The Bronx had the two biggest outer-borough real estate loans last month as overseas investors exited Joe Simone’s mixed-use development in Pelham Bay while Mott Haven continued to attract residential investment. The borough scooped up three of the 10 largest loans outside Manhattan in February.

Brooklyn saw the most big lending with five property loans. Queens had two.

The 10 largest outer-borough loans last month totaled $820 million. That’s a drop of 37 percent compared to a year ago and a 40 percent decline from January.

Here are details on the deals.

1. Getting out | $108 million

(Loopnet)

Joe Simone’s Simone Development Companies secured $108 million in loan proceeds, including $7.7 million in new debt, from Bank of America to refinance a mixed-use property at 1776 Eastchester Road in Pelham Bay, the Bronx. The majority of the loan replaces debt held by EB-5 foreign investment solicitor the New York City Regional Center and M&T Bank.

2. Ground Zaro | $105 million

Jacob Schwimmer’s JCS Realty received $105 million from Joshua Crane’s S3 Capital to build a 447-unit, mixed-use building at 138 Bruckner Boulevard in Mott Haven, the Bronx. The 12-story rental building, scheduled to be completed on the former site of Zaro’s Bakery warehouse in early 2023, will include ground-floor commercial space.

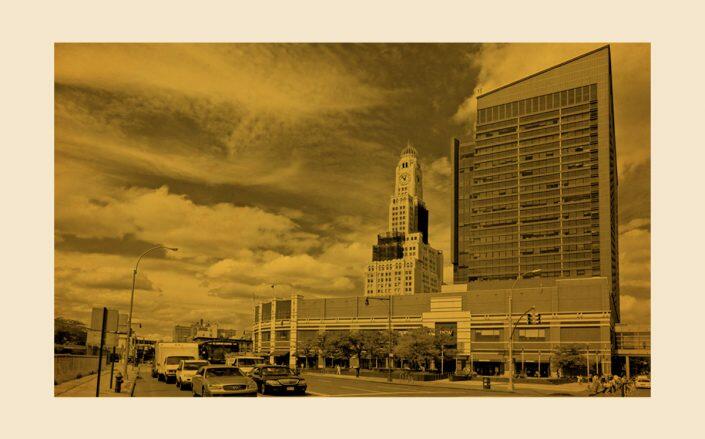

3. Office refi | $105 million

(Loopnet)

Brookfield Properties secured $105 million from Citibank to refinance the office portion of the Atlantic Terminal Condo at 139 Flatbush Avenue in Fort Greene, Brooklyn. The loan replaces debt originated by ING Real Estate Finance in 2005.

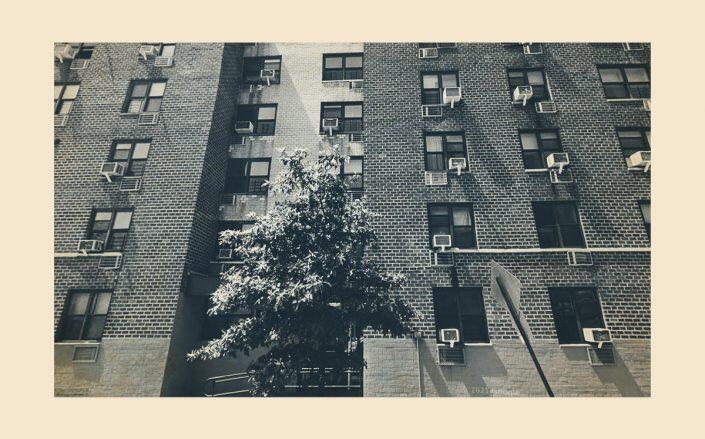

4. Indiana calling | $90 million

(Google Maps)

Camber Property Group received $90 million from Merchants Bank of Indiana to acquire two low-income apartment buildings with a combined 260 units at 579 Blake Avenue and 350 Sheffield Avenue in East New York, Brooklyn. Mo Vaughn’s Omni New York sold the buildings.

(Google Maps)

Read more

5. Office refi deux | $85 million

Wharton Realty Group received $85 million in loan proceeds, including $28.2 million in new debt, from Investors Bank to refinance a 470,000-square-foot office building with ground-floor retail at 162-08 Jamaica Avenue in Queens.

6. Spicy meatball | $84 million

Restaurant supplier Jetro Cash & Carry landed $73 million in new proceeds as part of an $84 million loan from CTL Capital for a 136,000-square-foot warehouse at 43-40 57th Avenue in Maspeth, Queens, and an adjacent 111,000-square-foot parking lot.

7. Throg in the neck | $70 million

Companies affiliated with Joel Leifer and Cheskel Berkowitz received $61.4 million as part of a $70 million debt agreement with Greystar following their January purchase of a nursing home at 727 Throgs Neck Expressway in Throgs Neck, the Bronx.

8. Consolidate of late | $60 million

Properties tied to real estate investor Alexander Levin received $60.2 million from Bank of Montreal to consolidate debt on a 120,000-square-foot shopping center at 2109-2127 Emmons Avenue in Sheepshead Bay, Brooklyn, and a condo building with a checkered financial history at 45 John Street in the Financial District. Loancore Capital was the prior lender at the property in Brooklyn.

9. Flank stake | $58 million

Flank Development refinanced the hotel portion of the Boerum, a mixed-use development at 140 Schermerhorn Street in Boerum Hill, Brooklyn, with a $57.5 million loan from JPMorgan Chase. The funds replace KKR as the senior lender. The property — a Hilton with condo units above it — also uses the address 265 State Street.

10. Deermar season | $55 million

Joseph Banda’s Ranco Capital secured a $55 million refinancing, which includes $15.9 million in new proceeds, from Bridge City Funding for the Deermar at 262 9th Street in Park Slope, Brooklyn. The funds replace Bank Leumi as the senior lender at the newly constructed luxury rental building.