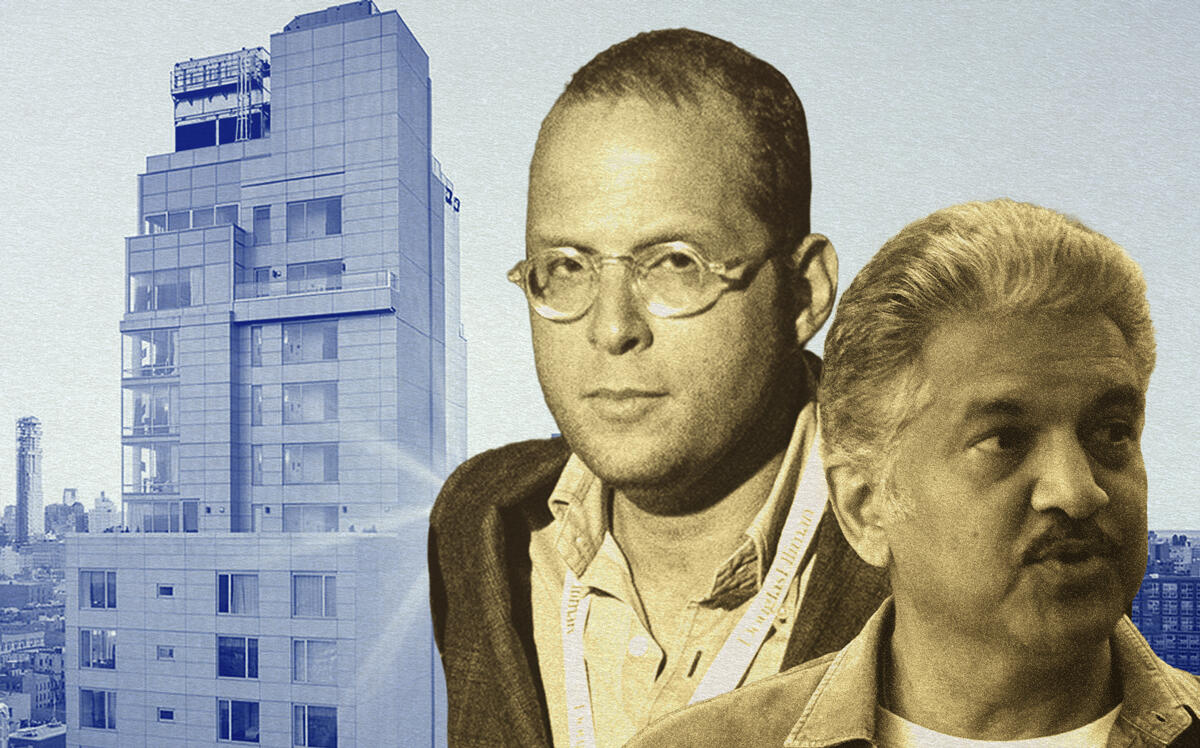

Rotem Rosen’s MRR Development scored a loan worth $113 million to refinance the Hotel Indigo on Manhattan’s Lower East Side and purchase a site in Miami.

Rosen along with his partner, Indian billionaire businessman Anand Mahindra, secured the loan through the Israeli bond market, marking one of the largest Israeli bond raises by a U.S. real estate company during the pandemic.

By securing financing from the Israeli bond market instead of a traditional bank, MRR was able to lock in a low interest rate, 4.5 percent, bond documents show.

The hotel at 171 Ludlow Street is home to the popular rooftop bar Mr. Purple. The Indigo chain is a boutique brand under InterContinental.

In 2018, MRR purchased the property for $162.5 million from Brack Capital and InterContinental Hotels Group. The company secured $73 million in financing from the Israeli bond market for the acquisition.

The bond raise also allowed Rosen’s group to finally close on the site in Miami’s Arts and Entertainment neighborhood. MRR went into contract to buy the property between 18th and 19th streets and Northeast Second Avenue and Northeast Second Court in 2018 for $30 million.

The properties were purchased from LLCs tied to Javier Cervera, founder and president of Cervera Real Estate Ventures.

About a decade ago, U.S. real estate companies flocked to the Israeli bond market for cheap financing. But in recent years, large firms started defaulting on their debt. Among them were Starwood Capital Group, Brookland Capital and Canada-based Urbancorp.

Most notably, Yoel Goldman’s All Year Holdings failed to make payments to bondholders and All Year disclosed an “accidental” transfer of funds to Goldman’s personal account in 2018.