Esusu, a startup at the intersection of fintech and proptech, raised $130 million in Series B funding from SoftBank and others at a $1 billion valuation.

The New York-based company, one of the few Black-owned startups to achieve unicorn status, aims to help renters get recognized by credit bureaus for making timely rent payments, a benefit that mortgage payers have long enjoyed.

Esusu says the path it creates for tenants to boost their credit scores can mitigate “financial exclusion” based on race and background; tenants are more likely than homeowners to be people of color.

Rent is many individuals’ largest monthly expense, but something credit bureaus historically have not factored into scoring. More than 60 million U.S. households are left out of the mainstream credit system because they lack credit history, according to the Federal Reserve Bank of Boston.

Congress in 2013 signaled a desire to reduce that count, but has not achieved much, according to Esusu executives. A bill that would qualify rent payments in credit ratings, the bipartisan Credit Access and Inclusion Act of 2021, was reintroduced in July.

Read more

Esusu hopes to advance the cause by partnering with enterprise landlords and ferrying payment data to the major credit bureaus. The software can be integrated with dominant property management software platforms including Yardi, RealPage and Entrata.

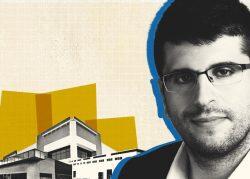

Getting big property owners on board has not been easy, said co-founder Samir Goel. Neither he nor co-founder Abbey Wemimo, an immigrant from Nigeria, had backgrounds in real estate before founding Esusu in 2018.

“We had to really cut our teeth in this industry to create a win-win-win, so landlords, renters and society at large wins,” he said. “Every single real estate owner and operator is overworked and understaffed, and so we had to make sure that we weren’t contributing any additional operational overhead.”

Landlords benefit in several ways by reporting rent payments, starting with improved cash collection, according to Goel. Data from TransUnion, one of the three major credit bureaus, show renters are more likely to pay on time if they can build credit by doing so. Owners also can sell the service as a kind of “financial health amenity” to attract and retain tenants, he said.

Additionally, Esusu facilitates low- or zero-interest micro-loans for renters, paid directly to the landlord, when they fall behind on rents, making owners’ cash flow more reliable. The loans are provided by “philanthropic organizations, institutions and funds who are really passionate about solving the issues of homelessness,” such as the Michael and Susan Dell Foundation and the retailer Target, Goel said.

Esusu’s service is available to renters in 2.5 million homes through partnerships with 35 percent of the largest landlords on the National Multifamily Housing Council, including Morgan Properties, Related Companies and Camden Property Trust. The company charges landlords a $3,500 roll-out fee and then $2 per unit each month.

The Series B, announced Thursday, comes less than six months after the company’s $10 million Series A. This latest round was led by SoftBank’s Vision Fund 2, with participation from Jones Feliciano Family Office, Lauder Zinterhofer Family Office, Motley Fool Ventures, Schusterman Foundation, SoftBank Opportunity Fund, Related Companies and Wilshire Lane Capital. The company has raised $144 million.

Goel previously worked in sales strategy at LinkedIn. Wemimo was a mergers and acquisitions deal consultant at PwC. Both cited their own families’ struggles building credit and gaining access to financial resources as inspiration for the concept.

Helped by its latest infusion of funding, Esusu plans to triple its employee count in the coming months.