A significant change could be coming to the Community Reinvestment Act in New York.

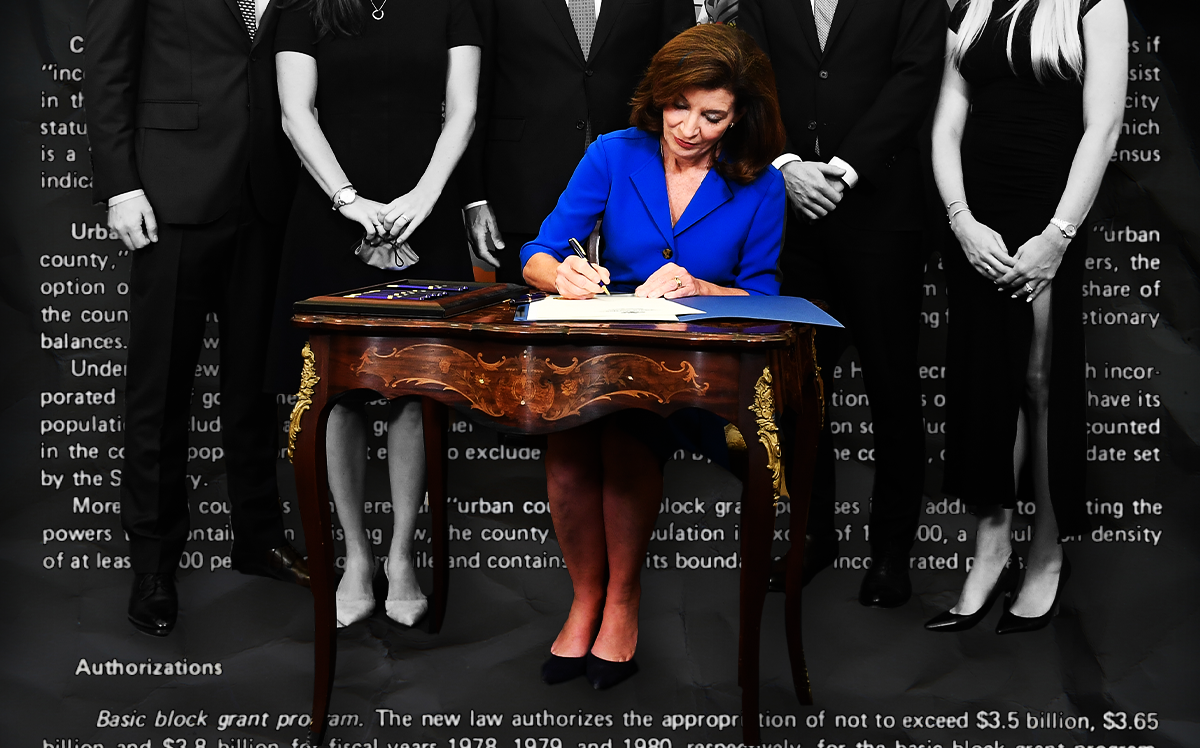

The state Senate delivered a bill to Gov. Kathy Hochul on Friday that would expand the requirements of the state program to non-depository lenders. Hochul has 10 days to sign or reject the bill; HousingWire reports that the mortgage industry expects her to ink it.

The Community Reinvestment Act compels banks to lend adequately in communities where they take deposits. Several states, including Massachusetts and Illinois, have extended the mandate to non-depository lenders.

Supporters of the bill cite the need to fight redlining, a practice where lenders do not provide credit in or near communities of color. Some lawmakers believe the practice was worsened by the pandemic.

A report from the New York Department of Financial Services in February found that non-CRA-regulated lenders charged higher rates to low-income and minority borrowers in Buffalo, HousingWire reported.

Opponents of the bill, namely the mortgage industry, claim that non-depository lenders do provide loans in the communities where they operate.

Read more

“The independent mortgage banks’ business model takes funds gathered from global capital markets and reinvests them in local New York communities, with a focus on [low-income] and minority households,” said a statement from the Mortgage Bankers Association.

Both sides of the debate claim that evidence supports them. Massachusetts in 1977 extended CRA requirements to independent mortgage lenders, and their share of mortgages to minorities jumped by 129 percent from 2009 to 2020, according to HousingWire. In New York, however, without any such law, the metric surged 157 percent.

The New York legislation comes as changes to the federal law are debated. Alterations proposed by Trump-appointed Comptroller of the Currency Joseph Otting were soundly opposed and rescinded. But federal officials are still looking at how to modernize the law to deal with nontraditional lenders, as well as how to explicitly address race, which the measure does not do.

[HousingWire] — Holden Walter-Warner