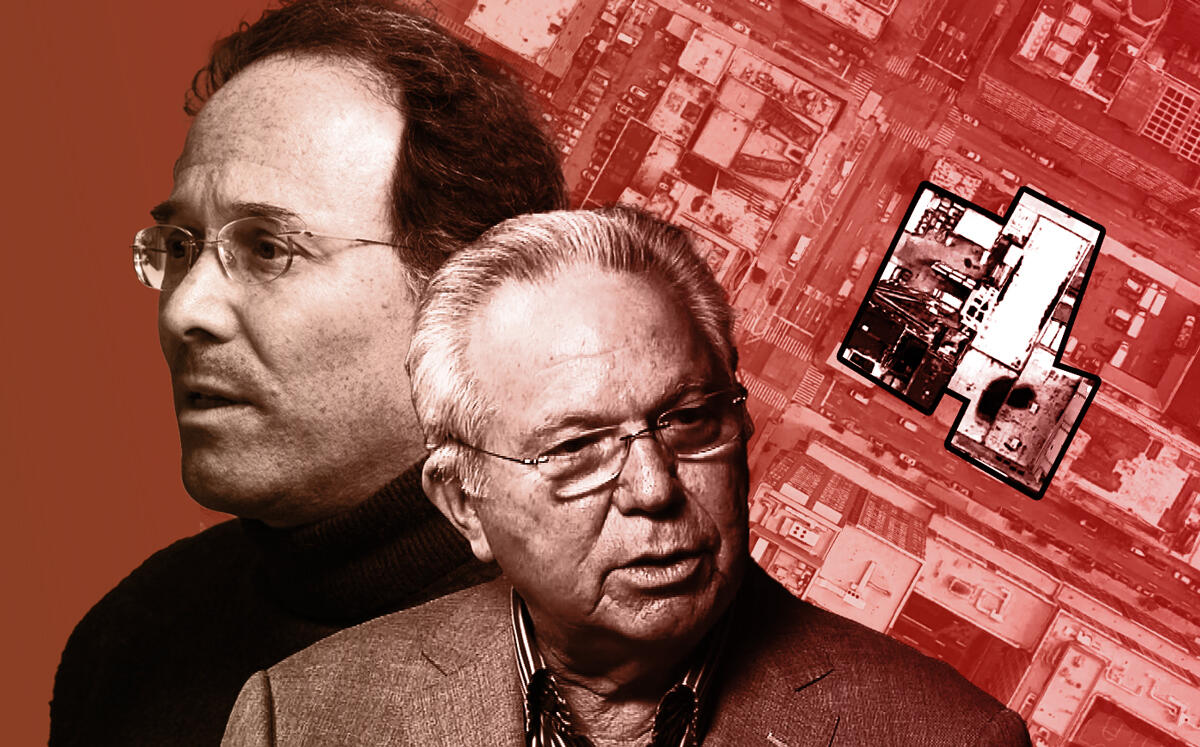

Robert Gans, owner of a prized Hell’s Kitchen assemblage with lucrative potential, has filed for bankruptcy protection.

Circling above is one of the city’s top developers: Gary Barnett.

The Chapter 11 bankruptcy, which Gans filed earlier this week, will shield his property from a foreclosure sale scheduled for September by an affiliate of Barnett’s Extell Development and its partner, Eli Tabak’s Bluestone Group. Gans’ bankruptcy was first reported by Crain’s.

A limited liability company controlled by Extell and Bluestone, which bought the senior debt secured by his portfolio for $148 million and claims mezzanine arrears of $27 million, wants control of his 57,700-square-foot assemblage between West 45th and West 46th streets on 11th Avenue.

The Extell and Bluestone affiliate bought the senior debt in April from Mack Real Estate Credit Strategies.

Other properties at stake include a smaller parcel owned by Gans across 11th Avenue with 150,000 square feet of development potential, the building that houses the strip club Scores on West 28th Street and 32,000 square feet of industrial property in Queens.

Attorneys for Gans disputed the amount of outstanding mezzanine debt, which Bluestone originated in 2018 for $17.8 million, according to a court filing. Mezzanine loans, which are secured by equity, have higher interest rates than senior loans secured by real property.

Read more

Extell and Bluestone also seek to terminate Gans’ option to buy a property at 605 West 45th Street that would interrupt the assemblage and potentially force the developers into a large buyout.

If Extell cannot prevent Gans from buying it, or meet his price, it faces a long wait. Gans has scheduled the closing for January 2027, court records show.

An April lawsuit filed by Gans against Bluestone, which seeks $100 million for an alleged conspiracy and “predatory scheme” to sell his property out from under him, is ongoing.