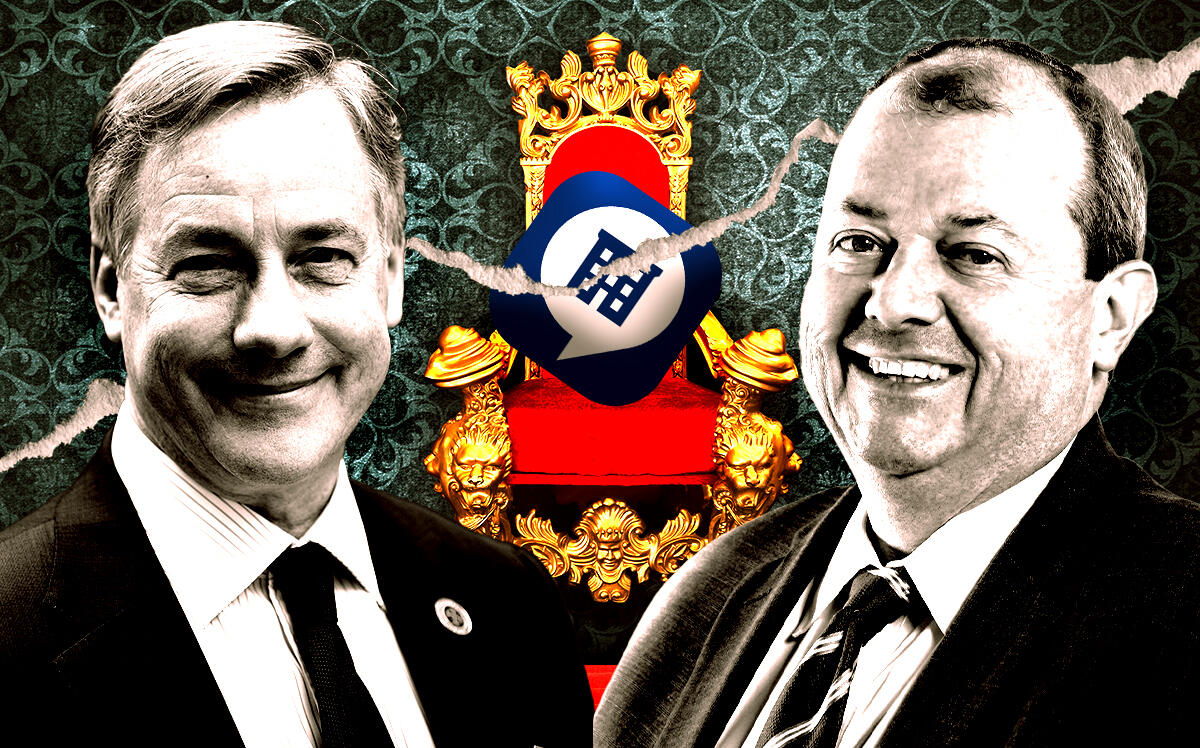

CoStar Group spent three decades building its reputation as a commercial real estate data behemoth before deciding to make a big gamble on residential real estate.

The publicly traded firm picked up a slew of online marketplaces beginning in 2014, spending over $2 billion over six years bulking up its residential data portfolio. It was CoStar’s $250 million purchase of Homesnap in 2020 that garnered it a slice of the residential action in New York City — and an inside partner that would guide its attempt to take on a uniquely frustrating and lucrative market.

In its quest to take on Zillow-owned StreetEasy, Homesnap is teaming up with the Real Estate Board of New York, which has fielded complaints about StreetEasy for years from the city’s residential brokerages. (The brokerages, though, also have themselves to blame: for years, they resisted calls to pool listings together to create an MLS, making New York City one of the few major markets to lack one.)

We pay these companies a ton of money to continue to have a stranglehold on an industry we wish they weren’t a part of.

CoStar plans to support the rollout with $180 million in additional investments in residential products this year, which it said in its second quarter earnings will be allocated to content development, marketing costs and technology.

CoStar’s foray into residential seems warranted by the numbers.

The company reported $83 million in net income for the second quarter, a 37 percent jump from last year. CEO Andy Florance attributed the boost in part to the company’s residential portal, which he said achieved high double-digit sales increases.

The stakes are also high for REBNY, which has long been accused of favoring its commercial broker members.

Douglas Wagner, who oversees brokerage services for Bond New York and chairs REBNY’s Residential RLS, said the offering comes after the city’s firms managed to balance being “privately owned businesses who must compete to remain successful” with necessary industry-wide collaboration.

Eventually, Wagner said, they “realized we had to share everything.”

Stubborn old guard

The Corcoran Group founder Barbara Corcoran (Getty)

For years, nothing set the brokerage community ablaze quite like the prospect of an MLS.

Things could have perhaps been different if Barbara Corcoran, then head of the Corcoran Group, and Alan Rogers, then head of Douglas Elliman, had handled things differently at the turn of the millenium.

Two of the city’s largest firms, they signed a deal with California MLS operator HomeSeekers.com to create a for-profit consumer-facing MLS and announced it to the New York Times — all without informing their competitors. Though they were invited to participate, Elliman and Corcoran wanted to charge them for handing over their valuable listing data. It did not go over well and tensions eventually boiled over in what became known as the “Battle of 2000.”

“I think the early attempts to do this were marred by the fact that some of the bigger brokerages believed they were going to have such powerful proprietary websites that they weren’t going to need to play nice with the other children,” said Coldwell Banker Warburg president Frederick Peters.

The talks – coupled with an unhealthy dose of infighting – went on for over a year before falling apart. It would take almost two decades before another serious effort was made, and that one was derailed by REBNY: The trade group slapped homes.nyc with cease-and-desist letters four days before its launch, though its owner had been under the impression he had the group’s blessing to launch a consumer-facing MLS.

“I think we all had to go through the experience of going through StreetEasy and Zillow to realize if this community is going to be successful and move forward as one voice, we had to do something different,” said Berkshire Hathaway HomeServices New York CEO Steven James, a longtime Elliman executive whose efforts to create an MLS date back to the 90s.

Spencer Rascoff, former CEO of Zillow (Photo by Kevin Scanlon)

Meanwhile, StreetEasy went around the brokerages by creating a consumer-facing, easy-to-use website. By prioritizing the consumer and making it easy to search properties by neighborhood and a variety of filters, the site won over the general public, thereby forcing brokers and brokerages to follow.

Zillow bought StreetEasy in 2013 for $50 million and soon started charging brokers for rental listings and lead generation. While those policies have been lucrative, they’ve fostered animosity in many brokers. They feel they’re being bilked out of money and business despite building StreetEasy’s foundation by supplying the listings.

“We pay these companies a ton of money to continue to have a stranglehold on an industry we wish they weren’t a part of,” said Keller Williams broker William Krooss-Tadas.

Enter Citysnap, which is positioning itself as StreetEasy’s friendlier twin. The site’s mantra is “Your Listing, Your Lead”, a promise to pass leads on to listing brokers free of charge. The site also won’t charge for listings and REBNY isn’t increasing membership dues as a result of the service.

“I like that on paper because it cuts out the use of StreetEasy,” said Serhant broker Ariel Mahgerefteh. “I truly would love to see them get big and be the default model.”

Read more

While the base site is free for brokers to use, there are two premium tools for subscribers: CitysnapPro+, which costs $83 per month per person and provides data and analytics, and CitysnapAd, which allows agents to advertise on social media and create a custom website. CoStar CEO Florance has said brokers can pay for top placement on the site but a REBNY spokesperson said that feature is not active and did not specify whether it would be activated.

So far over 4,700 brokers have signed up for Citysnap, a spokesperson said. Several brokers said they were just becoming aware of it when asked in mid-July.

“I’m a creature of habit,” Krooss-Tadas said. “Citysnap wants me to break that and use their thing but I’ve learnt how to do my thing my way.”

Charm offensive

From July to December, Citysnap ads will be plastered on a hundreds of taxis, on transit takeovers at the Moynihan Train Hall, on the 100-yard digital screen at Westfield World Trade Center, on billboards around Penn Station, Bryant Park and Times Square, and across every major neighborhood in Manhattan. Ads will also appear on streaming services and audio and social media platforms. The campaign aims to produce over 500 million impressions, according to a REBNY spokesperson.

Commercial brokers may find it strange to see CoStar lauded as a savior by their residential counterparts. The commercial data goliath refused to lower its fees two years ago at the height of the pandemic, though it did offer to postpone bills, and Florance said it provided extra aid to some clients on a case-by-case basis. Additionally, CoStar’s track record is dotted with litigation and aggressive business tactics against its targets.

James, who was helping REBNY when it was looking for an MLS partner, said the organization first identified Homesnap as a potential partner before it was bought by Costar. When Costar entered the picture there were initial concerns about its litigious track record.

“We talked it through,” James said, explaining the committee decided they had nothing to worry about as long as the contract was clear and communication with Costar was good, adding that CoStar “apparently was very forthright and has delivered along the way.”

When asked if the company’s reputation gave REBNY pause about partnering with them, a REBNY spokesperson said the trade group is “committed to working with CoStar.”

The goal here cannot rationally be to supplant StreetEasy.

StreetEasy contends it has the more consumer-friendly business model. The company says that selling leads to buyers’ brokers protects the consumer, pointing to a New York Department of State memo warning of dual-agency transactions. It also defended its practice of charging $6 per day for rental listings as a method of ensuring brokers don’t post duplicate listings or let them linger after they’re filled.

A slew of newish features aim to pull in brokers and consumers alike, including ShowingTime, a free tool allowing sales agents to schedule tours; StreetScape, an augmented reality tool that lets anyone scan a building from the street with their phone and see available listings and building information; and StreetEasy Experts, a lead generation program that only charges brokers after a successful transaction.

“We are the platform to deliver a tech-enabled future agents and consumers want because of our consumer-obsessed approach,” said a StreetEasy spokesperson. “We continue to provide and develop products to facilitate agent-consumer connections and grow agent business – this includes the ability for agents to post their sales listings on StreetEasy for free.”

Citysnap says it can maintain clean data through REBNY’s existing data compliance policy and that compliance specialists police listings to ensure they’re valid. Brokers pushed back against the idea that StreetEasy connects buyers to knowledgeable brokers through its premium lead generation programs.

“They literally do nothing besides open the door,” Mahgerefteh said. “Why are we paying 3 percent for just opening the door? That’s totally unfair to me, unfair to the buyer — it’s more worth it for them to work with the listing agent directly.”

Brokers who rely on StreetEasy for leads may be reluctant to leave the platform since Citysnap won’t sell them leads generated from other brokers’ listings, Peters said. But the platform’s debut is bigger than a play for immediate converts.

“The goal here cannot rationally be to supplant StreetEasy,” he said. “The goal is to be a competitor; competitors make everyone better.”