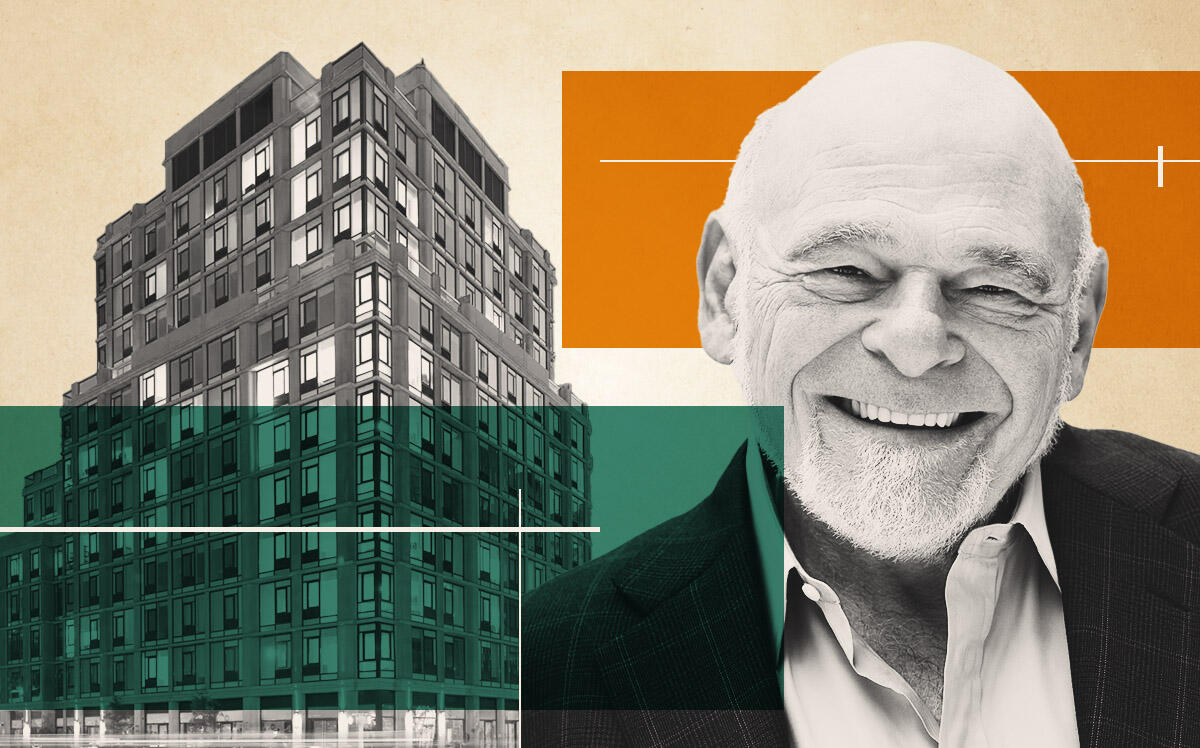

Fresh off a big-ticket sale of an Upper West Side apartment building, Sam Zell’s Equity Residential is looking to sell a portfolio of Manhattan and Brooklyn rental buildings for north of $750 million.

The Chicago-based REIT put five buildings with a combined 1,180 units up for sale, The Real Deal has learned.

The listing comes as EQR continues to reduce its exposure in New York City and similar markets and deploy the sales proceeds into markets like Atlanta, Denver and Texas.

A representative for Equity Residential did not immediately respond to a request for comment. But on the company’s April earnings call, its chief executive officer, Mark Parrell, said the REIT plans to reduce its holdings in New York and Washington, D.C., so that about a third of its portfolio is in the Northeast.

“We’re going to continue to own a lot in New York, and New York is going to be a terrific market in 2022,” he said. “And then you’ll see our exposure to that market drop over time. And I think, hopefully, that will be well timed with improvements in performance in some of the Sun Belt markets [where] we’re adding exposure.”

He estimated it would take a couple of years to rebalance the portfolio. The REIT had 36 properties in New York spanning nearly 9,350 units at the end of 2021, according to its annual report.

Read more

Last year the company spent about as much money on acquisitions — about $1.7 billion — as it got from sales, Pharell said. The 14 properties it sold had an average age of 30 years, while the 17 properties it bought had an average age of 2.

The buildings up for sale are 505 West 54th Street in Midtown West, 400 and 431 West 37th Street in the Hudson Yards area, 500 West 23rd Street in Chelsea and 111 Lawrence Street in Downtown Brooklyn.

The sales pitch describes the properties as well-maintained where a new owner can make a value-add play and raise rents to meet the surging market.

The properties have “below-market rents with above-market care,” according to marketing materials from Eastdil Secured, where a team led by Will Silverman and Gary Phillips is leading the sales effort.

Equity Residential recently struck a deal to sell the 354-unit building at 140 Riverside Boulevard to Douglas Eisenberg’s A&E Real Estate for $266 million, Bloomberg reported.

EQR had put the Chelsea building at 500 West 23rd Street up for sale in 2018 along with nearby 800 Sixth Avenue. The latter sold the next year to Greystar for nearly $240 million; Equity Residential held on to the former.

At the time, pressure from new supply was pushing rents down. But now rents are booming.

Manhattan net effective rents reached their highest levels on record in March, according to Douglas Elliman’s rental report.