People across the United States locked down by the pandemic needed space to lock their extra things away, boosting self-storage properties to the top of the market.

Self-storage shares on the FTSE Nareit All Equity REITs Index have returned more than 85 percent between price gains and dividend payments since Feb. 21, 2020, according to the Wall Street Journal. This figure greatly outpaces the broader REIT index, which returned only 18 percent in the same period.

Specific self-storage companies are outpacing larger stock market gains as well. Since the start of the pandemic, the S&P 500 index has delivered a 41 percent total return. The Journal reported Public Storage stock returned 73 percent in the same time, while Extra Space Storage shares have doubled in value.

The net operating incomes of Public Storage, Extra Space Storage, Life Storage and CubeSmart combined to exceed $1.2 billion in the third quarter, according to FactSet data reported by the Journal. All four companies reported occupancy above 95 percent during the quarter.

Additionally, the average storage bill for renters is reportedly hitting new marks. Credit and debit card data examined by KeyBanc Capital Markets put the average monthly bill in November at $155.65. That’s the highest average bill in five years of analysis.

Read more

As a result of the booming self-storage sector, analysts are beginning to take note and make adjustments to projections for leading companies. The Journal reported price targets for storage companies are being raised as the sector proves its resilience in the face of the pandemic.

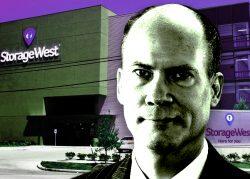

Self-storage firms are making big moves to capitalize on the rising tide for the sector. Pennsylvania-based CubeSmart recently closed on a $1.7 billion acquisition of Storage West. The public company owned at least 1,200 properties as of late 2020 and has only expanded since then.

In November, StorageMart reached an agreement to acquire Manhattan Mini Storage, reportedly for more than $3 billion.

Meanwhile, Southern California-focused MiniStorage is also exploring a sale, which could value the company at $400 million.

[WSJ] — Holden Walter-Warner