It’s a “he said, they said” battle of Biblical proportions at one of New York’s biggest multifamily players.

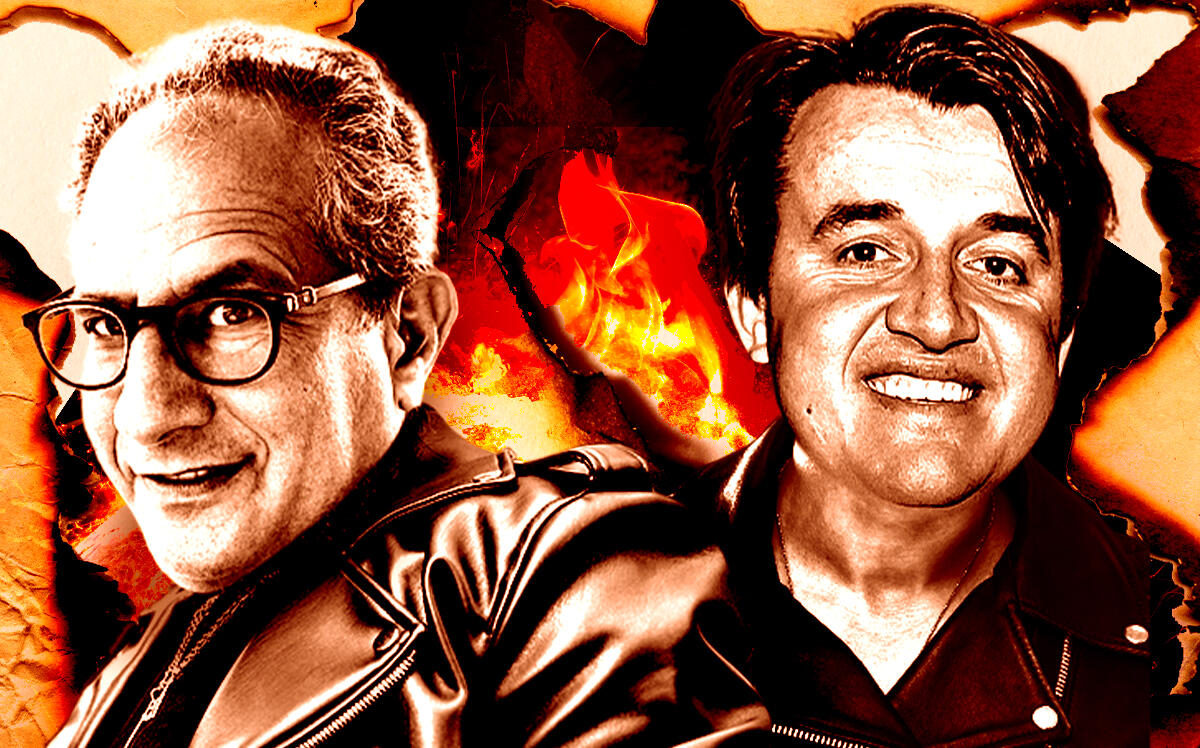

After co-founder Will Blodgett alleged that the firm hoodwinked and stole tens of millions of dollars from him, Fairstead has fired back, alleging instead that Blodgett spun an “egregious conspiracy” to take over the firm and push out two of its leaders, CEO Jeff Goldberg and controlling shareholder Stuart Feldman. (Editor’s note: Read Blodgett’s original suit here.)

If Blodgett didn’t get his way, Fairstead claims in a lawsuit filed August 2 in Delaware, he threatened to leverage his family’s immense wealth to go “torched earth” on the company and take key employees and business to his own firm.

In Fairstead’s telling, Blodgett began his plot in 2020, when he told some of Fairstead’s business partners that his connections – not Feldman – had bankrolled the firm. While Blodgett himself comes from humble stock, his wife is the progeny of billionaires: hedge funder Donald Sussman and Laurie Tisch, whose brother Steve is the chairman and co-owner of the New York Giants, and whose brother, Jonathan, is the CEO of Loews Hotels.

If those who did business with Fairstead believed Blodgett was the money man, they might switch allegiances from Fairstead to his new firm, the suit claims. According to Fairstead, which counts top CBRE broker Steve Siegel as a partner, the firm’s capital influx, hundreds of millions of dollars, actually came from Feldman.

In mid-2021, Blodgett and three “co-conspirators” began downloading thousands of Fairstead documents, the suit alleges. The trove included a deal summary for a large portfolio that Blodgett had previously recommended the team not pursue, as well as other leads. In total, he took some 2,600 documents, which, “taken together, serve as a blueprint on how to form a business that could compete with [Fairstead] in the affordable housing real estate market,” the suit claims. Many of the documents were already public, as Fairstead’s deals involving Section 8 vouchers or tax credits involve disclosures to government agencies. But other documents were kept on a need-to-know basis.

Blodgett’s supposed allies downloaded thousands of supposedly sensitive documents, including one titled “Jeffrey Goldberg Net Worth 12-31-18.” In another instance, one of Blodgett’s alleged partners moved files for a potential acquisition of a Jacksonville apartment complex from an active deals folder to the dead deals pile. He then bid on the property from an email address associated with Caremi Partners, Blodgett’s father-in-law’s family office, according to the suit.

Fairstead’s portfolio spans 18 states and over 16,500 units, making it one of the larger multifamily players in the nation. It owns name-brand apartment portfolios in New York, including the Dawnay Day collection in East Harlem and the Caiola portfolio.

The new complaint, first reported by Law360, paints a totally different picture from Blodgett’s own suit against the company, which The Real Deal reported on last week. That suit accuses Fairstead of encouraging Blodgett to launch his own venture, only to threaten to fire him months later while demanding an outlandish percentage of the firm’s revenues. Blodgett alleged that Feldman bragged, “I fucking rope-a-doped you.”

Both sides acknowledge that Blodgett considered taking Fairstead employees with him to his new firm. In Blodgett’s suit, he says Fairstead encouraged the idea, and that his employment agreement included neither noncompete nor non-solicit clauses. Fairstead asserts that the employees with whom he discussed leaving the firm had noncompetes in their contracts, many of which Blodgett himself signed.

By June 2021, according to Fairstead’s suit, Blodgett had apparently secured backing from significant Fairstead business partners and gave his co-founders an ultimatum: Give him control over Fairstead or watch him leave and “inflict maximum harm” on the company.

Fairstead claims Blodgett waited until then to strike, knowing that Feldman and Goldberg would be facing down maturing construction loans at 28 projects, all of which included personal guarantees. The company had never faced so many unstabilized construction projects, it states in the suit.

Fairstead says it discovered the download activity last summer and retained forensic consultants. It argues that activity, traced to Blodgett, justified his termination. The firm also claims the downloads justify nullifying Blodgett’s ownership in some of Fairstead’s special-purpose property acquisition LLCs, which provided him with millions of dollars in carried interest.

“To say that Blodgett is untrustworthy and was caught ‘red-handed’ would be a massive understatement,” the suit reads.

Read more

Not only does Fairstead want its documents and devices back, but it also called for the judge to cancel Blodgett’s interest in Fairstead’s property shell companies, end the arbitration suit and deliver money damages.

Kelly Magee, a spokesperson for Blodgett, called the allegations “retaliatory nonsense.”

“Will proudly helped build Fairstead into the company it is today and is only fighting for what is rightfully his,” she said.

A spokesperson for Fairstead declined to comment on ongoing litigation. In May, when The Real Deal asked Fairstead CEO Goldberg about what impact Blodgett’s departure had on the company, he simply said: “I think in some ways change is good.”