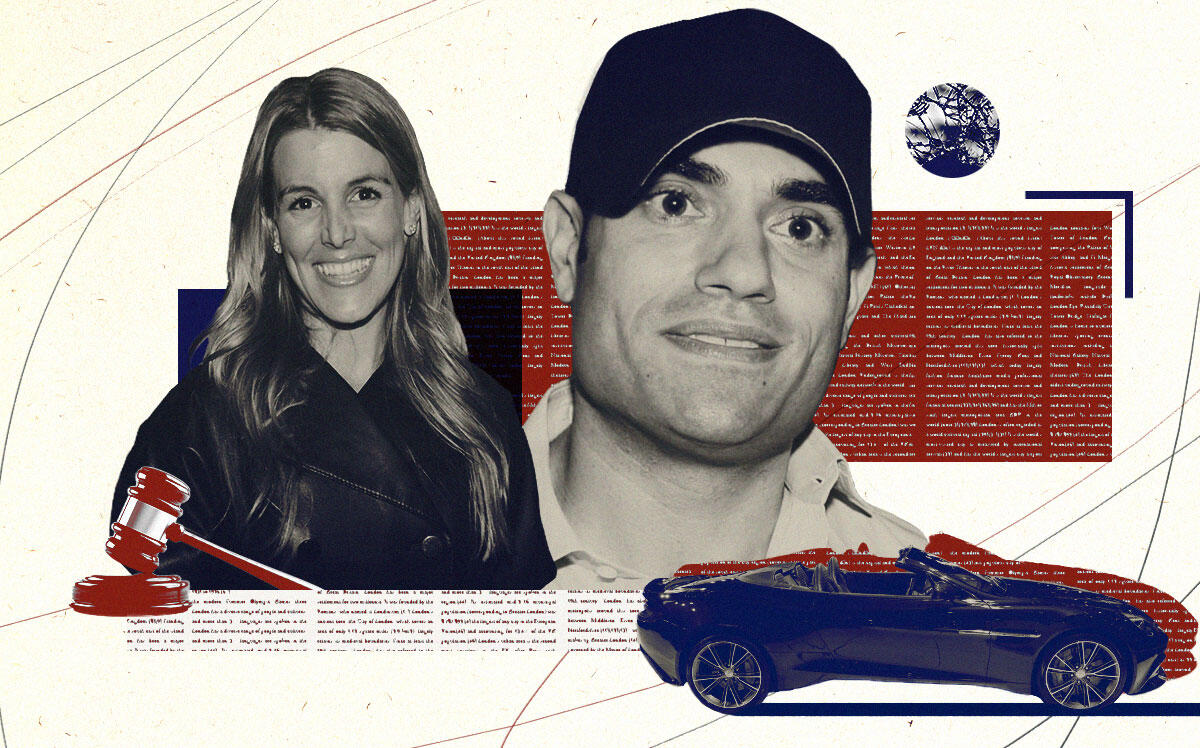

A judge has had enough of former HFZ Capital Group principal Nir Meir’s delay tactics.

Thirteen months ago, a state judge ruled that Meir was on the hook for more than $19 million owed to an affiliate of Israeli auto magnate Yoav Harlap.

But Meir has not paid a dime of the debt, which stems from a delinquent loan on a failed Upper East Side project by HFZ.

On Tuesday, the Manhattan judge determined that Meir’s wife Ranee Bartolacci and her company, Ermitage One, owe $12.6 million. The ruling allows the Harlap affiliate, YH Lex Estates, to go after Bartolacci’s assets, including proceeds from the $43 million sale of Meir and Bartolacci’s Hamptons estate.

The judge did not mince words in assailing Meir’s legal tactics, which included trying to put two entities into bankruptcy in Delaware.

“In my time here, I have never seen a series of procedural maneuvers at every turn designed to push off the merits and to get around the merits and move it to a different forum, and to avoid service of various things,” said New York Supreme Court Judge Joel Cohen at a hearing April 27.

The drama behind the Meir’s departure from HFZ Capital, the Manhattan embattled development firm all but destroyed by foreclosures and investor lawsuits, could be the plot line for an HBO drama — albeit one that is hard to follow.

Shortly after Meir was terminated from HFZ Capital in December, one of its lenders and creditors, Monroe Capital, sought to eject Meir and his wife from their Hamptons estate. Meir fired back alleging that he, not HFZ, owned the home.

The suit was discontinued and Meir was able to sell the estate to New England Patriots owner Robert Kraft. After paying back his lenders, Meir was supposed to be left with around $10 million, according to court documents.

The Harlap entity already had a judgment against Meir, so it should have been able to collect from that. But after the sale, Meir’s lawyers argued that his wife had been the property’s true owner and thus the proceeds belonged to her. Meir’s lawyers presented the court an ownership document that appeared to contradict a previous ownership chart.

In the meantime, Meir and his wife moved to Miami Beach, renting a waterfront estate on Sunset Islands for $150,000 a month.

Records show they did not hole up there, watching Netflix and ordering pizza. Rather, they spent hundreds of thousands of dollars on fine wine, private jets and yacht charters and over $1.5 million on gold coins and bullion, according to checking account records revealed in the lawsuit.

YH Lex Estates also alleged Meir spent $6,000 in a single month at the Gold Rush Cabaret, a strip club in Miami.

Meir’s attorneys said in a previous interview with The Real Deal that the purchases did not indicate any wrongdoing and that the money was Meir’s wife’s to spend.

“Nir had a healthy lifestyle when he was at HFZ, nothing to apologize for,” said Larry Hutcher, Meir’s high-powered attorney. “He was doing well, and his wife has elected to continue to live a lifestyle.”

Bartolacci’s attorney argued in a separate hearing that she had family money, and that the cash was not Meir’s to be handed over to his creditors.

“They were using private jet travel for the last 10 years,” said Pankaj Malik of YK Law. “She was a trust fund baby before she got married.”

All the while, Meir’s former boss, Ziel Feldman, was alleging in another lawsuit that Meir was to blame for HFZ’s collapse. Feldman alleged the executive had stolen millions of dollars from the company in part to pay for his extravagant lifestyle. Meir’s legal team denied the allegations, calling it ludicrous for Feldman to claim that “he had no knowledge of what took place inside his own business.”

In February, Harlap’s lawyer filed another lawsuit against Meir and Bartolacci asking the court to turn over their fleet of luxury cars, including an Aston Martin, to help satisfy the judgment.

The lender’s suit alleged Bartolacci’s company transferred at least $3.7 million back to her husband after April 2021 and that some money went to Applied Bank, a Delaware institution that offers asset protection. Meir’s lawyers have denied that he is trying to hide anything from creditors.

In April, Meir’s lawyers sought bankruptcy protection in Delaware for two Meir-managed entities, which would have delayed the state court proceedings. But a court-appointed trustee blocked that attempt, sending the proceedings back to state court. Meir is challenging that, of course.

Bartolacci finally gave a deposition in April claiming mostly to not know about Meir or HFZ’s finances or the Hamptons house’s ownership structure. She said the waterfront estate was a present and that she could not remember if she herself had bought it.

“There was a birthday party. It was for my birthday and I set up something on the beach, but I don’t recall if I signed a contract or not,” Bartolacci said in her deposition.

YH Lex Estates now has a judgment against Meir, Bartolacci, Feldman and HFZ over the loan.

YH Lex Estates attorney Mark Hatch-Miller declined to comment. Meir’s representative Matthew Hiltzik, president and CEO of prominent communications firm Hiltzik Strategies, declined to comment. Bartolacci’s lawyer, Malik, did not return a request to comment.