As Fifth Avenue battles back from the pandemic, a new listing in the heart of the shopping corridor will test the strength of its recovery.

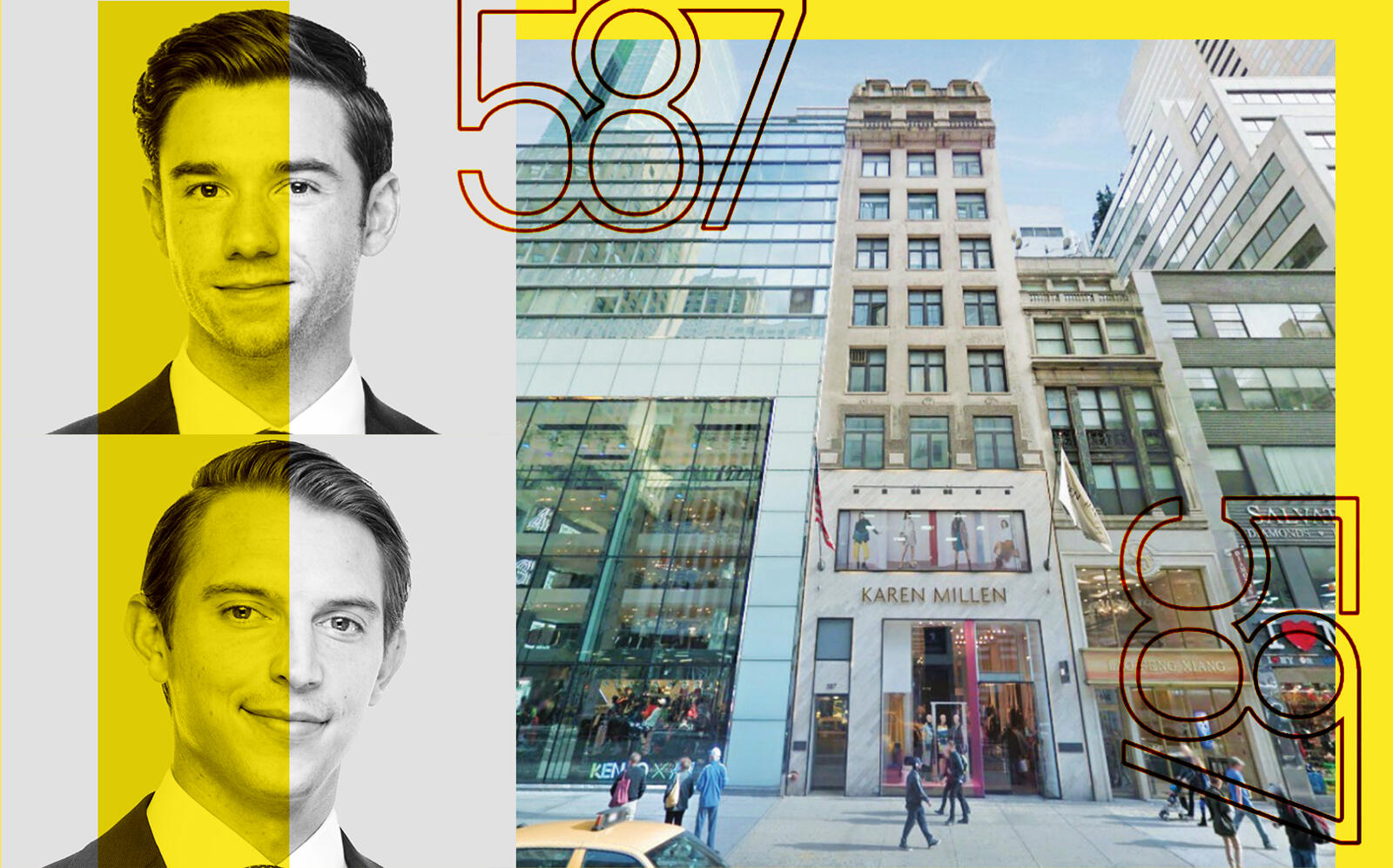

The leasehold for 587 Fifth Avenue, a 10-story, mixed-use building between 47th and 48th Streets, is hitting the market asking $36 million. Steve Kassin’s Infinity Collective holds the ground lease, public records show. Zachary Redding and Dylan Kane of B6 Real Estate Advisors have the listing.

The building offers 4,000 retail square feet and 38,600 square feet of office space. It’s 66 percent leased, according to B6. Redding said the “iconic location makes this an ideal opportunity for investors, or users seeking a headquarters location.”

The ground-floor retail space runs for 125 feet along Fifth Avenue and features 16-foot ceilings. A pop-up shop for Italian luxury sneaker brand P448 is in the space, but a new tenant could move in later this year.

The ground lease runs through August 2079, and annual payments rise in fixed steps from $655,000 today to $750,000 in 2036, then drop to $600,000 from 2041 on.

The zoning allows for a floor-area ratio of 15, which means 587 Fifth Avenue is currently more than 22,000 square feet underbuilt. The air rights could be sold or used for future development.

Read more

Infinity, which did not respond to request for comment, acquired the ground lease in 2016 after years of lawsuits between the previous owners, Xerxes Group and Zamir Equities. While the lease transfer documents don’t list a price, ACRIS shows a document amount of $26.6 million.

The pandemic walloped street retail and Fifth Avenue in particular, given its reliance on tourism and wealthy Manhattanites, who left town en masse. In April 2020, when shutdowns ground in-person shopping to a halt, foot traffic in the area plummeted 98 percent, according to Placer.ai, a retail data firm. It has since recovered to two-thirds of pre-pandemic levels.