A moribund nine-figure deal for a Brooklyn medical facility has been resuscitated.

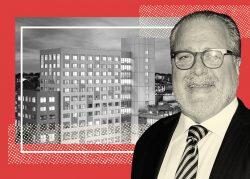

Nursing home operator Allure Group bought the SUNY Downstate Medical Center in Bay Ridge for $160 million, public records show.

Webster Bank, formerly Sterling National, provided a $122 million acquisition loan.

But the transaction nearly died on the table because of a dispute between the seller, Abraham Leser’s Leser Group, and intermediary buyer Pearl Schwartz, a little-known dealer who flipped the contract to Allure for a tidy $7 million gain, according to court and deed records.

“It’s done and I got what I wanted,” Leser said, despite earlier having tried to cancel the transaction and keep Schwartz’s $3 million deposit when the sale failed to close by a March deadline.

Leser Group had expected to use proceeds from the sale to fulfill $70 million in obligations to its bondholders, according to court filings. But the deadline to close the sale came and went.

Trouble could not have been entirely unforeseen.

Schwartz had agreed in December to buy the hospital from Leser Group for $153 million; three weeks later, she filed for bankruptcy to protect his right to buy at that price.

Funding had fallen through, Schwartz said in bankruptcy filings, and she needed “new financing to pay off the [$3 million] note and avoid forfeiture.” Leser Group took a different view.

“[Schwartz] used Chapter 11 to field other offers,” and secured a contract in February to “re-sell” the hospital for $160 million to Allure, lawyers for Leser Group said in court proceedings.

But Schwartz was not the only one whose loan was headed for the rocks.

Marvin Rubin, principal of Allure Group, saw a $128 million commitment from Dwight Mortgage Trust vanish, according to filings by Leser Group in Brooklyn’s bankruptcy court.

“[T]his commitment apparently did not come to fruition and Rubin has sought out other financing, which was certainly not finalized by March,” according to Leser Group.

Rubin did not respond to a request for comment.

Details of the messy financing emerged after Schwartz sued Leser Group in May, saying the seller failed to close because of unfinished work on the building’s sprinkler system.

While legal papers flew back and forth, the sale of the state-run hospital, which provides outpatient surgery to the community, closed on June 3.

“The sale of the Bay Ridge building has no impact on Downstate operations at the site,” said a representative for the hospital, which canceled surgeries last year because of unvaccinated staff.

Flipping a sales contract to a buyer at a higher price, as Schwartz did, can risk embarrassing the seller for leaving money on the table and shirk the obligation to close on the sale.

“I didn’t think Allure was going to pay that kind of price,” Leser said. “And I don’t think Allure believed I was really going to sell.”

Read more

Leser Group refinanced the properties in 2018 with $71 million from TD Bank after it signed Northwell Health to a long-term lease in 2016. Leser Group bought the three-building, seven-story medical center in 2009 for $44.9 million and the garage in 2015 for $1.3 million.

Allure owns the adjacent property at 691 92nd Street, which it acquired in 2010 for $20 million and operates as a nursing home. The company was at the center of the Rivington House scandal during the first term of the de Blasio administration, which led to a settlement with the state attorney general.