As rising Covid cases and delayed office returns dampen optimism about a near-term return to normal, New York City’s largest commercial landlord is still taking the long view.

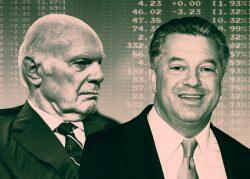

During a second-quarter earnings call Thursday, SL Green executives held firm in their belief that the city was poised for a strong post-pandemic rebound.

“The commentary you’re hearing from us is commentary you should think about over a period of years, not September versus October, because that really has no bearing on the performance of our portfolio,” CEO Marc Holliday said in response to one of several analyst questions regarding implications of the Delta variant.

“I don’t think [the Delta variant] would change anything that tenants are doing for their five- or 10-year long-term planning, and that really is evidenced by the ink on the leases,” he continued.

Holliday noted SL Green had signed 1 million square feet of leases in the first half of 2021, and had another 600,000 square feet in the pipeline. SL Green leased a total of 1.2 million square feet in all of 2020.

In April, Holliday said he was looking forward to a “truly explosive recovery” in New York. That has not happened yet, and physical occupancy in SL Green’s office portfolio is around 25 percent. In January, Holliday noted that tenants had made plans to return to the offices by late summer. SL Green says it still expects tenants to begin returning in earnest after Labor Day.

“I continue to maintain that the safest place to be is in healthy offices that have policies and protocols in place,” Holliday said. “Wherever the spread may be taking place, it’s not in the SL Green portfolio, that I can tell you.”

For the second quarter, the real estate investment trust reported funds from operations of $117.7 million or $1.60 per share, down from $1.70 per share in the second quarter of 2020. Despite including some of the worst months of the pandemic, Q2 2020 results were boosted by $0.15 per share in lease termination income.

For the most recent quarter, net income was $1.51 per share, almost double the $0.76 per share for the same quarter a year ago.

Read more

SL Green was an active seller from April through June, shedding 635-641 Sixth Avenue to Spear Street Capital for $325 million, and a 20 percent stake in the Sky Apartments at 605 West 42nd Street to Joe Moinian, in a deal that valued the property at more than $850 million.

A few hours before the afternoon earnings call, the firm announced the sale of a 49 percent stake in the Daily News building at 220 East 42nd Street to South Korea’s Meritz Alternative Investment Management, in a deal that valued the property at $790 million.

A scrapped deal to sell the Daily News building to Jacob Chetrit for $815 million last year was one of the early victims of the pandemic. SL Green held on to a $35 million deposit, and the parties settled their dispute in September.

“We just decided that there was upside in the rent roll that we wanted to continue mining,” SL Green president Andrew Mathias said on the call, explaining the decision not to sell the property outright.

Proceeds from these sales went toward SL Green’s long-running $3.5 billion share buyback program. The company has repurchased or redeemed 4 million shares so far this year.

“We only do share buybacks with the proceeds from asset sales,” chief financial officer Matthew DiLiberto said. “But we have taken the opportunity to pay down debt to keep the leverage levels in line with some of the asset sales, too.”

On the call, SL Green executives also outlined several milestones they were looking forward to in the third quarter: the beginning of vertical construction at One Madison next month; the launch of marketing for residences at 185 Broadway next week; the start of demolition work for a retail-and-condos complex with Giorgio Armani at 760 Madison Avenue; and the opening of One Vanderbilt’s observation deck in October.

With One Vanderbilt now almost 90 percent leased — and having just locked in a record-setting $3 billion refi — the company’s attention is focused on filling up the top few floors of the office tower — with asking rents at a record $322 per square foot, as The Real Deal reported Wednesday.

“We’ll be very selective about how we finish off the top of the building,” said Steven Durels, the firm’s executive vice president and director of leasing. “That may be a 2022 event, hopefully sooner, but we certainly haven’t planned for sooner.”