Foreign investors want their money back after plowing $16.5 million into a failed redevelopment project on a historic pier in the Battery.

The funds — used to rehabilitate 22 Battery Place, a landmarked three-story building and clocktower on a century-old jetty facing the Statue of Liberty — helped create Pier A Harbor House, one of the city’s most successful dining and entertainment venues of the mid-2010’s, according to a lawsuit filed last week in Manhattan.

Investors, however, were fed “one false promise after another” by developers and restaurateurs who took their money, admitted the project was “undercapitalized and over leveraged from the beginning,” and then abandoned the property once the pandemic took hold, despite continuing to operate other businesses in the city, the lawsuit alleges.

The complaint was brought by an LLC that raised and invested the funds through the EB-5 program, which gives foreign investors a shot to become permanent U.S. residents after investing in job-creating real estate or infrastructure projects.

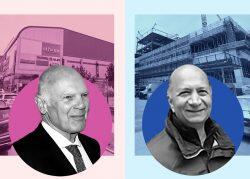

Peter Poulakakos and Paul Lamas of Hph Hospitality Group and Drew Spitler of the Dermot Company, the complaint alleges, are the duplicitous borrowers who enjoyed $15 million to $18 million in annual revenues after the rehabilitated property opened in 2014.

Despite the lucrative business, Harbor House failed to pay rent to the Battery Park City Authority, the state entity that owns the property, between February and October 2018, but withheld that information from lenders as it constituted default under the loan agreement, according to the complaint.

Harbor House shut its doors in March 2020, as non-essential businesses were ordered to close. A month later, its owners informed the BPCA and the EB-5 investors that it would not reopen. In August 2020, the owners turned over the premises’ keys to BPCA, although the authority disputes that the lease was “surrendered,” according to the complaint.

A loan repayment guarantee signed by Lamas and Spitler in 2011 prevents the transfer of their debt obligation to another party.

The Dermot Company did not respond to a request for comment. Hph Hospitality could not be reached. The plaintiff wants them to repay the loan’s principal, allegedly due last March, plus $2.6 million in interest, amounting to over $19 million in damages.

Hph’s other restaurants include Harry’s at 1 Hanover Square and the Michelin starred L’Appart at 225 Liberty Street, according to its website.

Read more

The plaintiff has taken the matter to court before, suing the tenant of the Pier A building, Pier A Battery Park Assocs., although a judge recently scaled back claims it brought last year, noting that the investment fund declined an offer for full repayment in 2017. Now, the investors’ fund is suing the LLCs which borrowed the $16.5 million, Dermont Pier A and Hanover Atlantic Gardens, directly.

The EB-5 foreign investment program, which expired at the end of June and has yet to be renewed by Congress, has been called “controversial” by the Center for Immigration Studies due to a “series of scandals” in which investment funds were misused.

In addition to the $16.5 million lent by the foreign investors, the city and BPCA spent a combined $42 million to repair and restore the Pier A building. The pier dates back to the 1880s, when the police used it to patrol the city’s ports for suspicious activity.

Since its latest tenant, Harbor House, vacated the building in October, local Tribecans have proposed alternate uses for the space. The Battery Park City Authority, however, has dampened their ambitions. The property remains tied up in various financial obligations that came with its pricey redevelopment, according to the BPCA.

Lease owners including Poulakakos and Lamas are obligated to pay rent to the BPCA totalling $41 million over a 25-year lease, while the authority must share eight percent of revenues over $18 million, the New York Times reported in 2015. The BPCA did not immediately have an accounting of those financial obligations, and declined to comment on any arrears, leaving the fate of the historic pier out at sea.