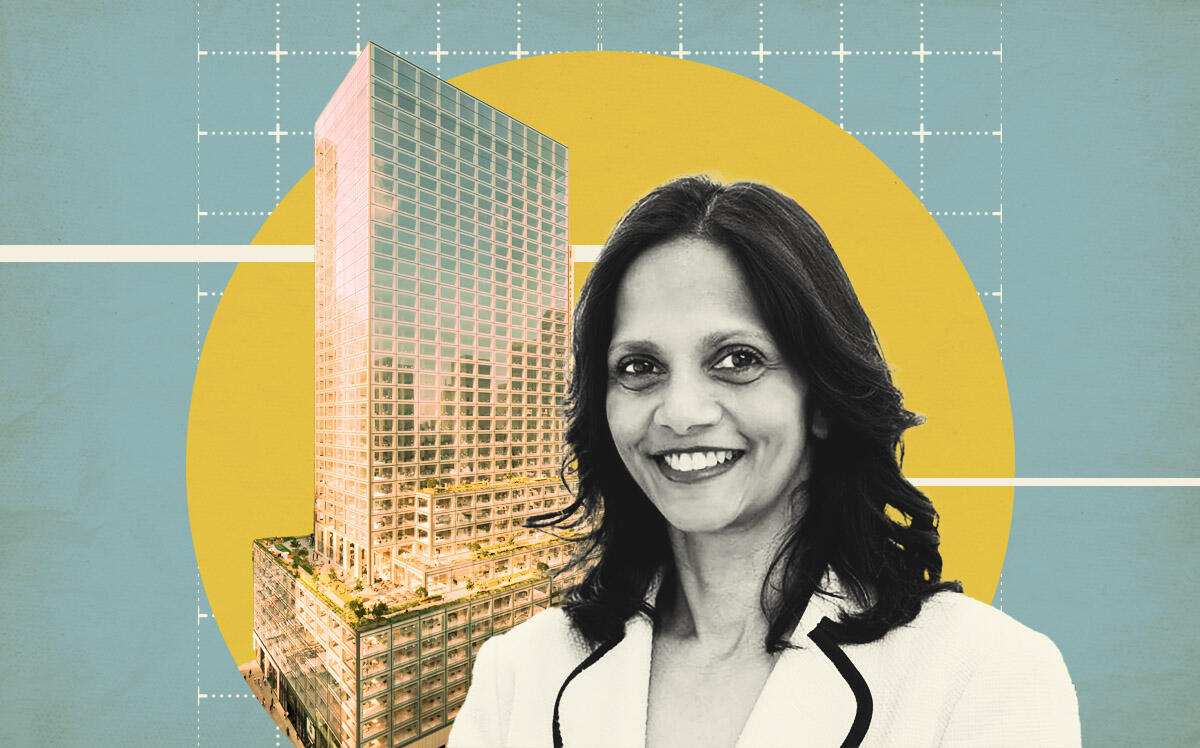

After emptying out 666 Fifth Avenue, Brookfield Asset Management is one tenant closer to filling up 660 Fifth Avenue, the $400 million redevelopment of the same property.

Australian financial services company Macquarie Group has signed on as the first tenant in the revamped office tower, the Wall Street Journal reported. Financial terms were not disclosed, but the blended rent for Macquarie’s six floors was reportedly above $100 per square foot.

Macquarie is leasing 220,000 square feet, roughly one-sixth of the 1.25 million-square-foot tower. The anchor tenant will have 30,000 square feet of outdoor terraces, a private lobby and entrance and signage rights at the top of the building.

The space under the lease is roughly equivalent to what Macquarie is giving up elsewhere as the company moves to a hybrid work model, according to the Journal.

The first tenant is a major step for Brookfield at a property filled with plenty of controversy in recent years.

Brookfield purchased a 99-year ground lease from Kushner Companies in a $1.3 billion deal in 2018. There were questions about whether Jared Kushner, Donald Trump’s son-in-law and an executive at his family’s company that counted the building as his crowning achievement, leveraged foreign policy connections to secure a bailout of the property.

The Qatari government’s investments with Brookfield sparked concerns the country could be trying to curry favor with the administration, charges now-former Brookfield Properties chairman Ric Clark called “conspiracy theories.”

Read more

After locking up the ground lease, Brookfield spent time redeveloping and repositioning the property, as well as getting tenants out of the building. Brookfield bought out at least five tenants in the first half of 2020 alone at a cost of $22.7 million.

Macquarie’s arrival may open the floodgates at the Midtown property. Mikael Nahmias, a Brookfield senior vice president, told the Journal the building will be fully leased, “if not by the end of the year then very soon afterwards.”

That would be a positive development not only for Brookfield, but the Manhattan office market as a whole. The borough’s availability rate hit 19 percent in the first quarter, according to Savills Research, the highest availability recorded going back to the beginning of the century.

Meanwhile, Brookfield is reportedly looking to spin off its asset management business. The Toronto-based investment manager is planning a new entity that will control fee-generating assets including real estate, infrastructure, credit, private equity and renewable energy.

[WSJ] — Holden Walter-Warner