Property developers in China face $13 billion of foreign currency bond payments through the end of this year.

About 60 property groups in China have debt deadlines before the end of 2022, according to the Financial Times, which cited data from Dealogic. The payments due this year make up about 13 percent of the sector’s total outstanding obligations to foreign bondholders.

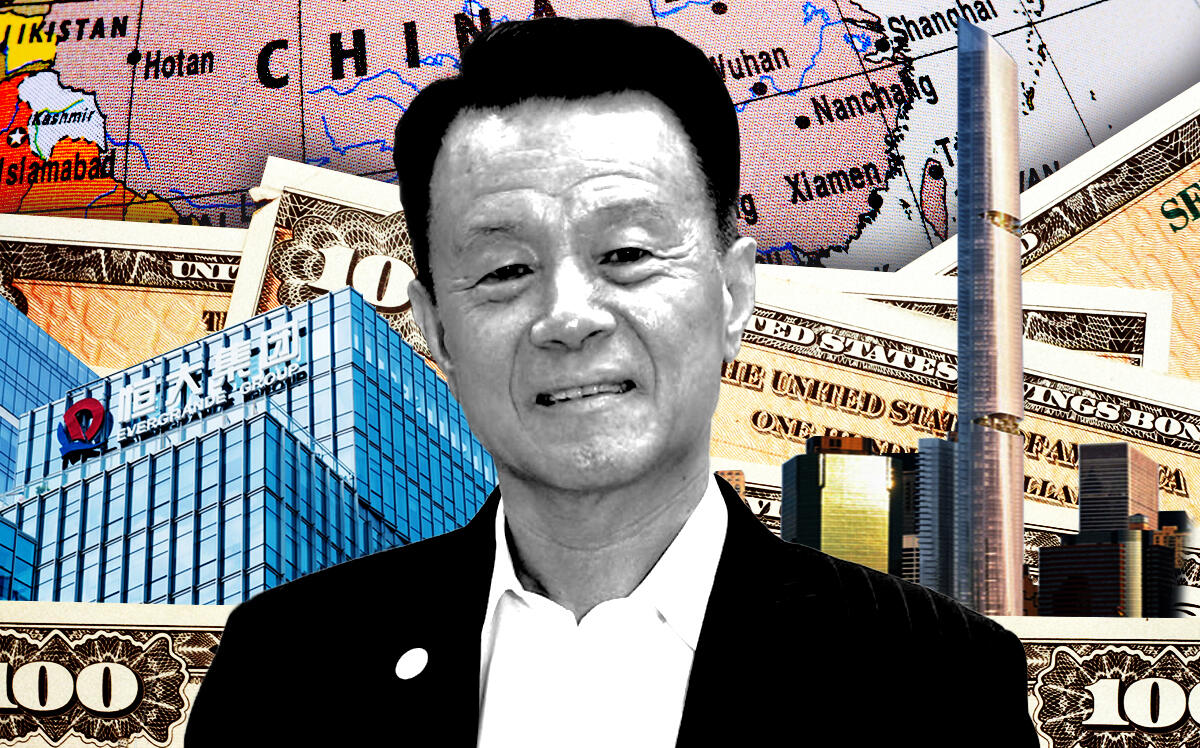

China’s real estate sector has already had a wave of defaults this year after Evergrande defaulted for the first time in December. Shimao Group, one of the country’s largest developers, defaulted on a $1 billion bond last weekend after failing to pay interest and principal on the debt. Shimao still has about $5.5 billion of outstanding foreign debt.

The defaults are worrying foreign creditors, some of whom are now looking to cash out of their investments amid concern that repayments to domestic investors will be a priority for most of the developers, according to the FT.

These distressed developers are expected to seek to extend debt maturities, though it’s becoming more difficult for these firms to refinance existing debt given instability across the market right.

A few Chinese developers with properties in the U.S. have faced financial troubles over the last few months. Oceanwide, once an owner of properties and land coast-to-coast in the U.S., recently lost control of its Manhattan development site after failing to pay back $165 million out of a $175 million loan from Midtown-based DW Partners. The company had planned to build a 1,500-foot skyscraper on the land.

Last month, the Chinese parent company of Pacific Park co-developer Greenland USA was downgraded by S&P Global Ratings, which said it was at risk of defaulting on its debt payments.

Read more