After suffering a record quarterly loss, SoftBank is mulling the sale of a significant player in U.S. real estate.

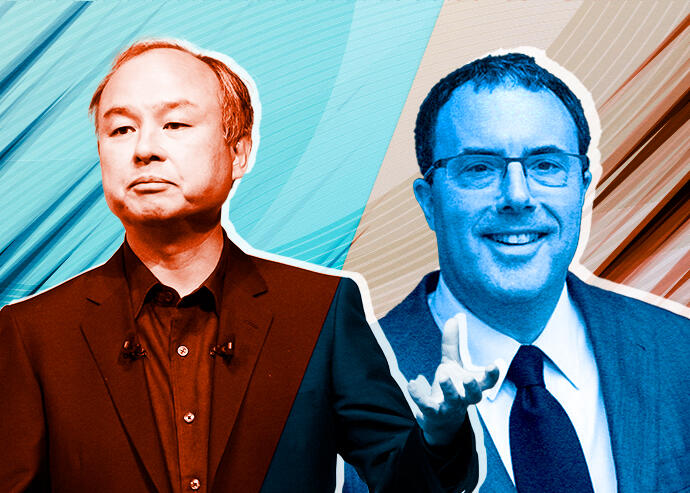

Masayoshi Son’s firm has started discussions about selling Fortress Investment Group, Bloomberg reported. Son disclosed the talks on Monday, the same day SoftBank announced a $23.4 billion net loss.

Son didn’t mention any specific partners for the discussions regarding Fortress, an important real estate player. Last month, however, Bloomberg reported that Abu Dhabi sovereign wealth fund Mubadala was in talks for a deal that would value Fortress at upwards of $1 billion.

SoftBank announced its acquisition of Fortress, one of New York real estate’s more active lenders, in February 2017. The deal came out to $8.08 per share, or $3.3 billion overall.

Read more

The acquisition was geared towards bringing more investment talent in-house for SoftBank. Fortress was founded in 1998 and went public in 2007 with a $634.3 million IPO, debuting at $18.50 a share.

As of the fourth quarter, Fortress has $53.3 billion in assets under management, including real estate and other private credit equity assets worth $34.5 billion. It become a household name in New York real estate in the late 2000s, when it bankrolled Harry Macklowe’s disastrous purchase of the Equity Office portfolio. Fortress also served as a rescue lender for Kent Swig, as detailed in The Real Deal’s new book, “The New Kings of New York.”

Last month, Fortress flipped an industrial property it bought only six months earlier for a $10 million premium. The 50,000-square-foot building in Moreno Valley, California, sold for $29.3 million to Bridge Investment Group.

From last June through February, Fortress spent at least $259 million on small industrial sites across the Inland Empire.

Recent years haven’t been kind to SoftBank, which took a beating with WeWork’s 2019 implosion and again with the slide in global tech stocks. The company was recently forced to write down the value of companies in its portfolio, including Coupang and SenseTime.

SoftBank has also lost some talent. This year, chief operating officer and WeWork executive chairman Marcelo Claure departed from the investment group amid a compensation disagreement.

— Holden Walter-Warner