The Aman Group is exploring a sale of the Crown Building, which could result in one of the most expensive hotel sales in recent New York City memory.

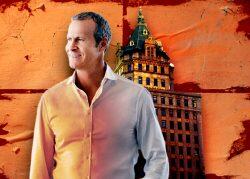

A deal for the Fifth Avenue property is among the strategic options being eyed by the luxury hospitality company led by billionaire developer Vlad Doronin, Bloomberg reported. One person familiar with the matter told the outlet the building could fetch $600 million.

The deal would be structured with a manage-back clause, retaining Aman as operator of the property. A representative for Aman confirmed it was working with JLL and UBS on a potential sale, but noted it would be contingent on a “long-term management contract.”

Read more

Doronin’s OKO Group in June closed on $754 million in refinancing for the luxury condo and hotel project, which occupies the top 20 floors of the 24-story building.

OKO is converting the upper portion of the building from office space to 22 luxury condos and an 83-room hotel. Amenities include an outdoor dining terrace, a three-floor spa and a jazz club.

Closings have already commenced on the condo portion.

Doronin and developer Michael Shvo purchased the space in 2015 for $475 million. In 2017, Shvo was sidelined from the project after being indicted on tax evasion charges, but retained an equity stake. Two years later, OKO secured $750 million in financing for the conversion, including a $300 million senior loan from Bank OZK and $450 million in mezzanine debt from Cain International.

The hotel market hasn’t been much to write home about in the Big Apple since the onset of the pandemic. Even a sale of one of the city’s biggest hotels resulted in a humbling loss.

MCR Investors purchased the Sheraton New York Times Square Hotel from Host Hotels & Resorts for $323 million. Host previously acquired the 51-story, 1,780-key hotel in 2006 for $738 million.

— Holden Walter-Warner