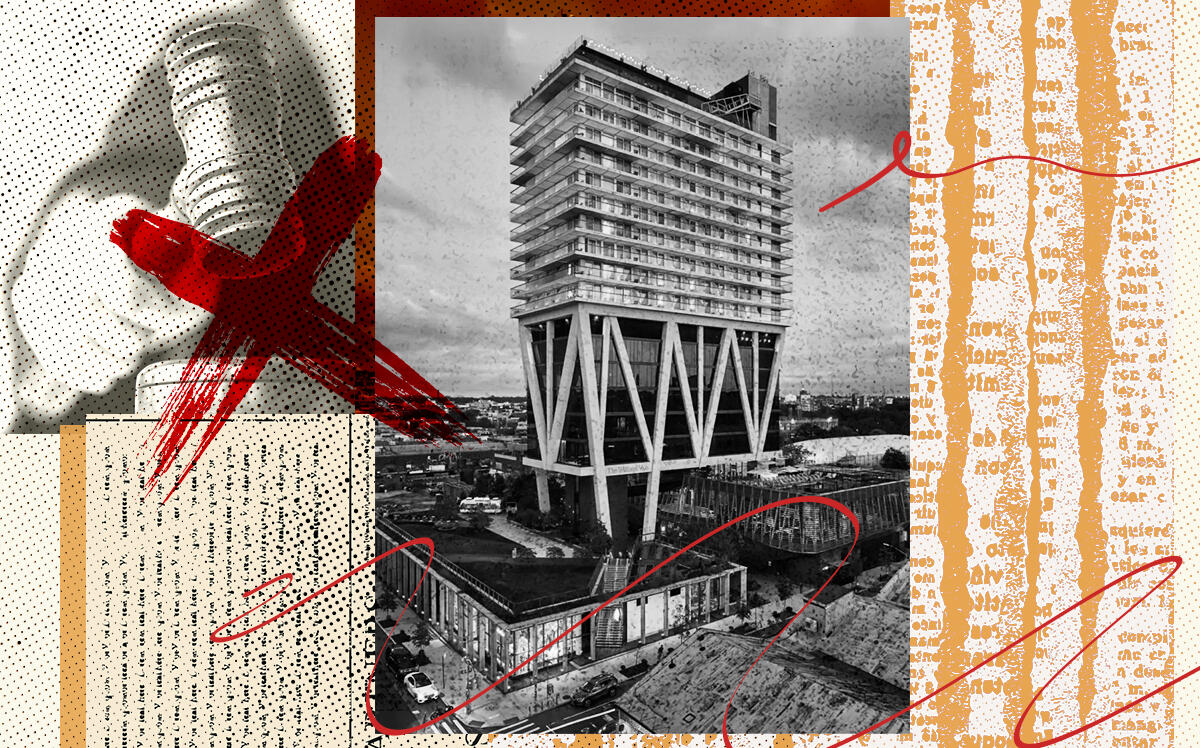

Weiss’ run at the William Vale hotel ranks among Brooklyn’s most dizzying real estate dramas. The hotel was co-developed by Weiss and All Year’s Yoel Goldman in 2016, and Goldman refinanced the property on the Israeli bond market the following year.

But Goldman quickly ran into trouble with bondholders. By the time the pandemic closed the William Vale’s doors in early 2020, foreclosures and investor spats had mounted. Restructuring officers eventually took the reins from Goldman and put All Year Holdings into bankruptcy protection late last year.

To repay the bondholders, the restructuring officers looked to sell All Year’s $1 billion Brooklyn real estate portfolio, which apart from its crown jewel, the William Vale, mostly consisted of walk-up apartment buildings across the borough.

A deal was struck to sell the rental portfolio to health care executive Avi Philipson’s Graph Group and Brooklyn landlord Rubin Schron’s Cammeby’s International Group. But selling the hotel proved to be a nightmare.

One issue: Goldman and Weiss’ byzantine ownership structure. The partners not only split ownership of the hotel, but also the ground lease, meaning they each had half of the entity that owns the property and half of the company that leases it. In a feat of financial engineering, Goldman and Weiss found a way to lease the property from themselves.

That has led to a litany of problems, mainly because any buyer of All Year’s stake in the property would have to become a 50/50 partner with Weiss. For the past year, Weiss has faced a lawsuit from All Year, which accuses him of siphoning money from the hotel.

In October of last year, Weiss made a surprising bid to acquire the hotel’s debt and All Year’s 50 percent equity stake for $163 million. All Year’s bondholders nixed the deal and went with an offer from Monarch Alternative Capital and Richard Wagman’s Madison Capital instead.

But the Madison deal fell through and Weiss came back to the table in April with an offer of $157 million.

By that point, it seemed all but certain that Weiss was at last going to seize control of the hotel, but in an 11th-hour twist, All Year’s bondholders went with a bid from a group led by Philipson.

Weiss has been trying to block the Philipson sale ever since. In a complaint filed in the bankruptcy proceedings against All Year, Weiss argued that a 2016 agreement with Goldman was supposed to ensure they would remain partners. A deal with Philipson, he alleged, would be putting him into a business relationship with a stranger. Weiss also argued that All Year was not allowed any transfer of ownership. All Year disputed the allegations.

“Weiss’s only connection to the Chapter 11 Case is that he is a jilted and unsuccessful bidder with respect to the William Vale hotel,” All Year said in a statement at the time.

But the bankruptcy judge’s ruling last week to dismiss Weiss’ claims may have come too late for All Year: Philipson blew a July 25 deadline to close his deal to acquire the hotel, according to the trustee for the Israeli bondholders. The bondholders now say they have the right to take Philipson’s $7.5 million deposit.

This means that, for now, All Year remains in control of the property, while Weiss keeps his 50 percent non-controlling stake.

As part of the state court proceedings, All Year is seeking to eject Weiss and his companies from the hotel’s ground lease. All Year received some good news there in late September, when a judge ruled that four companies allegedly connected to Weiss must comply with a subpoena to hand over the hotel’s financial records. If they don’t, they are each subject to a fee of $250 per day.

In another twist in the litigious saga, Goldman personally sued Weiss in September, alleging that Weiss has been illegally enriching himself with the hotel’s money. Goldman claims Weiss has refused to hand over financial information and stonewalled attempts to collect any records.

Now, Weiss’ legal team claims Goldman hasn’t properly served him. Weiss’ lawyer also argued that Goldman’s legal team required a response too close to Rosh Hashanah, making it difficult for Weiss to respond.

All Year is represented by Matthew Paul Goren of Weil, Gotshal & Manges and Janice Goldberg of Herrick Feinstein, who did not return a request for comment. Neither Weiss nor his attorney returned a request for comment.