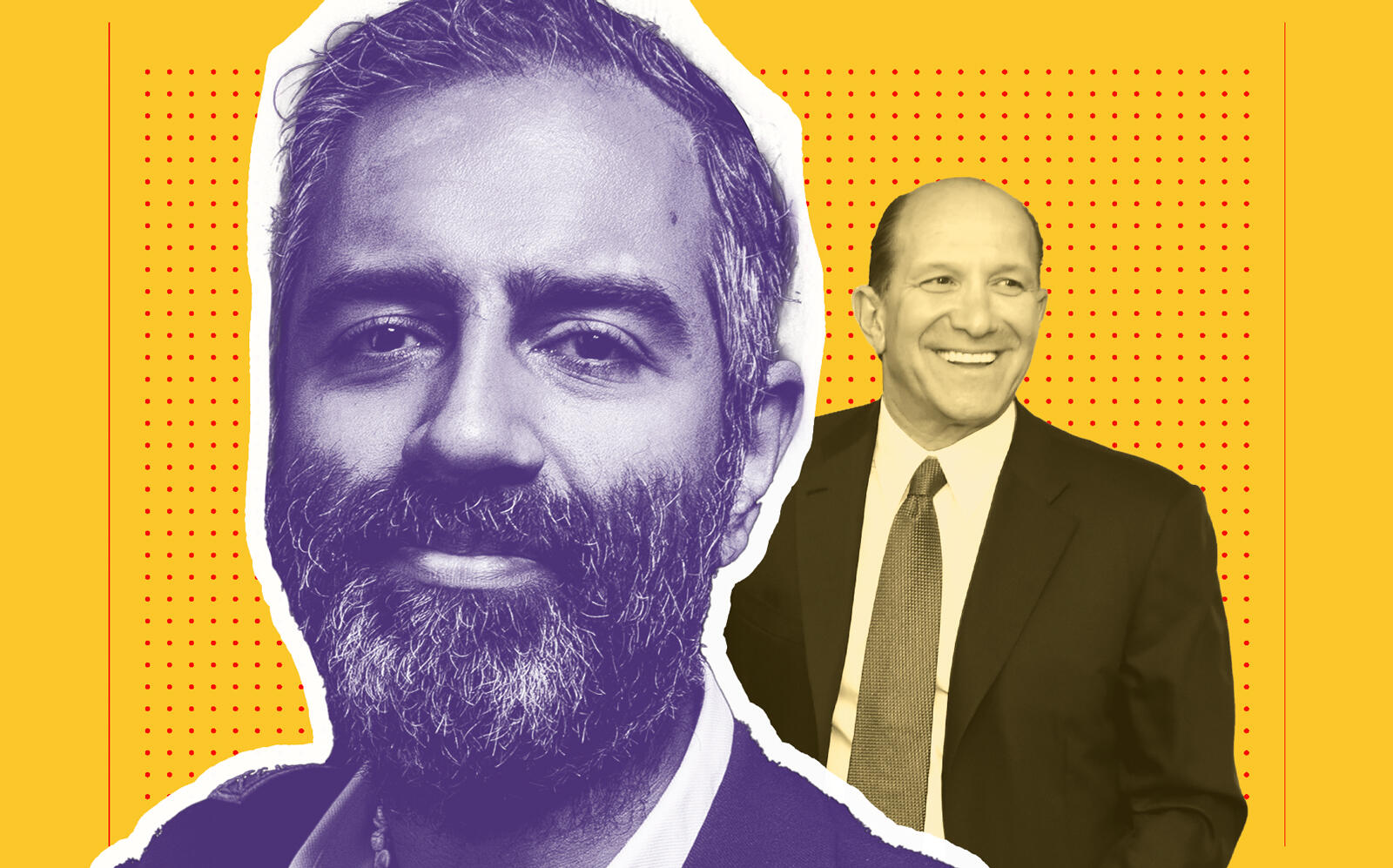

Amol Sarva has shared new details about how Knotel’s partnership with Newmark turned hostile.

In a video interview, Sarva said Cantor Fitzgerald CEO Howard Lutnick, whom he holds in low regard, pulled the strings that forced his company into bankruptcy.

“It was just like [a] consummate Wall Street type,” Sarva said in a 12-minute interview with Business of Business posted Thursday.

Newmark was the stalking-horse bidder in Knotel’s bankruptcy and purchased the company in March. Sarva had reportedly raised more money as recently as January, but could not come up with a way to retain control of the company.

In Sarva’s telling of the story, Lutnick’s firm used its relationship with Newmark to gain inside information on Knotel and force the ailing flex-office company into bankruptcy.

Sarva never identifies Lutnick or Newmark CEO Barry Gosin — who he said is an “amazing guy, really nice, great reputation” — by name, but he references their positions and how they played roles in his eventual ouster.

About a year after Gosin and Newmark invested in Knotel, the CEO approached Sarva about hiring Cantor Fitzgerald as the company’s investment bank, according to the startup founder. Then the pandemic hit, and Knotel’s business struggled. Last December, Sarva turned to two of his lenders to refinance Knotel’s debts. That’s when he learned that Lutnick had purchased the debt.

From that point on, Sarva said, Gosin was “nowhere to be seen” and he was dealing exclusively with Lutnick.

Sarva said the Cantor CEO gave him an ultimatum: Take another $20 million loan on the condition that he put the company into bankruptcy and let Newmark buy it, or Lutnick would foreclose on the debt.

“These guys basically chose this moment to put almost another $100 million total in, just in order to buy the company and wipe out everybody else,” Sarva explained.

Representatives for Lutnick and Gosin did not immediately respond to requests for comment.

Despite his dim view of Lutnick and how Newmark handled the situation, Sarva didn’t completely dismiss his responsibility for losing control of Knotel, which was once valued at $1 billion.

He said he could have done a better job doing due diligence on Newmark and Lutnick, who infamously cut off paychecks to the families of Cantor Fitzgerald employees who died in the 9/11 attacks.

“The real estate business is full of all these shady people and they are very outspoken about each other,” Sarva said. “It was just a question away.”

Sarva also acknowledged that Lutnick might have kept him around if the Cantor CEO had more confidence in his ability to fix Knotel.

“Arguably it’s all within their rights and it’s capitalism and it’s a dog-eat-dog world, and whatever, but you can choose. There are rules and you can also choose how you want to behave in life,” he said. “Knotel is in someone else’s control today because of that bad decision by me.”