The new publicly traded Douglas Elliman will look a lot like the old one, but if investors cooperate, it will be bigger, wealthier — and based more than 1,200 miles from its longtime Madison Avenue home.

And no, it’s not all about severing ties with its tobacco conglomerate parent, Vector Group, as Elliman said when it announced the spinoff last week. In paperwork filed Nov. 10 with regulators, the company touted its ability to retain talent with stock-based compensation and use access to capital markets to target acquisitions and invest in proptech.

While some details remain vague — and the company declined to comment — it’s clear from the filing that executives envision a company better equipped to compete on a national scale with public rivals ranging from Realogy’s brands to Compass.

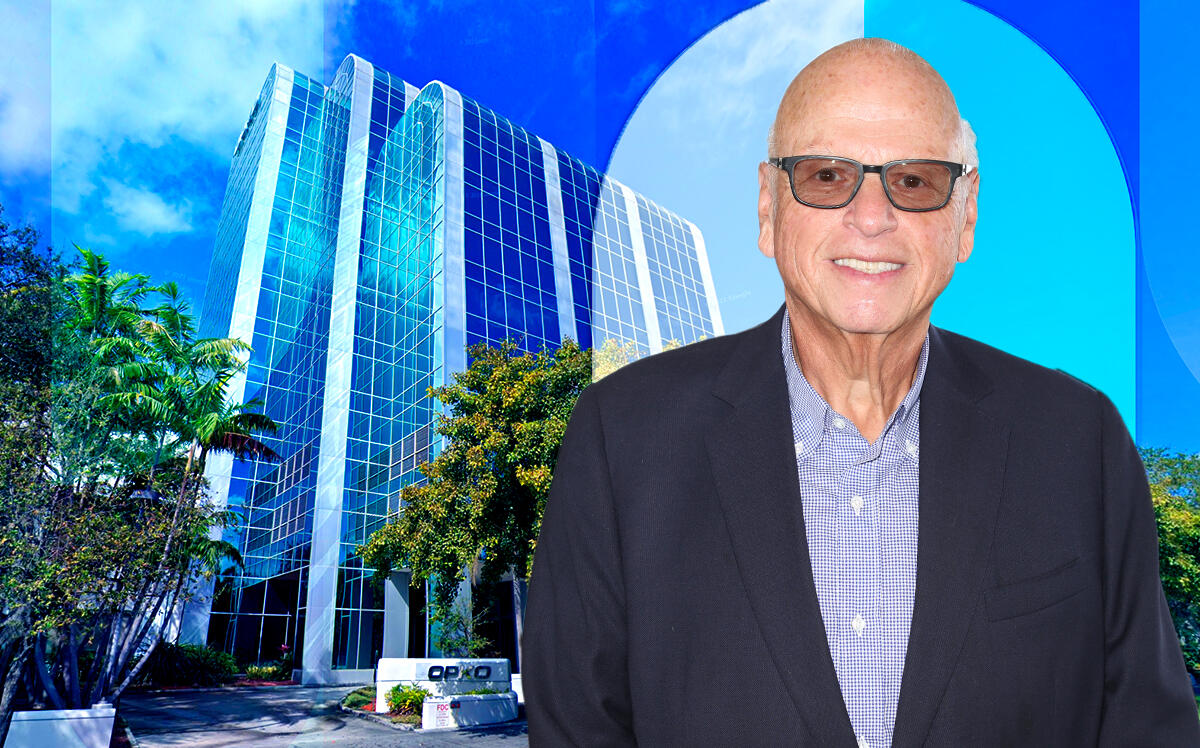

The largest shift: Elliman’s corporate headquarters will be at 4400 Biscayne Boulevard, the same address as Vector, instead of the New York offices that have long housed CEO Howard Lorber and most of the brokerage’s key executives and top agents. While Elliman didn’t detail its decision to move, many businesses have relocated to Florida in recent months, citing lower taxes and a more friendly business environment. The brokerage itself, under Scott Durkin, as well as property management and development marketing, will stay in New York, Elliman said.

Read more

While strengthening its position in New York, South Florida, California, Colo and Texas, Elliman said it expects to enter and expand into new markets as well. It’s optimistic about the market: Average home prices, in New York in particular, will increase in the rest of 2021 and into 2022, Elliman said.

Elliman is also hoping its new structure will allow the company to offer more compelling incentive-based compensation that will “enhance” hiring and retention and be better aligned with its business and plans for growth. With any luck, the company said a buoyant stock price will support merger opportunities without diluting Vector shareholders.

It also hinted that average commissions earned by agents, 5.3 percent in 2017 and 4.9 percent in 2020, could rise. The national rate is now about 5.8 percent, Elliman said, citing HomeLight data.

“This expanding market presents opportunities for significant commission income,” Elliman wrote.

Risks abound, as the company noted in the filing.

Elliman said its stock, which will trade under the ticker DOUG on the New York Stock Exchange, could be volatile because its fortunes will be married inextricably to the fate of the housing market without the “more predictable cash flow” from Vector’s tobacco and real estate investment businesses.

Here’s a breakdown of Elliman’s new features once the spinoff is complete. It’s subject to approval by Vector’s board of directors and the SEC and is expected to be finished by the end of the year.

Stock awards

Only one other major New York brokerage, Compass, offers the option of agents tapping into their own firm’s equity, and it quickly became a sought-after perk during the firm’s aggressive recruitment drive. Eight months after its IPO, though, the stock has lost 45 percent of its value.

Now, Elliman can bring its own shares to the table. The company will have 10 million shares to offer as rewards to agents, employees, executives and acquisition targets, according to a management incentive plan the company filed. That figure will increase by up to 4 percent a year. Elliman laid out sweeping criteria to qualify for shares, though it didn’t disclose exactly how it will structure them.

“The purpose of the plan is to attract and retain employees, non-employee directors and consultants and to provide additional incentives for these persons consistent with the long-term success of the company’s business,” Elliman wrote in the filing. Retention has averaged about 90 percent in the past three years.

Cash money

The company is also laying the groundwork for cash-based awards, to be set by Elliman’s compensation committee, made up of board-appointed directors. The committee will administer all the company’s stock and cash awards and may delegate its duties to Lorber, who will continue to have use of Vector’s private jet, a car and driver, $7,500 a month in expenses and two club memberships, according to the filing.

Not for everyone

Elliman’s new stock and cash awards won’t be standard company policy, however. The terms of Elliman’s 10-year management plan specifically note that awards won’t be standardized.

“The company is not obligated to extend uniform treatment to participants under the plan,” Elliman said in the filing. “The terms and conditions of awards need not be the same with respect to each participant.”

Participants were defined in the plan as employees, non-employee directors and agents who have been “selected” by the compensation committee to receive awards.

UPDATE: This story has been revised to add that the brokerage itself will stay in New York.