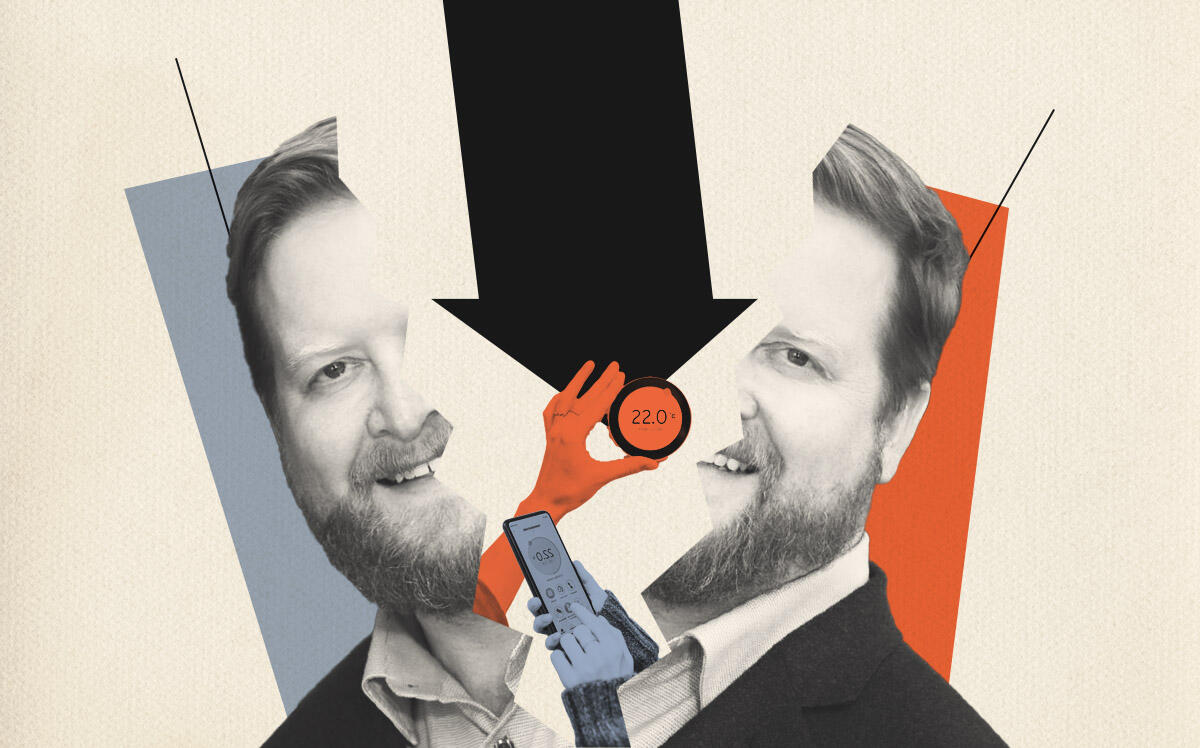

SmartRent’s beaten-down shares got some relief Thursday after the smart-home technology provider reported the highest quarterly revenue in its five-year history.

The company’s results could have been even stronger, executives said on an earnings call Wednesday. While demand for SmartRent’s services is at an all-time high, the global logistics logjam has hindered its ability to roll them out.

“What we’re fighting is supply headwinds,” CEO Lucas Haldeman said. “I think we’re all feeling cautiously optimistic, but still, every day is a dogfight.”

The Scottsdale, Arizona-based company, which provides property managers technology for devices like smart locks, cameras and thermostats, reported first-quarter revenue of $37.4 million, beating both its own forecast and Wall Street’s consensus estimate and doubling its total from the same period last year, giving the stock a nearly 13 percent boost on Thursday.

The company added 41 new enterprise customers during the quarter, bringing its count to 290 — an 80 percent gain year over year. SmartRent deployed its platform to 51,000 new multifamily units during the quarter, adding 13 percent to the total.

Still, the company’s net loss widened to $23.4 million from $9.3 million a year ago as a result of higher sales and marketing spending, as well as higher research and development expenses.

SmartRent, like other proptech firms that have gone public recently via mergers with special purpose acquisition companies, has struggled to win over skeptical investors, who in recent months have decamped from high-risk growth stocks. Shares of SmartRent, which went public last summer in a merger with a Fifth Wall-backed SPAC — a deal that valued the company at $2.2 billion — are down almost 60 percent since the start of the year.

SmartRent’s story may be nearing an inflection point, Cantor Fitzgerald analyst Benjamin Sherlund said Thursday.

The company is scoring new customers at higher price points than its legacy base and is integrating higher-margin products after its purchase of SightPlan, the analyst said, upgrading the stock to an overweight rating from neutral.

“We think SmartRent is well capitalized and we believe the company is in a strong position to ramp its deployment pace and importantly, increase its pace to reaching profitability,” Sherlund said.

SmartRent should reach profitability sometime in 2023, Haldeman said on the earnings call, while reaffirming the company’s revenue guidance for 2022 at a range of $220 million to $250 million. Recent macroeconomic volatility hasn’t changed the picture, he said.

“Especially as we see inflation kicking in and we see a tighter labor market — those are actually catalysts for our business,” the CEO said. “Those are positive indicators for our business in terms of helping our customers reduce costs and reduce complexity. If anything, we’re seeing demand growing.”

Read more