UPDATED, July 26, 11:00 a.m.: A developer known for luxury rentals picked up three sites in Lenox Hill last week, but will hold off on developing the properties as key tax breaks hang in the balance.

Kahen Properties purchased the three sites for $34 million, Crain’s reported. The sites are adjacent to one another, stretching from 1020-1024 Third Avenue to 1026 Third Avenue. The two sellers in the deals were Portfolio4 LLC and Jans Investment Co.

JLL’s Clint Olsen and Stephen Godnick represented Kahen in the series of acquisitions.

All three sites, situated between East 60th and East 61st streets, have three-to-four story tenement-style housing. Two also have vacant storefronts, while the third has Chipotle locked into a lease until 2029.

Zoning could allow for 12-story residential buildings.

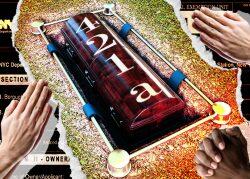

But obtaining the financing for a multifamily development on the site became trickier when the 421a tax break expired last month. The tax break reduced property taxes for developers in a trade for mandatory low-income housing construction.

Even before the tax break expired, financing for apartment projects started to slow as investors looked elsewhere. According to an analysis by NYU’s Furman Center, 68 percent of apartment units built in New York between 2010 and 2020 utilized the 421a tax break, while another 21 percent took advantage of a separate property tax relief mechanism.

Read more

It’s unclear when Kahen went into contract for the sites.

Majid Kahen, manginging principal at the development firm, didn’t respond to the outlet’s calls for comment. A spokesperson for JLL, however, disclosed that Kahen doesn’t have plans to develop the properties at the moment.

Kahen has largely been quiet in recent years. In 2013, the firm purchased the properties at 143 and 145 Madison Avenue for $12.2 million. It went on to develop the Mason, a 23-story rental building with 70 apartments. Average rents for units as small as a studio start at $4,000 a month, according to Apartments.com.

— Holden Walter-Warner

This article has been updated to include the brokers that represented Kahen Properties.