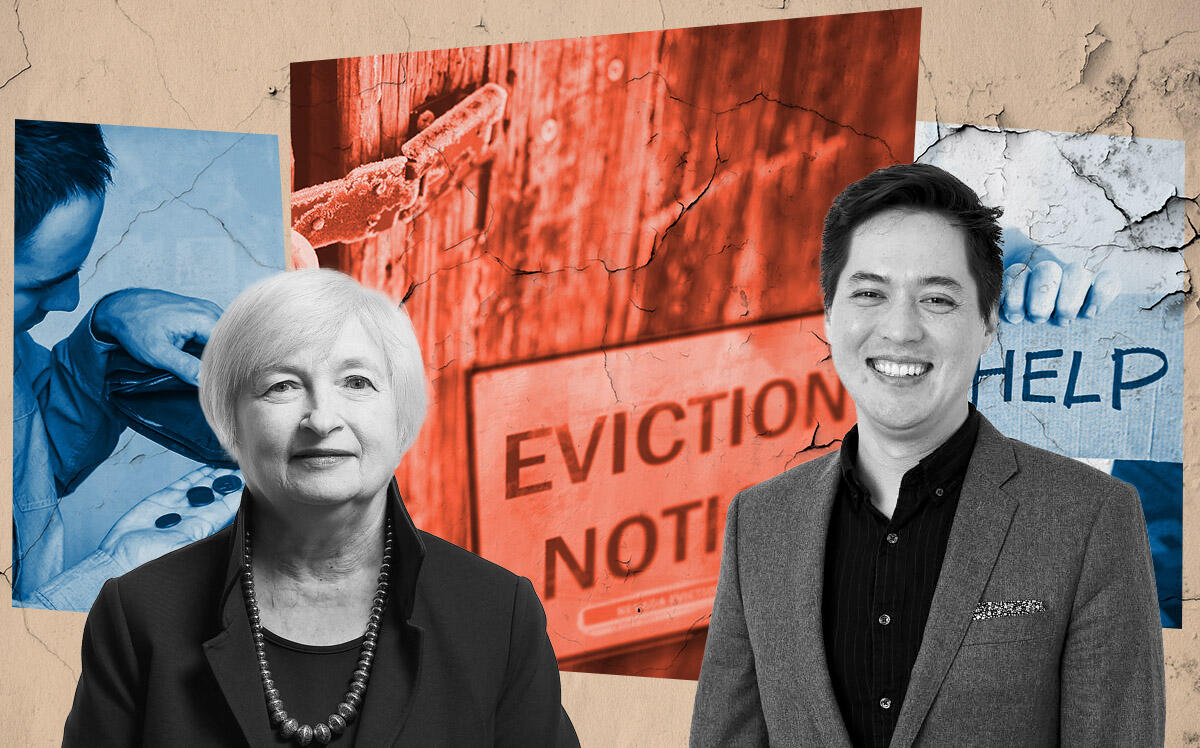

rnrnWe’ve got a lot of cracks in the system that could leave some homeowners at risk of foreclosure.rnrn

Another day, another underfunded aid package.

After the state’s rent-relief program left landlords $3 billion short, a preview of New York’s mortgage forgiveness program shows the forthcoming Homeowner Assistance Fund might do even worse.

To help homeowners who fell behind on mortgages and other payments during the pandemic, the state applied for $540 million of a $10 billion federal assistance program in the American Rescue Plan, said Joseph Sant, general counsel and vice president of the Center for New York City Neighborhoods during the organization’s Affordable Homeownership Summit.

Sant estimated the award would cover just 9 percent of New Yorkers’ delinquent payments. Citing data from the firm Black Knight, Sant said homeowners statewide have accrued about $5.85 billion in late mortgage payments since the start of the pandemic.

Read more

The U.S. Treasury has yet to approve the state’s ask. When it does, Sant’s nonprofit says homeowners must think of the Homeowner Assistance Fund as Congress intended it: a backstop, not a blanket solution.

“HAF is an important tool, but It’s not going to be able to address the scale of mortgage delinquency in New York state by itself,” Sant said. “We have to do more to let homeowners know about their post-forbearance options and this figure really brings that home.”

Sant recommended homeowners look into loan modification and repayment plans once their forbearance period lapses.

The Consumer Financial Protection Bureau, for example, is requiring mortgage servicers to review cost-mitigating options with homeowners before a forbearance period ends and before initiating a foreclosure, Sant said. Those protections extend at least through the end of the year.

New York State Banking Law, which regulates a subset of servicers in the state, reinforces that homeowners should have payment options, including the opportunity to defer payments or modify their loan.

Another benefit, according to Sant: “Compared to the Great Recession and the programs that existed then, there are significantly fewer document burdens.”

Still, those protections only apply to federally backed mortgages, which excludes about 30 percent of U.S. mortgage holders. Seniors with reverse mortgages are likewise left out, and

property taxes paid outside of a mortgage, co-op maintenance, condo fees and homeowner association fees aren’t covered either.

“We’ve got a pretty good loss mitigation system for federally backed mortgage borrowers but a lot of cracks in the system that could leave some homeowners at risk of foreclosure,” Sant said.

When the Treasury does greenlight New York’s program, homeowners can apply for up to $50,000 in relief.

To be eligible, borrowers must have experienced a Covid hardship, meaning a dip in household income or increased expenses such as medical costs or childcare, this year. A hardship that began in 2020 and continued into 2021 counts, too.

Homeowners are eligible regardless of whether they applied for forbearance.

The program will be available through an online portal and run by the state’s Division of Homes and Community Renewal, unlike the bungled rent relief program, which the state’s Office of Temporary and Disability Assistance is handling.

“We are hopeful that the program will have an application process that is easy to access,” said Mireille Martineau, director of the Homeowner Assistance Fund at Center for New York City Neighborhoods.