All that glitters is not gold, and ultra-pricy Manhattan real estate certainly glitters.

Several residential projects in the borough, modest and otherwise, proved credit worthy last month, including 111 West 57th Street, a Billionaires’ Row tower beset by years of financial distress and scandal, where one of the original lenders began to mop up what’s left of the building’s debt (still a lot).

Large office buildings also dotted the list of big loans, with workplace landlords commanding serious debt in Flatiron and Midtown’s Plaza District.

The 10 biggest real estate loans fetched $678 million last month, less than half of August’s total and about two-thirds what was issued last September. Here are more details.

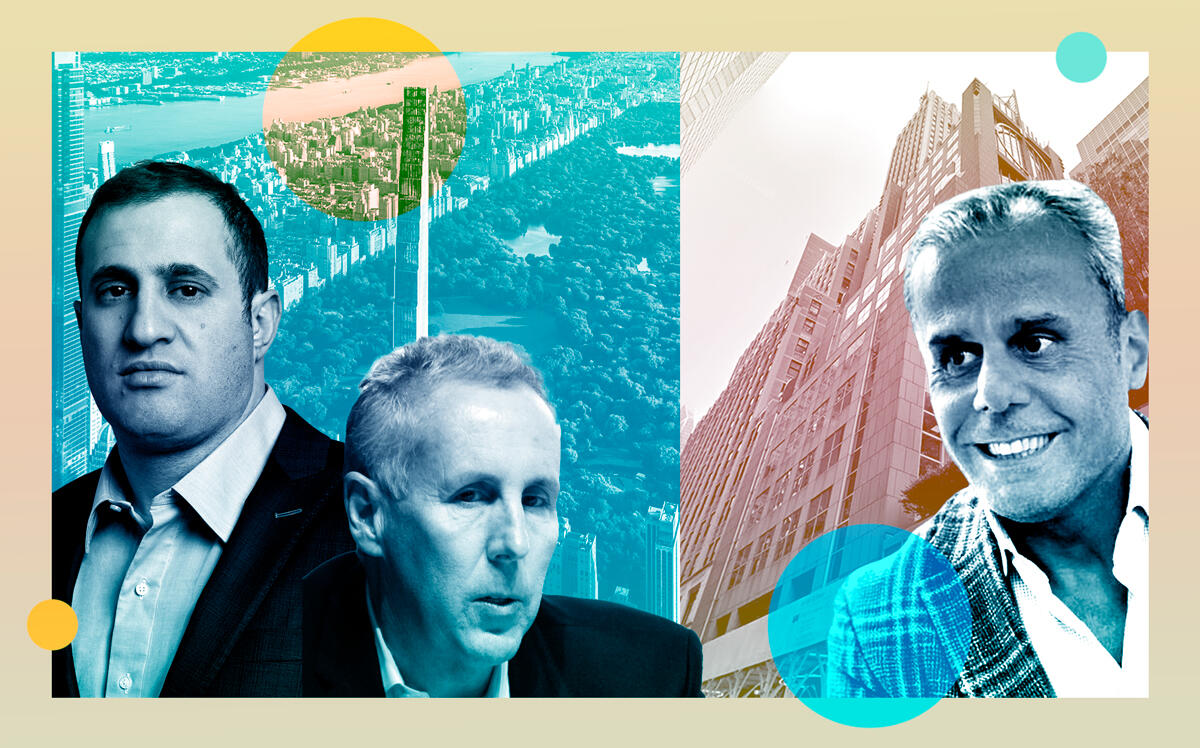

Cleanup on Billionaires’ Row | $239 million

Michael Stern’s JDS Development Group and Kevin Maloney’s Property Markets Group refinanced debt on 111 West 57th Street — dubbed Steinway Tower — with $239 million from Apollo Commercial Real Estate Finance. The new loan retires $400 million in senior debt held by insurance giant AIG’s real estate investment arm, which led financing for the controversial project in the mid-2010s. The subsidiary of Apollo Global Management supplied a $325 million mezzanine loan at the time, which went into default and resulted in the project’s 2017 foreclosure, although Stern and Maloney ultimately retained ownership.

Corcoran took over sales at the building in February. There are nine active listings asking a combined $230 million. The priciest is a triplex asking $66 million, or more than $9,000 a square foot.

Banking on office | $120 million

Acris Capital provided Bobby Zar’s ZG Capital Partners with $56.6 million to buy, and $63.4 million to redevelop, the former Santander building at 43 East 53rd Street. ZG Capital paid $102.5 million in July for the 20-story Plaza District building, which was developed for the Spanish bank in 1990. Santander relocated its headquarters to a space subleased from WeWork at nearby 437 Madison Avenue.

Rialto Capital has a $55 million equity stake in the property. The renovations are estimated to cost between $60 million and $80 million; Zar’s investment firm has been in talks with architecture firm Gensler.

Midtown moola | $98 million

Meyer Equities got new senior lenders at 469 Seventh Avenue, a 267,000-square-foot office building at the corner of West 36th Street in the Garment District. Citi Real Estate Funding and UBS refinanced outstanding debt with a $98 million loan, replacing three insurers. The 16-story building was constructed in the 1920s.

Greener Meadow | $61 million

Cerebrus Capital provided Meadow Partners with $44.6 million to acquire, and $16 million to renovate, two East Village apartment buildings at 305 East 11th Street and 310 East 12th Street. About a third of the buildings’ 89 units are rent-stabilized. Meadow bought the properties for $58 million in August; the firm owns 430 apartments throughout the neighborhood.

Office party | $47 million

JPMorgan Chase took over lending at GFP Real Estate’s 230 Fifth Avenue with a $47 million refinance loan, including $8 million in new funds. The 465,000-square-foot office building in the Flatiron District contains 140 showrooms that specialize in home fashion and design. The building also has an expansive nightclub and rooftop bar — one of the city’s largest — created by the late Steven Greenberg, a Wall Street trader turned nightclub pioneer in the 1980s. The new financing replaces debt held by Principal Life. GFP has owned the building since 1958.

Read more

Salvation renovation | $34.5 million

Greg Kraut’s KPG Funds received $34.5 million from Los Angeles-based Thorofare Capital to redevelop 132 West 14th Street, a 50,000-square-foot building in Greenwich Village formerly used by the Salvation Army. KPG plans to renovate the building into new office space; it recently filed plans with the Department of Buildings to raise the roof level of the structure, and bought the groundleese in 2021 for $22 million.

LES is more | $33 million

Damien Smith’s Prosper Property Group got $33 million from Valley National Bank to refinance 63 Pitt Street, a new 12-story rental building with 59 units on the Lower East Side. The funds consolidated $30 million in loans made by Parkview Financial and Hakimian Capital in 2020. A one-bedroom, one-bathroom apartment in the building is available for $4,900 a month, according to StreetEasy.

Hong Kong to Chinatown | $22.5 million

The Lam Group refinanced 202 Centre Street, a 39,000-square-foot office building in Chinatown, with $22.5 million from Hong Kong-based Shanghai Commercial Bank. The loan includes $11.7 million in new funds and replaces debt held by Wells Fargo. Plans to renovate the building’s commercial space were filed with the Department of Buildings earlier this year.

Co-op CMBS | $14 million

The Connaught Tower, a 360-unit co-op at 300 East 54th Street in Sutton Place, refinanced its debt with $14 million from New Jersey-based Investors Bank, which was acquired by Citizens Bank in April. The funds replaced a CMBS loan issued in 2013 that came due after a 10-year term. Investors Bank also refinanced the Beaux-Arts Dorilton co-op, at 171 West 71st Street on the Upper West Side, whose exterior appears as the fictional Arconia on Hulu’s “Only Murders In the Building.”

Face lift | $9 million

A co-op at 1270 Fifth Avenue in Carnegie Hill refinanced debt with $9 million from Principal Life Insurance, including a new $6.2 million mortgage. Plans to restore the exterior of the 201-unit building were filed with the Department of Buildings earlier this year.