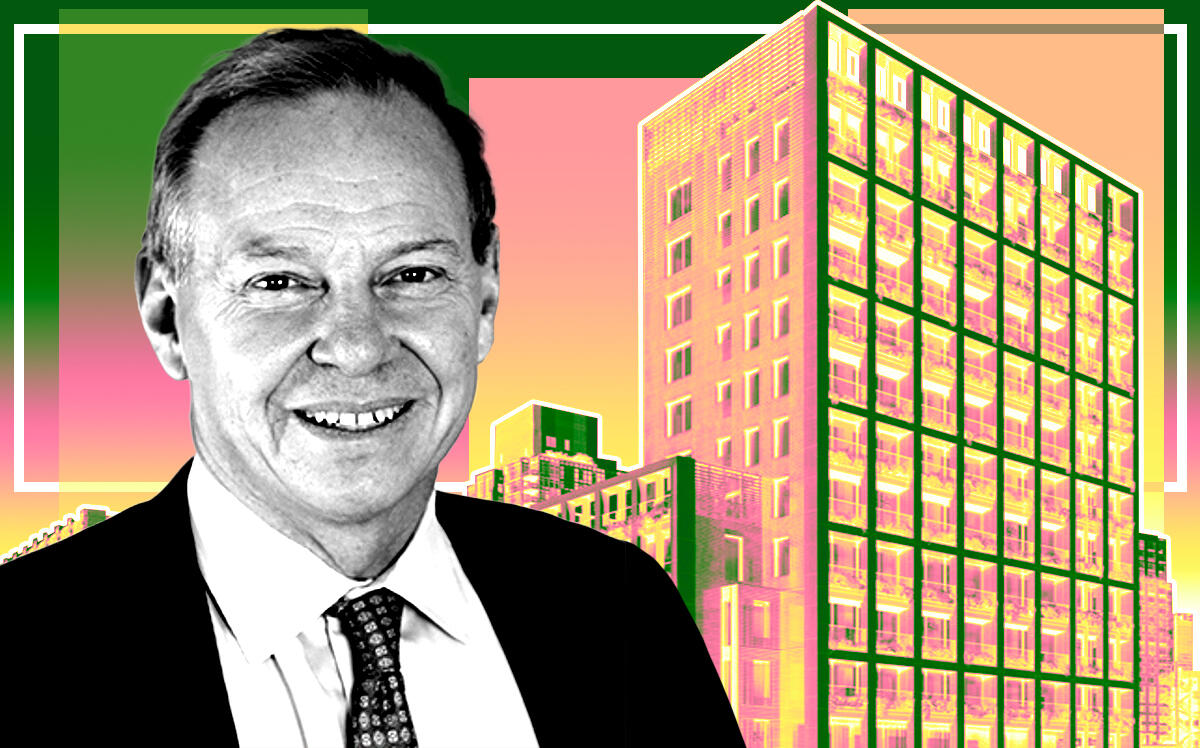

Anbau Enterprises has scored a nearly $100 million loan for its Flatiron condominium.

The developer landed a $98 million loan to refinance Flatiron House at 39 West 23rd Street, the Commercial Observer reported. The fixed-rate, full-term, interest-only loan was provided by First Republic Bank.

The financing was arranged by a Meridian Capital Group team including Adam Hakim and James Murad. Anbau and First Republic didn’t respond to a request for comment from the outlet.

The development consists of two towers, encompassing 44 units and 117,000 square feet, as well as a retail unit. Amenities include a central courtyard garden, resident lounge, game room and fitness center.

Anbau filed its plans for the development in 2016 — COOKFOX Architects served as the designer of the project. Anbau purchased the development site, then a parking lot, in 2011. It paid $23.5 million to a representative of Horizen Global.

In 2019, the developer landed a $139 million loan for construction financing. Bank OZK provided Anbau with a $96 million senior loan, while Goldman Sachs originated $42.6 million in mezzanine debt.

Read more

The project remains under construction, according to Anbau’s website.

In 2018, Anbau bought two adjacent parking garages in Hamilton Heights for $22.5 million, planning to create two condo buildings. Anbau purchased the garages at 620 West 153rd Street from Verizon, which used the garages to store its vehicles. The developer was eyeing a total of 150 units, ranging in price from below $1 million up to $3 million.

First Republic recently provided a $22 million mortgage to an affiliate of Infinity BH Corp., led by Ighal Goldfarb, for the acquisition of 160 condos in Hollywood, Florida. Infinity BH paid $212,000 per unit, $33.9 million in total.

[CO] — Holden Walter-Warner