Changes to New York’s rent laws dealt a severe blow to the business of condo conversions, according to a new study.

In the year following the June 2019 passage of the Housing Stability and Tenant Protection Act, just five condo conversion plans were submitted to the Attorney General’s office, the lowest level since the 1960s. In the previous five years, an average of nearly 24 conversion plans were filed each year, according to a recent report prepared by the Steven L. Newman Real Estate Institute at Baruch College.

The report attributes the steep drop-off to the new law, which stipulates that 51 percent of tenants in a rental building must agree to buy their unit for a conversion to take place. Before June 2019, the required threshold was just 15 percent of tenants, or so-called “insiders.”

At the time, many in the industry opposed the change, claiming conversion projects would become collateral damage from the new law. Opponents said the threshold jumping to 51 percent would stop all conversion projects, and cut renters off from becoming homeowners.

Read more

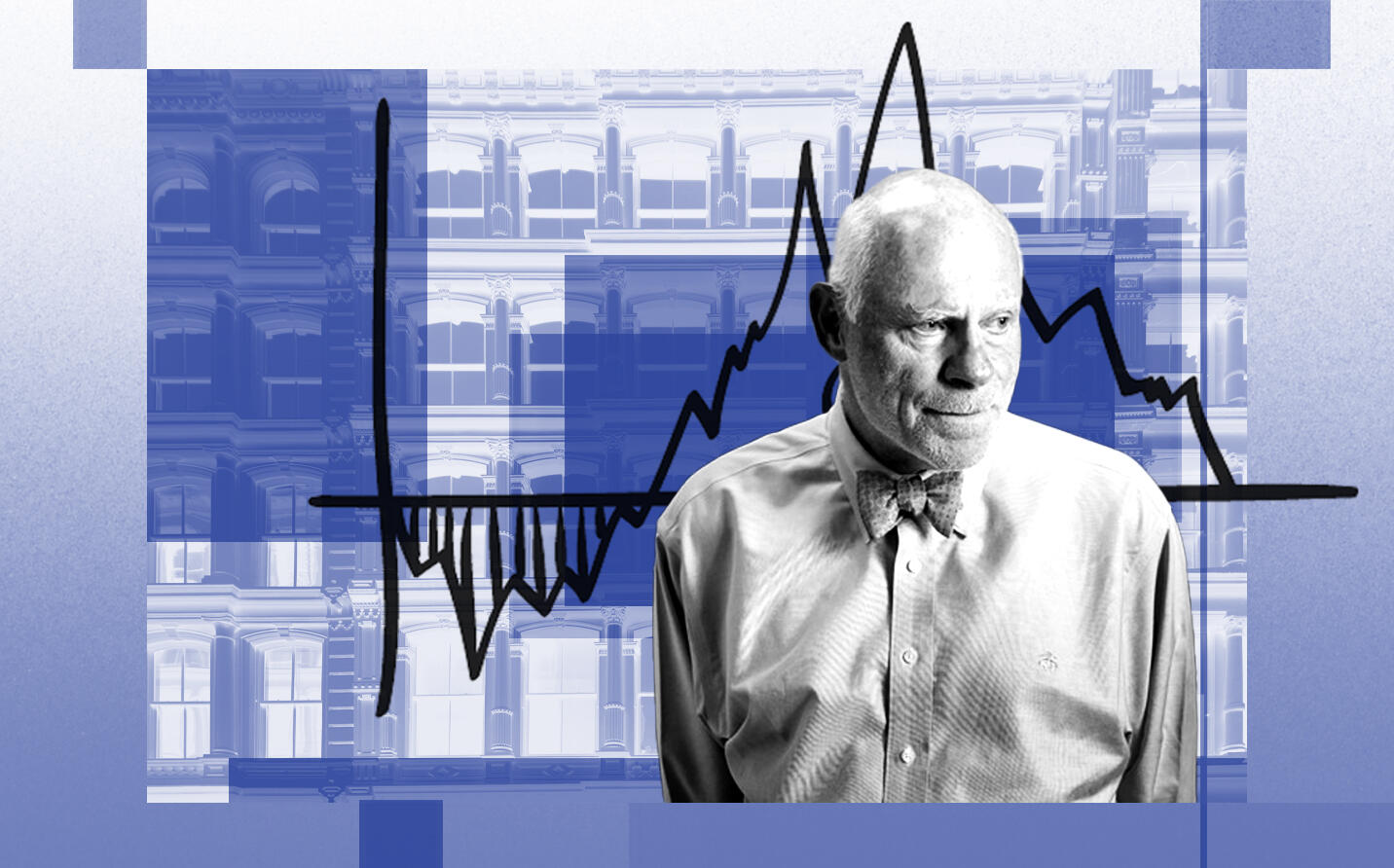

The impetus for the survey came from developer Francis Greenburger’s Time Equities, which has converted more than 10,000 rental units into condo or co-op apartments. Greenburger also vocally opposed the law in 2019.

“We anecdotally felt that when the law changed, conversions stopped,” said Roberta Axelrod, who leads such projects for the firm. “But we didn’t have any concrete official data.”

The study relied on data from the New York State Attorney General’s office, homeownership rates from the U.S. Census Bureau, the New York State Department of Labor, listing portals such as StreetEasy, residential brokerage market reports and industry sources, including brokers, accountants, asset and property managers. No special accounting or adjustment was made for the pandemic, which began during the last five months of the period of study.

But Greenburger — who is a Baruch alum and sits on the school’s advisory committee — stressed that neither he nor his firm interfered in the research, which was led by professor Yildiray Yildirim.

“We wanted to have an objective party study this rather than someone who would have a bias,” Greenburger said.

Tenants in buildings undergoing conversions were typically offered discounts ranging from 30 to 35 percent below the market price, according to the report. The study claims this has raised homeownership rates by an average of 1.3 percent in neighborhoods where conversion projects occur.

“Increasing homeownership in the city by 1 percent is a big deal,” said Yildirim. “When you increase the homeownership rate, then you’re creating wealth.”

In 2018, the homeownership rate in New York City was 33 percent compared to the national rate of 64 percent, according to NYU’s Furman Center.

The report does note that these projects were already on the decline before the rent law changed, based on a historical study of condo and co-op conversions dating back to 1961.

The number of conversion projects began to surge in 1978 and remained elevated for about 12 years. The highest point was 1986, when 564 rental buildings were converted into condos. Beginning in 1987, the number of projects dropped and hasn’t exceeded 100 since.

Greenburger attributed the dropoff to an aggressive investment sales market that drove up land prices. But he said he believes that the conversion market would be “viable” today given low interest rates and the demand for “moderately-priced units” in the city.

The developer said he plans to use the study’s findings to make the case to lawmakers that the 51 percent threshold should be lowered back to 15 percent. He also plans to propose putting some of the profits from conversion projects toward an affordable housing fund, which he hopes will appeal to lawmakers.

“We’re trying to build support around the idea among key policymakers,” said Greenberger. He said some meetings have occurred and generated “a little bit of interest” so far.