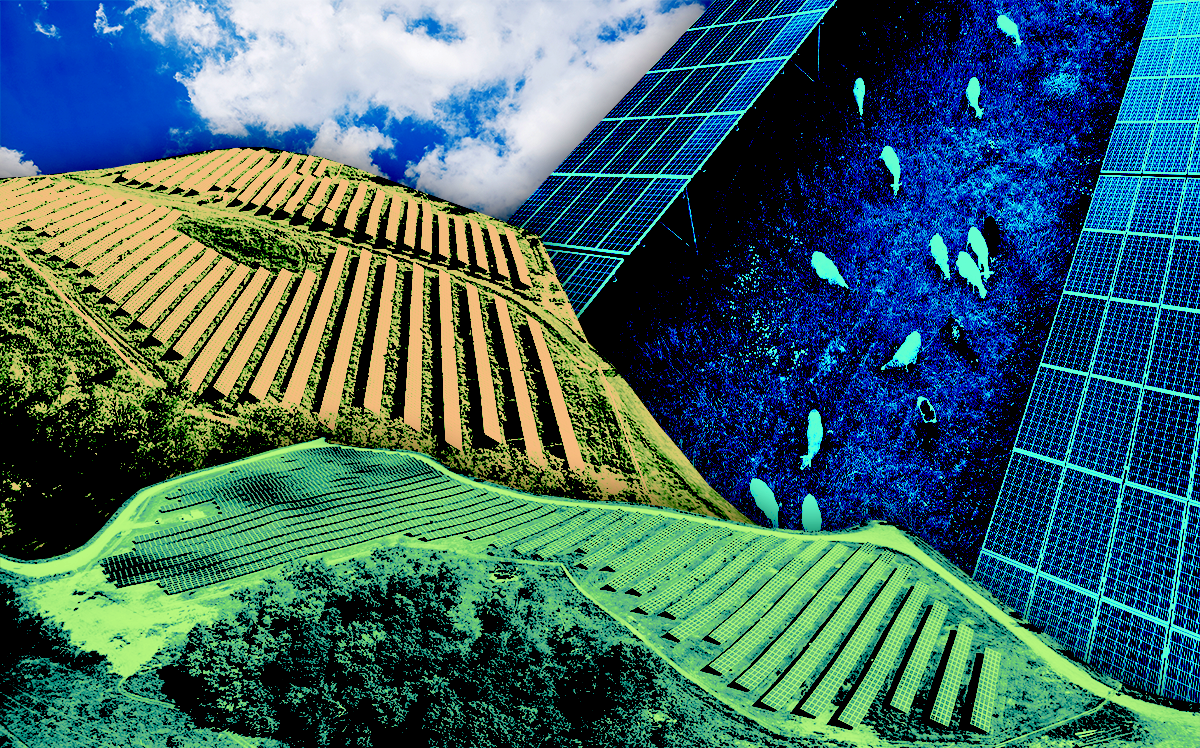

The future of American energy lies in a 30-acre field at the base of the Finger Lakes, tucked between rolling hills and two-lane roads. It contains 23,000 solar panels producing nine million kilowatt hours of electricity each year, enough to power 840 average American homes. And then there are the sheep.

Agrivoltaic array in Newfield, New York (Image courtesy of Nexamp)

Welcome to the weird world of agrivoltaics. It’s an increasingly popular practice that mingles sheep, bees and even some crops amid rows of photovoltaic panels. As solar energy moves to the forefront from the fringe, co-location is one way solar developers, eager for land, are negotiating truces with upstate farmers whose fields have become hot properties.

Even among solar developers who don’t fancy sheep grazing through their multimillion-dollar investments, farmland is in high demand. Flat, cleared plains, rich soil and proximity to power stations mean they offer many of the same qualities that make good solar farms.

Dictionaries may not recognize agrivoltaic, a word coined a decade ago to describe techniques first used in the early 1980s. Yet it’s a buzzword for a new crop of developers and investors amid an influx of funding from federal and private sources as the nation races toward ambitious goals for renewable energy.

Investors include specialty outfits like SolaREIT and the big bovines of the financial world such as BlackRock, which has invested more than $5 billion in renewable energy across the globe. Agrivoltaics provide a carrot that developers can use to sign 20-year leases — the length of a solar field’s technological life — on farm parcels that can range from a few acres to several thousand.

The developers themselves vary widely. Some work on utility-scale projects that span thousands of acres across several towns. Others tap into local subscriptions to build smaller, “community-solar” arrays that feed directly into local distribution grids.

One constant: landowners, often farmers, who are under pressure to find a new, consistent stream of income to keep their operations alive in the 21st century. Even before the pandemic, farmers battled stiff global competition and falling prices for key crops like soybeans and corn. Farmer debt and loan delinquency reached new heights and a trade war forced many to rely on federal assistance to survive, according to the USDA.

In all, almost 16 gigawatts of solar projects wait in the state interconnection queue, according to data from the New York ISO, the nonprofit that operates the bulk electricity grid. While the exact acreage of these projects isn’t known, every megawatt generated typically requires between five and eight acres. By that metric, just the yet-to-be-turned-on projects cover at least 80,000 acres, the equivalent of Boston, Washington, D.C., and Manhattan combined.

And the pipeline is just starting to fill.

Towering aspirations

In September, the Biden administration released its plan for solar energy’s role in decarbonizing the electric grid. If enacted, the U.S. would have to generate 14 times more solar energy than now by 2050. That would require 10.3 million acres of solar panels, roughly two New Jerseys of photovoltaics.

New York is a particularly urgent case. In 2019, as part of the Climate Act, the state set aggressive targets for renewable energy production: six gigawatts of solar energy by 2025 that would need between 30,000 and 42,000 acres of solar arrays. By 2040, New York aims to draw all its electricity without greenhouse gas emissions.

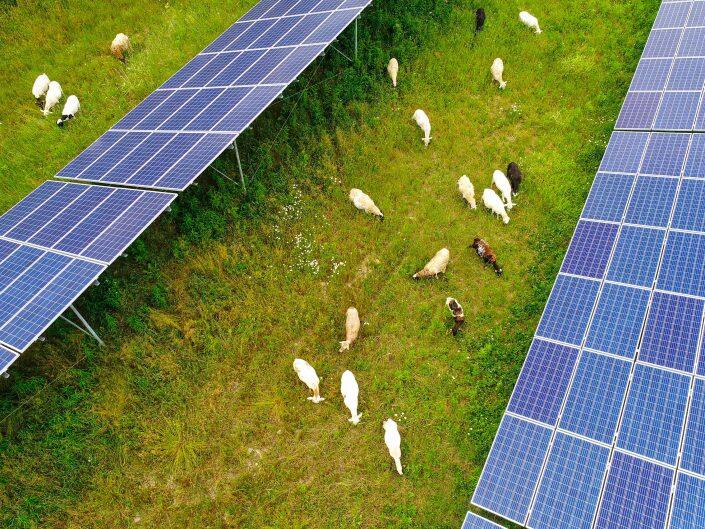

Image courtesy of Nexamp

It’s safe to say those are some ambitious goals. Last year, the U.S. drew less than 4 percent of its energy from solar sources. In New York, it was just 2.5 percent. Getting anywhere close to these benchmarks will require a big investment of money and land — farmland in particular.

While less than half of New York’s utility-scale solar developments are on farmland now, 84 percent of the state’s remaining land suitable for solar arrays is agricultural, according to a study from Cornell University. The American Farmland Trust, a nonprofit that seeks to preserve agricultural land, expects as much as 90 percent of future solar panel installations nationwide will take place in rural areas.

The trust recently polled about 400 New York farmers on their attitudes toward hosting solar arrays on their land. Only about a 10th already had photovoltaic setups or were in talks to lease their land to build one. Half of those who didn’t have solar already said they’d consider hosting it.

Most farmers considering solar say they would do it for the easy income. About a third of New York farmers are over 65, a group that owns or operates almost 2 million acres.

“They don’t have the next generation on the farm to take over,” said Samantha Levy, climate policy manager at the American Farmland Trust. “They can lease out their land for solar and generate income from that without having to get up at five in the morning or earlier to ride a combine.”

Solar goes mainstream

In the rush to reach state and federal climate goals, solar developers are lining up to plant money trees on upstate farmland.

Solar developers have deployed sophisticated models to find parcels. They examine the slope of the land. They determine whether it’s been cleared of debris. Above all, they need somewhere to send all the power they generate.

“A key thing that drives all developers first and foremost is the interconnection point,” said Michael Cucchiara, vice president of business development at Nexamp, a Boston-based solar developer with 300 megawatts of solar panels in operation. “You may have a great piece of land — flat, open, no wetlands — and we could do five, 10, 15, 20 megawatts. But if there’s nowhere to bring that power into the substations and into a grid, you just can’t do it right.”

This summer, Nexamp pulled in $680 million in debt and equity financing to expand, tapping traditional lenders including some global banks, according to Nexamp.

“It’s clearly not a specialty area any more,” Cucchiara said. “We see competitors in the space that are getting backed by large banks out there, the Goldmans of the world and things like that. BlackRock, they’re out there doing this.”

Like most solar developers, Nexamp leases almost all its land, allowing original landowners to retain control of the parcels. By the time the solar arrays expire, the leases do as well.

Playing catch-up

As the size of the farms grows, though, so does the opposition.

To build a 500-megawatt array in the New York villages of Oakfield and Elba, Hecate Energy is piecing together leases for 4,650 acres across 67 parcels held by 31 different owners. If approved, almost all of it would sit on agricultural land — and 40 percent would be prime farmland, the exact footprint that groups such as the American Farmland Trust are trying to preserve.

Hecate has hosted open houses to answer questions about the project and calm fears about the project’s impact on property values or views.

Bruce Naas, a farmer in Oakfield and president of the Genesee County Farm Bureau, signed an option to lease 60 acres of his own land for the Cider Solar project.

“We here at our farm elected to put the poorer ground into solar,” Naas told The Batavian. Growing crops “would not generate the income that we have been offered by the solar company. So, for us, it’s strictly a business decision.”

Not everyone is convinced. A group of local residents opposed to the project contracted T.J. Boyle Associates, a Burlington, Vermont–based landscape architecture and planning firm, to review how the project might mar views. The group also signed up an environmental protection consultancy to critique the project’s potential impacts on water resources and wildlife. Under the state’s new siting process, such groups can apply for public funds to help pay for the costs of contracting consultants.

Others worry that solar growth threatens farms at a time that they’re already facing destruction. Some 11 million acres have been converted to non-agricultural land between 2001 and 20016, long before solar energy went big, according to Ethan Winter, the AFT’s northeast solar specialist. Today, it’s about 2,000 acres a day, he said.

Image courtesy of Nexamp

Industry executives say conservation efforts are a smokescreen for garden-variety NIMBYism. Solar developers must adhere to state guidelines that protect topsoils and prevent any permanent loss in value, said Zack Dufresne, executive director of the New York Solar Energy Industries Association.

“Agriculture and electricity can and should coexist,” he said.

Research on how solar development might harm property values remains young. One study that analyzed 400,000 property transactions in Massachusetts and Rhode Island near 208 solar arrays found minimal price declines, particularly in rural areas. While home sale prices fell 1.7 percent, or $5,751 on average, those losses were largely concentrated among homes within a 10th of a mile of an array and those in non-rural areas.

Because a quarter of New York’s land is devoted to agriculture, solar development on farmland is fanning concern that it may threaten the future of farmers. New York lets local governments handle their own land use decisions, and some towns have proven far more prepared for the solar development boom than others.

Some 223 community solar projects dot the state. The smaller-scale projects, which typically max out around five megawatts, connect directly to the local distribution grid, bringing power directly to homes near the solar farm. They’ve become increasingly popular in the state, exceeding utility-scale and rooftop installations in 2020, according to data from the Solar Energy Industries Association.

Projects under 20 megawatts must navigate local land use regulations. While most have figured out how to handle more projects, some are struggling to keep up.

Read more

Riverhead, Glen and Batavia paused commercial solar developments this year to consider updating zoning codes before handling new applications.

While uncertainty about how to regulate solar projects has prompted reluctance from some municipalities, others have proven receptive to corporate input in developing their land use rules.

“In some cases, we’ve been successful in encouraging them to create a local law,” Cucchiara said. “And we sort of wait and try and provide guidance as best we can.”

In April 2020, amid a bottleneck of applications to build new solar projects, New York created the Office of Renewable Energy Siting to place all large solar farm applications under one roof. Any project producing 25 megawatts or more now needs a permit from the office, which replaces the state’s previous energy facility siting procedures. In addition to ensuring a uniform process, the new office says it will finish every review within a year. That may be a stretch: It’s already reviewing 1.4 gigawatts of utility-grade projects.

Oh, and about those sheep: As miles of new solar panels come online, the American Solar Grazing Association can connect traveling flocks to solar developers. Yes, there’s an app for that. Happy grazing.